Oriana Power FY25 Results: PAT up 192%, Doubling in FY26

Conservative 100-150% growth guidance for FY26 with stable margins. Valuations discount FY26 growth. Opportunity emerges from FY27 as it executes Vison 2030

Get Stock Ideas at moneymuscle.in

1. EPC & IPP — Solar Power

orianapower.com | NSE - SME: ORIANA

Solar Power

EPC (Engineering, Procurement & Construction): Turnkey delivery of rooftop, ground-mounted, open access, and utility-scale solar projects.

IPP (Independent Power Producer): Develops and owns renewable assets, selling power under long-term contracts.

Deferred Capex / RESCO Model: Provides solar access to clients with minimal upfront investment.

Solar Parks: Developing multi-hundred-MW solar parks across Rajasthan, Tamil Nadu, Uttar Pradesh, and Haryana.

Battery Energy Storage Systems (BESS)

Grid-scale storage solutions to stabilize renewable supply and enable 24×7 clean power.

Green Hydrogen & E-Fuels

Allocated 10,000 MTPA Green Hydrogen capacity under SIGHT scheme.

Setting a 500 MW electrolyser manufacturing facility (expandable to 1 GW)

Developing 225 TPD e-Methanol project; long-term focus on hydrogen derivatives (e-methanol, ammonia) for global markets (Japan, EU, USA).

Compressed Biogas (CBG) — Exploring CBG projects as part of renewable mix.

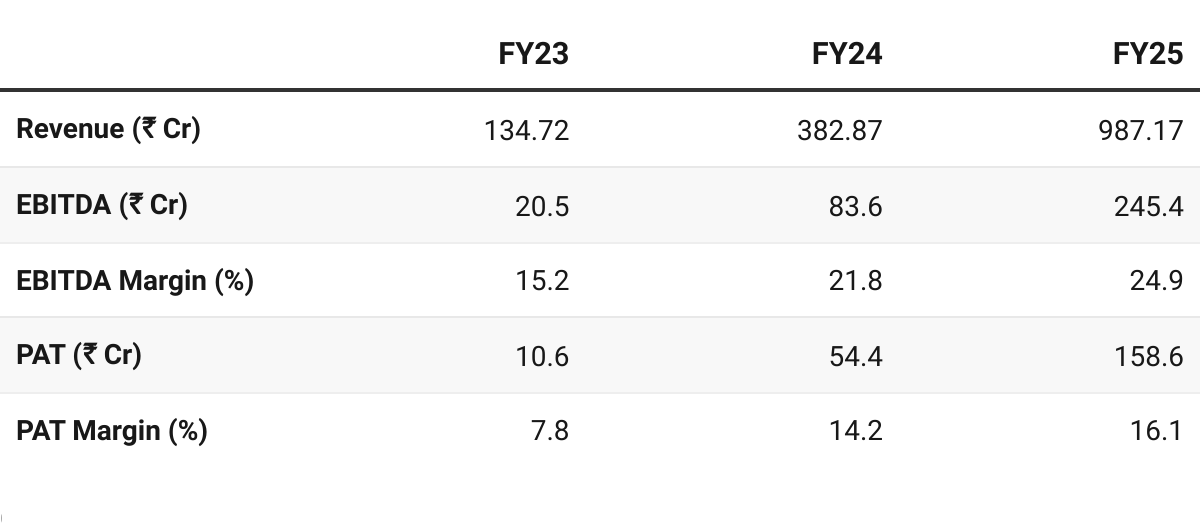

2. FY23–25: PAT CAGR of 287% & Revenue CAGR of 171%

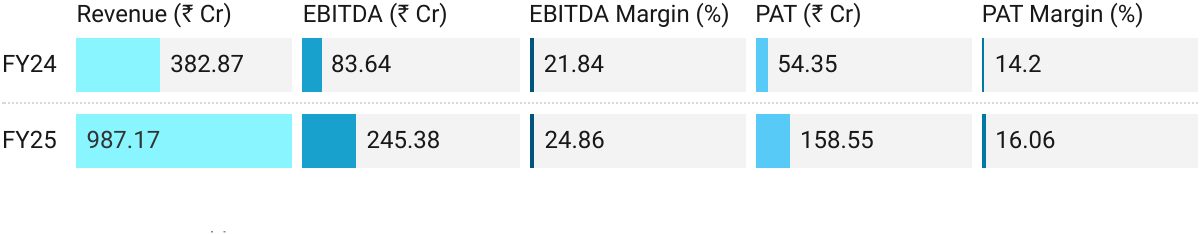

3. FY25: PAT up 192% & Revenue up 158% YoY

So, we have made a commitment that revenue will be around Rs. 800 Cr. but we have delivered Rs. 987 Cr., PAT we were expecting around Rs. 130 or 140 Cr., which market was expecting, but we have delivered Rs. 150 Cr.+ PAT.

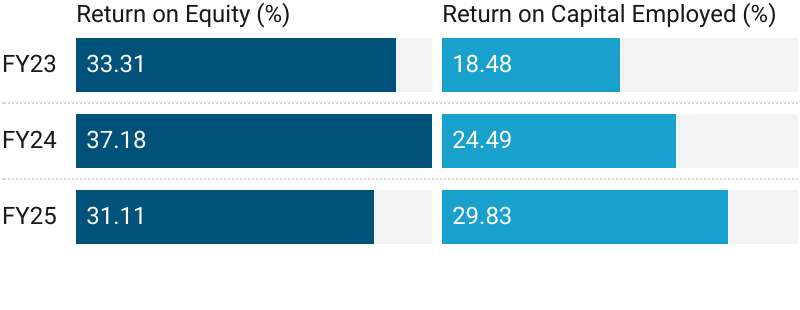

4. Business Metrics: Strong Return Ratios

5. Outlook: Growth of 100-150% in FY26

5.1 FY26 Guidance

So yes, we are going to maintain margins and about top line I can’t give any

number. But yes, it could be in the range of somewhere between Rs. 2,000 to 2,500 Cr

We always remain conservative on these type of guidance’s. So will not going to throw any numbers, any kind of number that will hurt out the sentiments.

Overall Outlook and Financial Guidance

Revenue Guidance: FY26 revenue to be in the range of ₹2,000-2,500 crore.

Profitability: Expects to maintain its current margins in FY26

Order Book: As of July 2025, solar project orders worth ₹2,922 crore and a pipeline of ₹8,450 crores in orders, providing strong revenue visibility.

Future Outlook by Business Vertical

Solar Energy:

FY26 Target: Target of 1 GW of installed solar capacity by FY26, which involves adding another 600 MW during the year.

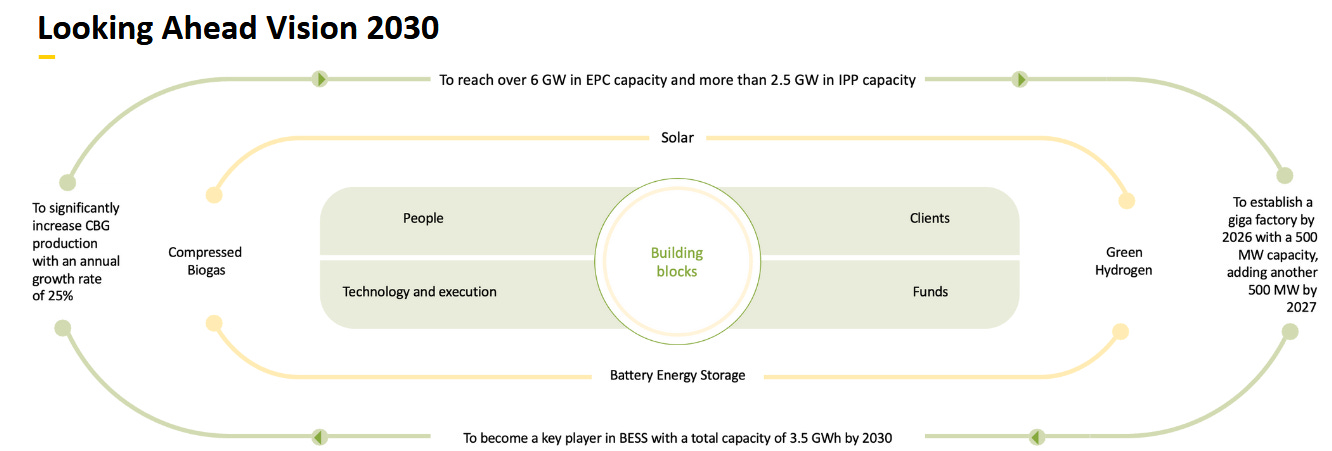

2030 Vision: Be a 6 GW EPC company with an additional IPP portfolio of 2.5 GW.

Battery Energy Storage System (BESS):

FY26 Target: Capacity target of over 1 GWh by FY26.

2030 Vision: BESS portfolio targeted to reach 3.5 GWh by 2030, a goal management believes could be achieved even earlier.

Green Hydrogen & E-Fuels:

Near-Term: The company does not expect any revenue from the green hydrogen vertical in FY26.

2030 Vision: The long-term goal is to have a 1 GW electrolyser facility and achieve 1 million metric tonnes per annum (MMTPA) of e-fuel production.

6. Valuation Analysis

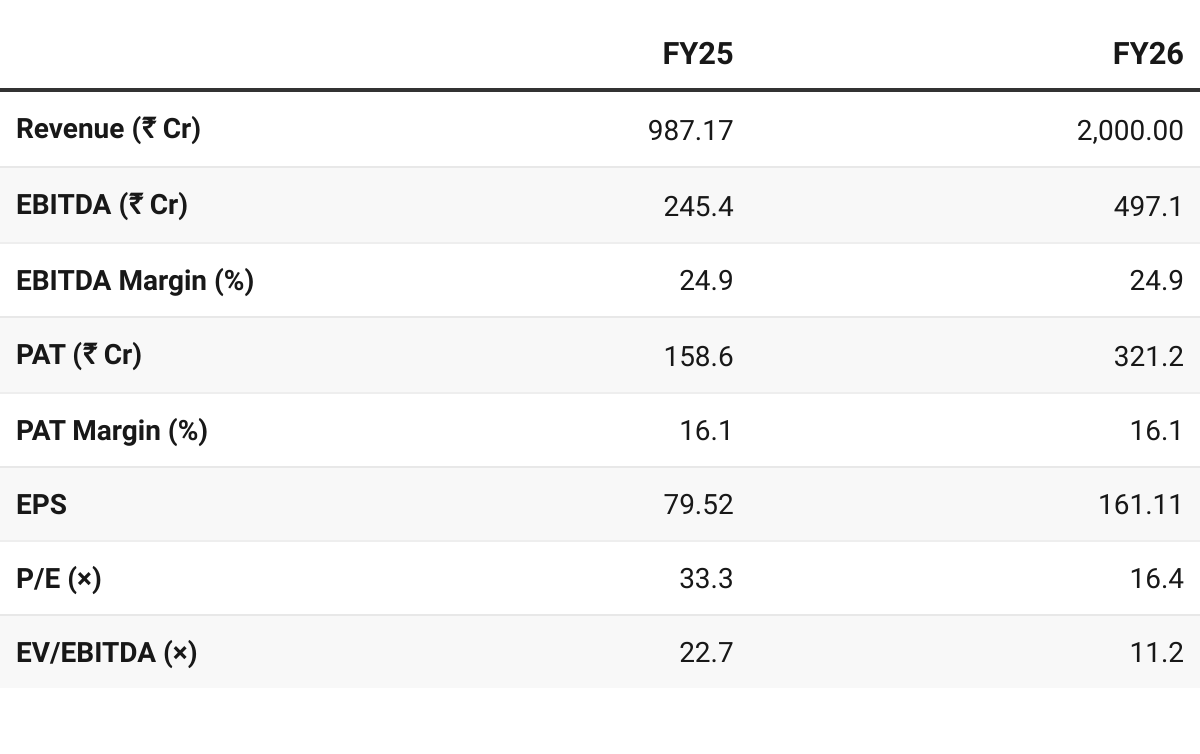

6.1 Valuation Snapshot

CMP ₹2,644.60; Mcap ₹5,373.60 Cr;

Valuation considering lower end of the ₹2,000-2,500 Cr guidance

Attractive Forward Valuation:

The opportunity can be rated as Attractive, but High-Risk. The forward multiples are appealing relative to the projected growth rate, but they leave little room for error if the company fails to execute its aggressive expansion plan.

FY25: Looked expensive (P/E 33×, EV/EBITDA 23×).

FY26E: Valuation much more attractive (P/E 16×, EV/EBITDA 11×) with revenue and earnings doubling.

If Oriana sustains its growth trajectory and deliver on its 2030 Vision , the market could rerate it, creating an opportunity for multiple expansion.

Looking reasonably priced on FY26E and potentially attractively valued if modest growth continues into FY27E. Multiples leave room for re-rating.

6.2 Opportunities at Current Valuation

Conservative Valuations: Valuations are based on ORIANA just meeting the lower end of its guidance range. If execution is closer to the midpoint or higher end of the guidance range it create an upside

BESS Scale-Up: Battery Energy Storage projects offer higher-margin opportunities and could drive margin expansion.

Valuation Comfort: Forward multiples are attractive at 16× P/E and 11× EV/EBITDA (FY26E).

Diversification into Green Hydrogen & E-Fuels: Early mover with 10,000 MTPA allocation under SIGHT, 225 TPD e-methanol project, and electrolyser gigafactory plan — medium/long-term growth driver could create opportunities in FY27.

Gigawatt-Era Ambition: Clear roadmap to 6 GW Solar EPC + 2.5 GW IPP + 3.5 GWh BESS by 2030, presents an opportunity over and above the opportunity seen based on FY26E valuations

6.3 Risks at Current Valuation

Execution & Scale Risk: Rapid doubling of revenue requires flawless project execution; any delays in land, grid connectivity, or supply chain could hurt FY26 targets.

Working Capital Stress: High receivables (₹400+ Cr in FY25) and EPC-heavy business model expose Oriana to cash flow mismatches.

Regulatory Dependence: Policy changes (ALMM, import duties, hydrogen subsidies) can affect costs and project viability.

IPP Capital Intensity: Expanding IPP portfolio ties up equity in SPVs; return profile depends on timely commissioning and refinancing.

Hydrogen & E-Fuels Uncertainty: Near-term revenue negligible; timelines depend on subsidies, global demand, and electrolyser pricing (China dependency).

Industry Risks: DISCOM payment delays, tariff pressure from aggressive bidding by peers, and grid curtailment risks could impact returns.

Valuation Sensitivity: While FY26 multiples look attractive, any miss on guidance (₹2,000–2,500 Cr topline) could compress valuations quickly.

Scale vs Valuation Gap: While valuations look cheap, discount may persist until ORIANA delivers on FY26 guidance

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer