Pakka: 35% revenue growth in FY24, 33% revenue CAGR for FY23-26 at 16 PE

On a growth trajectory since FY21 with revenue growth of 49% and EPS growth of 59% CAGR. Working to transform itself from a paper & pulp manufacturer to a sustainable packaging solutions provider.

1. Pakka Ltd, manufacturer of sustainable packaging solutions

pakka.com | NSE : PAKKA

Past, present and future of PAKKA.

PAKKA refers to itself as a manufacturer of sustainable packaging solutions but as of today is a paper and pulp manufacturer as per its segmental revenues. It is trying to transform itself into a sustainable packaging solutions provider. PAKKA is engaged in two business segments:

Paper & Pulp

Moulded Products

Sustainable Packaging Products

2. Growth trajectory since FY21 for revenue & EPS

FY21-23: Revenue growth of 49% and EPS growth of 59% CAGR

40% growth in FY23 driven by 36% growth in paper and pulp segments and 83% growth in molded products.

3. FY23: Peak Performance & high quality growth

Highest ever numbers delivered on total revenue, PBT, production volumes and export sales.

4. Q1-24: Behind on the revenue growth guidance but strong on earnings growth

Quarterly revenue grew 21.8% YoY as against the guidance of 35% growth for FY24.

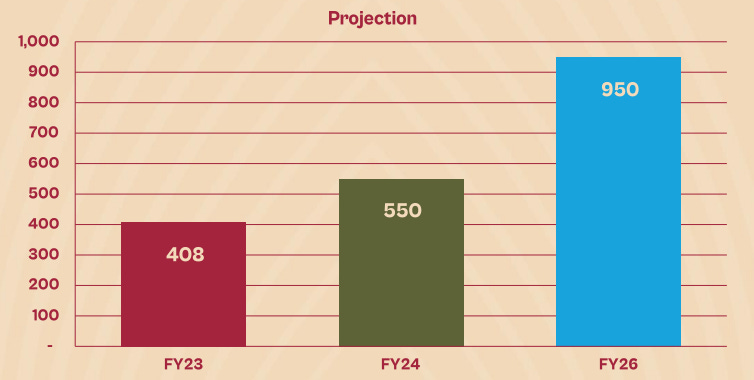

5. Outlook: 35% revenue growth in FY24; 33% CAGR for FY23-26

i. Guidance to grow revenue to Rs 950 cr by FY26

ii. FY26 growth based on transformation to sustainable packaging and capex in its manufacturing location in Ayodhya

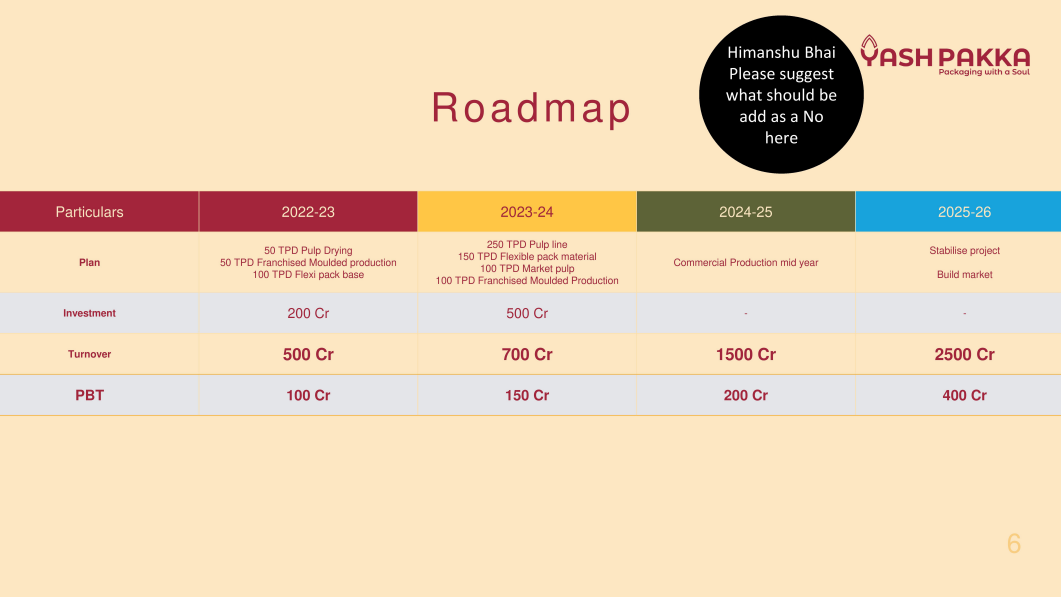

Roadmap for future growth thru international capex going up to 2030 and making PAKKA a $1 billion company is too ambitious and has been noted but kept aside as of now.

Focus is on the expansion in its site in Ayodhya.

6. FY21-23 revenue growth of 49% and guidance for revenue growth of 35% in FY25 at a PE of 16

7. What if the guidance is a bunch of numbers generated in air?

Q4-22 Investor Presentation submitted to BSE

The comment in black makes it sound as if guidance is being generated out of thin air.

Guidance given in Q1-24 investor presentation is significantly subdued from the guidance given in Q4-22 investor presentation.

8. So Wait and Watch

If I hold the stock then one can hold on as PAKKA has delivered on the top line and bottom line from FY21 to Q1-24. The question is, can one trust its guidance. For that one can hold on quarter to quarter, checking if PAKKA is serious about its guidance. On the first sign of the guidance being diluted one needs to jump out.

9. Look before jumping in

If I am looking to enter the stock then

PAKKA has delivered around 30% growth from FY21 to Q1-24. Additionally it is giving a growth guidance for 30%+ till FY26. A PE of 16 is attractive for such a performance

The real opportunity in PAKKA is if it transforms itself into a sustainable package company or else there are many paper companies available in a single digit PE.

Trust in the guidance is low and makes it a risky bet but a high reward bet if the transformation does take place.

Since its a bet, one should not enter in the stock in one shot.

Since its a bet, the size of the bet cannot be a significant part of the portfolio.

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades