Oswal Pumps Q2 FY26 Results: PAT Up 34%, On-track to FY26 Guidance

Guidance of 50-60% growth in FY26, 30-35% growth in the medium-term. Q2 FY26 was weak in terms of margins. OWSWALPUMS available at very attractive valuations

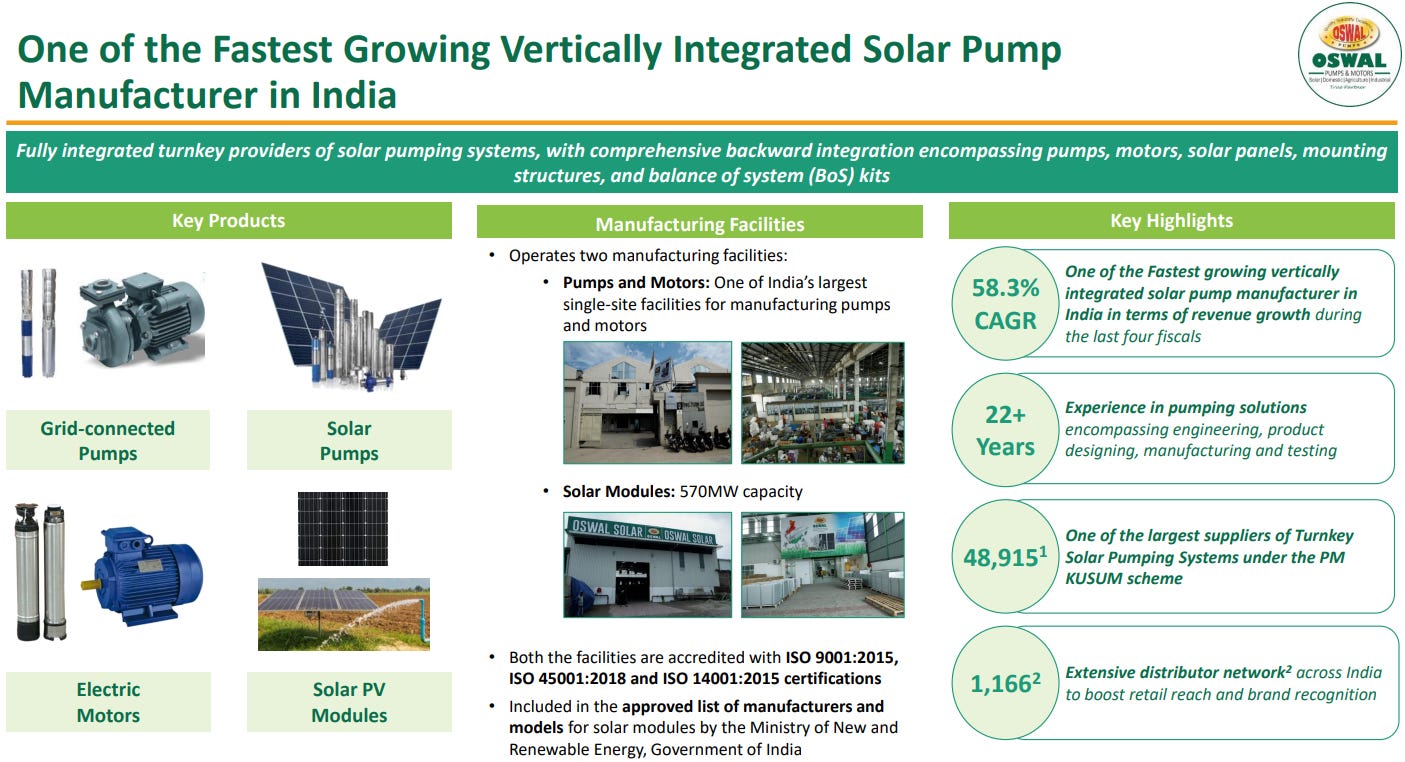

1. Pumps and Motors Manufacturer

oswalpumps.com | NSE: OSWALPUMPS

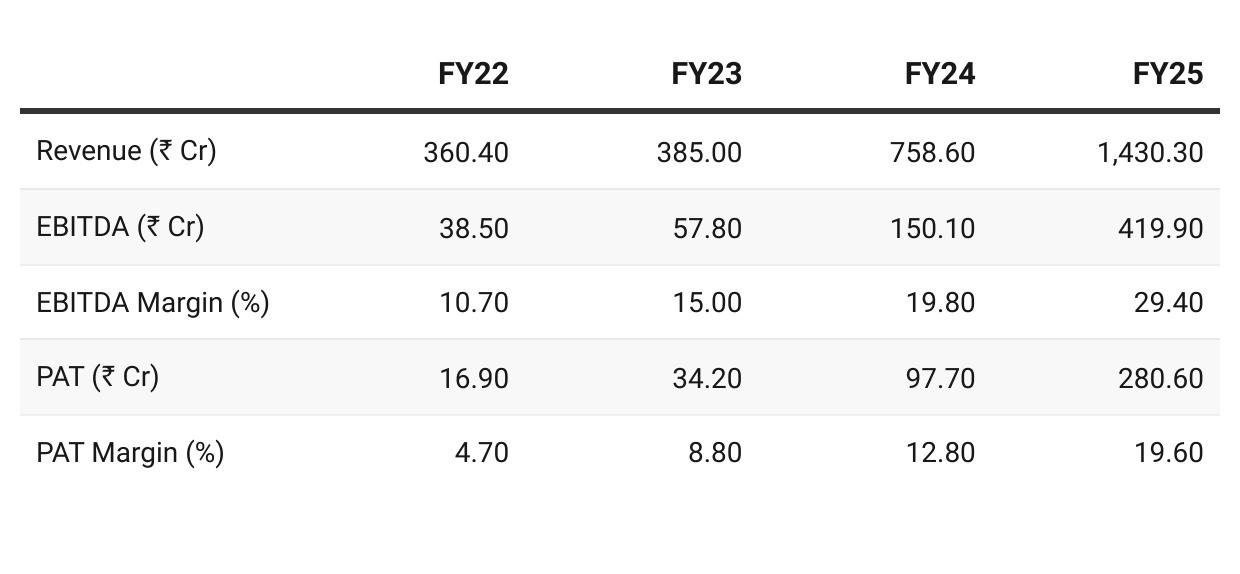

2. FY22–25: PAT CAGR 45% & Revenue CAGR 31%

Riding the tailwinds generated from the PM Kusum Scheme

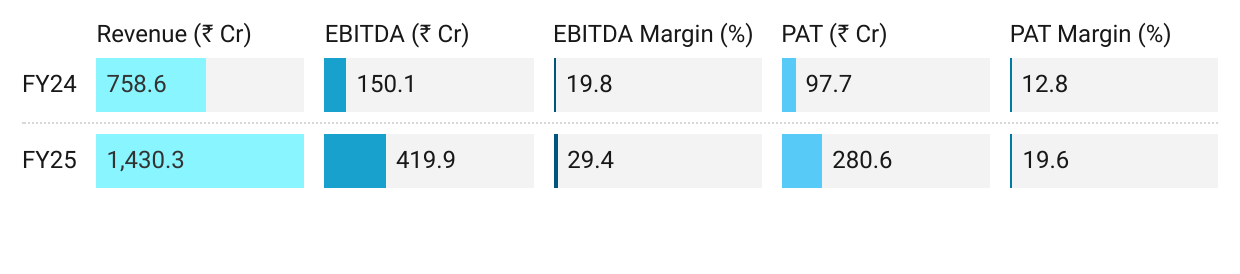

3. FY25: PAT up 167% & Revenue up 71% YoY

Revenue Growth: Surge in PM-KUSUM turnkey solar pumping systems, especially in Maharashtra & Haryana.

Margin expansion — higher mix of direct KUSUM turnkey sales (higher-margin vertical)

Q4 FY25 EBITDA margin dipped (27.1% vs 29.4% full-year) due to higher share of low-margin module sales vs turnkey pumps.

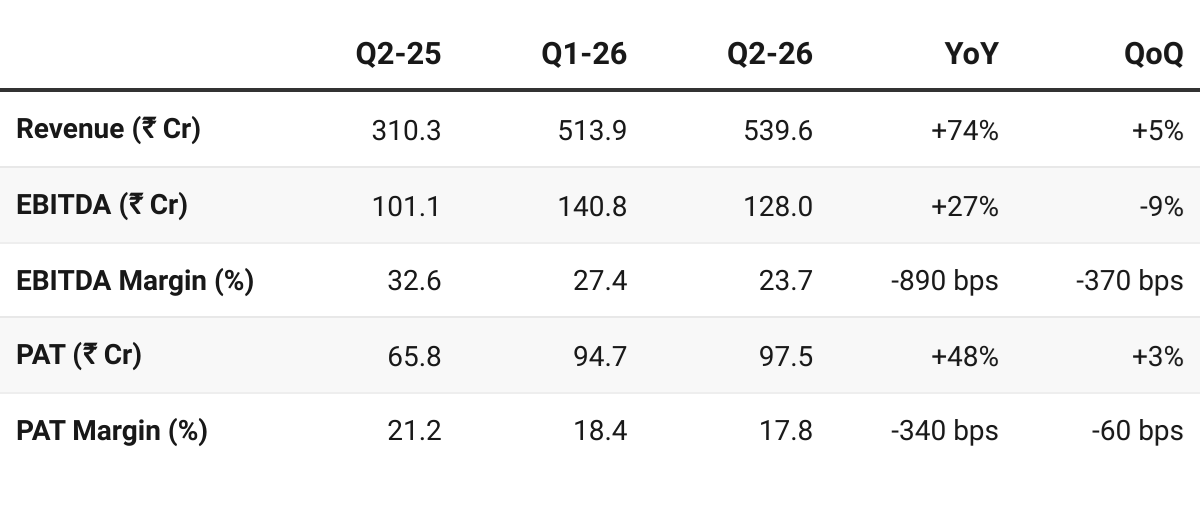

4. Q2 FY26: PAT up 48% & Revenue up 74% YoY

PAT up 3% & Revenue up 5% QoQ

Margins dipped in Q2 due to:

7.5% fall in L1 prices in PM-KUSUM & Magel Tyala tenders

impacting >80% of revenue

One-time impact of ₹40 crore low-margin module sales.

One-time expense of ₹2.5 crore (authorised capital increase)

🚩 Margin performance needs to be watched closely

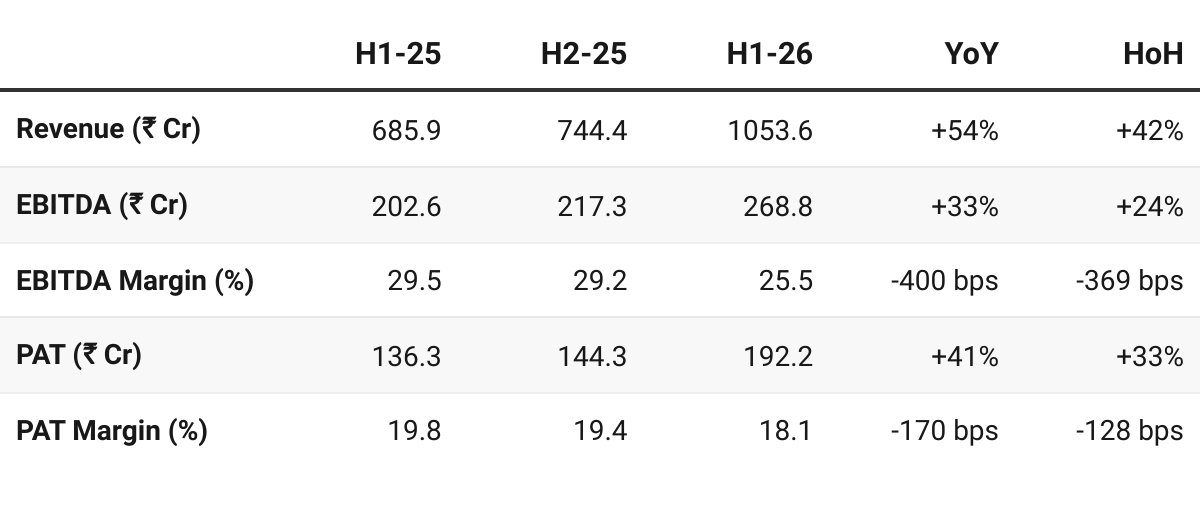

5. H1 FY26: PAT up 41% & Revenue up 54% YoY

PAT up 33% & Revenue up 42% QoQ

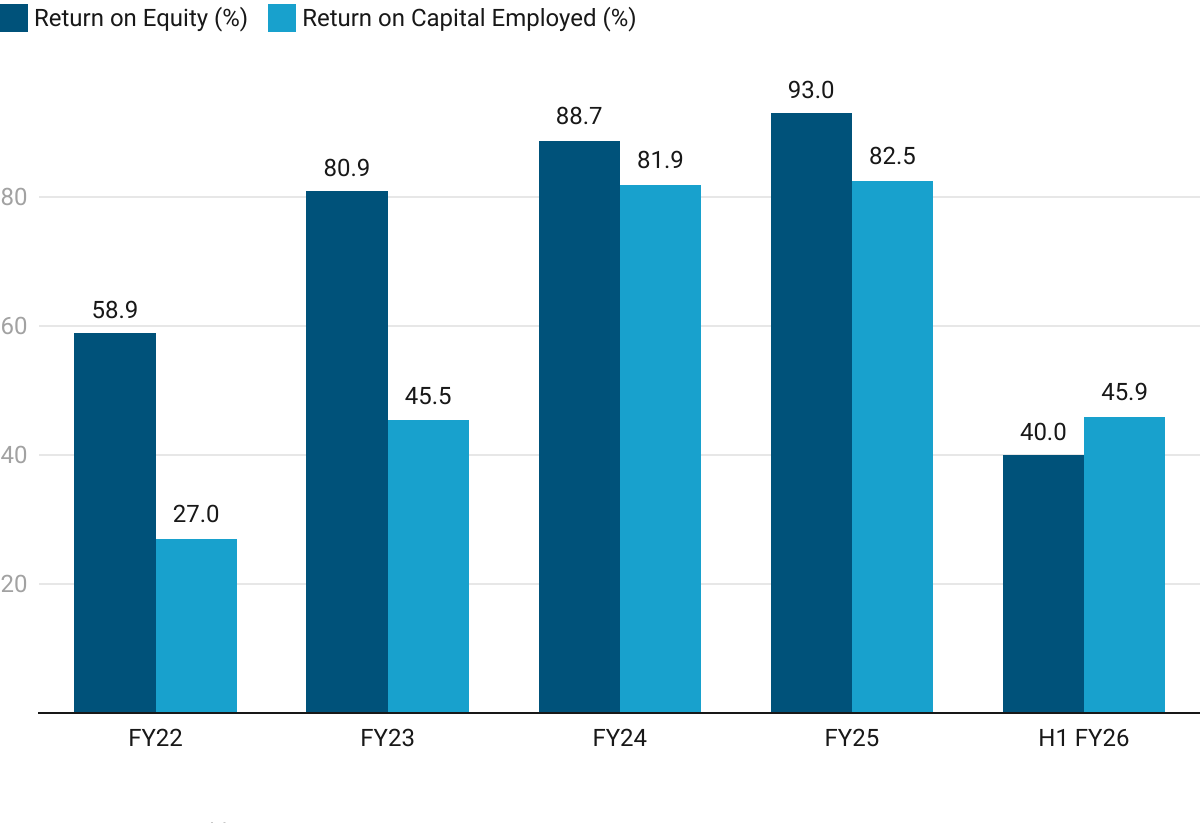

5. Business Metrics: Strong Return Ratios

Capital Infusion in Q1-26

Despite the capital infusion, the Company’s Return on Net Worth (RoNW) and Return on Capital Employed (RoCE) remains strong

6. Outlook: 50-60% Growth in FY26

6.1 FY26 Guidance — Oswal Pumps

50-60% revenue growth with stable margins in FY26

For financial ‘26, we are targeting revenue growth in the range of 50% to 60% with a medium-term goal of maintaining a CAGR of 30% to 35%.

We believe we should end Q3 with an operating EBITDA margin in the range of 25.5% to 26%. And Q4 with an operating EBITDA margin in the range of 26.25% to 26.75%. We expect PAT margins to be in the range of 17.5% to 19%.

Importantly, we are also anticipating the launch of PM-KUSUM 2.0 by the end of this fiscal, and we expect it to be larger in scope compared to the first phase.

Margins have weakened in Q2 FY26 resulting in lowering of margin guidance for FY26

Margin Guidaince during Q1-26 call: Guiding for operating EBITDA margin in the range of 27% to 29% and PAT margin between 18% to 20%.

PM-KUSUM & State Schemes – Outlook

PM-KUSUM 2 Launch Timeline

Expected in January FY26

Industry + MNRE “very bullish”.

State Schemes Mitigate Delays

Even if KUSUM-2 is delayed temporarily:

States like Maharashtra (Magel Tyala), MP, Karnataka, Haryana continue independent tenders

Thus no volume risk to growth rates.

Long-Term Solar Pump Demand

MNRE and industry discussions indicate:

Target of 1 million pumps per year under KUSUM 2/3

Huge multi-year tailwinds.

Capacity Expansion & Capex Outlook

Pump Manufacturing Capacity

Current: 2 lakh pumps per annum.

Target: 5 lakh pumps by H1 FY27

Capacity will be fully ready to meet FY27–FY29 scale-up.

6.2 H1 FY26 Performance vs FY26 Guidance

Strong Growth, Weaker Margins

Revenue Growth

H1 achieved 54% revenue growth — mid-point of 50-60% growth guidance.

On-track to deliver revenue guidance

Margins — Significant slippage on margins

FY26 margin guidance lowered in Q2 FY26

Described as a one-time slippage and a recovery path is detailed by OSWALPUMPS management

One needs to watch out for further slippages

Capacity Expansion — H1 FY27 target, on schedule

Receivable cycle increased due to monsoons and expected to normalise in Q3

While company says its temporary, receivables stand at ₹959 Cr against H1 FY26 sales of ₹1,054 Cr — nearly all the revenues are in receivables

7. Valuation Analysis

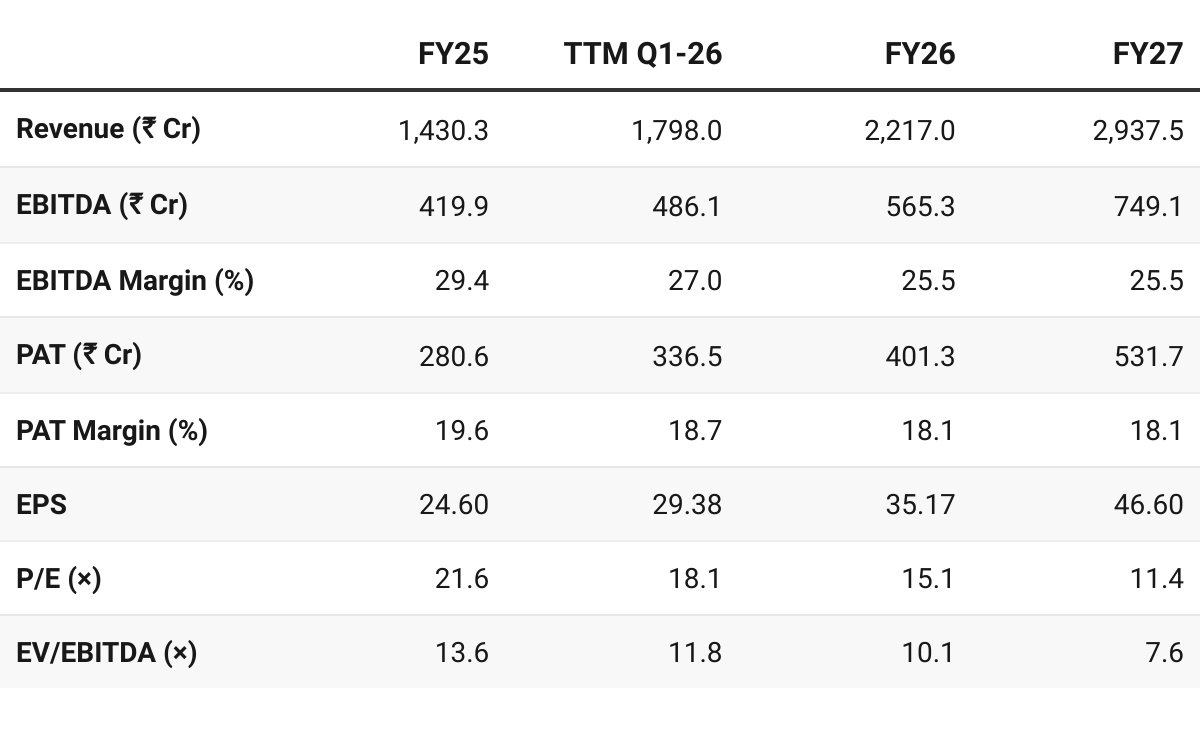

7.1 Valuation Snapshot — Oswal Pumps

CMP ₹531; Mcap ₹6,052.2 Cr

Revenue based on mid-point of guidance range.

Margins: Same as H1 FY26 — lower than the margins guided by management

High-Growth → Premium to Reasonable Valuations

OSWALPUMPS has seen a serious price correction since its Q1 earnings

Based on Q1 FY26 earnings it was priced at premium but now its priced quite reasonably at 18× for its 50-60% growth in FY26 and 30-35% medium-term growth

Valuation become really attractive if medium-term guidance of 30-35% growth plays out into FY27

7.2 Opportunity at Current Valuation

Multi-year industry tailwinds driving growth

Volume visibility from PM-KUSUM 2 & State Schemes reducing cyclicality

Earnings compounding is under-priced

Even after margin contraction OSWALPUMPS delivered 41% PAT growth in H1 FY26

If the growth continues at this pace, FY26–27 earnings upgrades by the street become highly likely

7.3 Risk at Current Valuation

Quality of earnings: Revenue getting converted into receivables and not cash puts a big question-mark on the quality of earnings

Margin Pressures — margins may be capped despite scale

Tender pricing pressure as new EPC players enter

L1 tender rates fell 7.5% in recent rounds.

More EPC-only bidders = irrational pricing behaviour.

Solar pump tenders homogenized → price-led bidding becomes common.

Even though Oswal’s integration protects margins, tender resets could compress margins and reduce near-term profitability visibility

Government program dependency

Around 70–75% of revenue tied to PM-KUSUM & state solar irrigation schemes

Delays in KUSUM 2, change in subsidy structure or fiscal tightening by states could be a negative

Previous Coverage of OSWALPUMPS

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer