Oberoi Realty: PAT growth of 57% & Revenue growth of 30% in 9M-25 at a PE of 25

Price increases of 20-25% without impact on demand. New project launches and outlook for strong cash flow create a positive outlook for FY26.

1. Real Estate Developer

oberoirealty.com | NSE: OBEROIRLTY

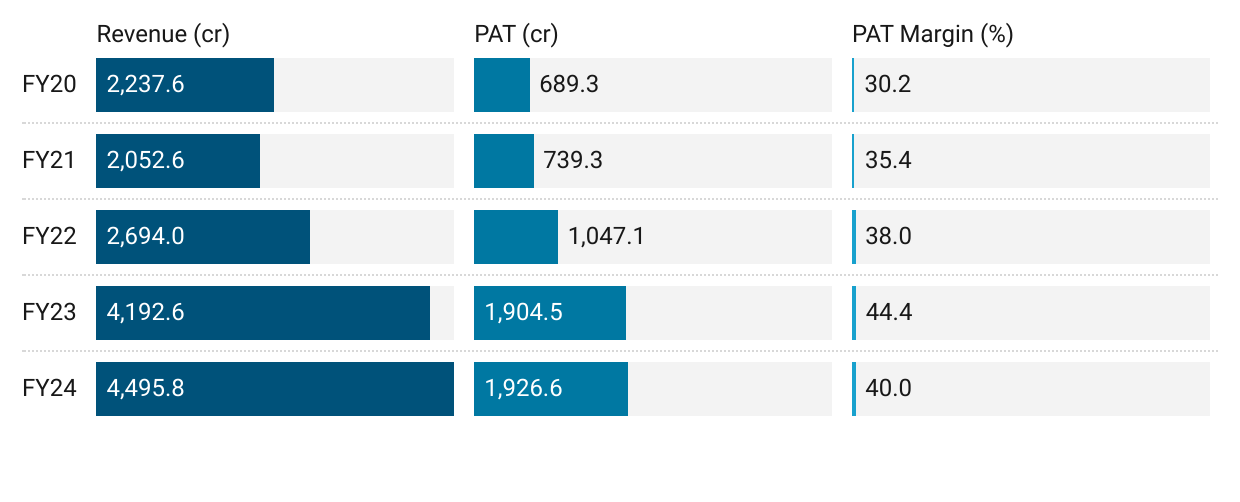

3. FY20-24: PAT CAGR of 29% & Revenue CAGR of 19%

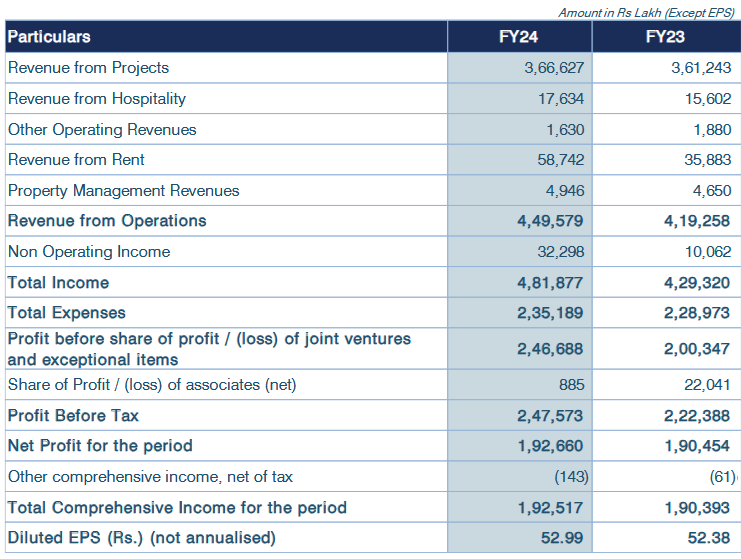

4. Flat FY24: PAT up 1% & Revenue up 7% YoY

5. Q3-25: PAT up 72% & Revenue 34% YoY

PAT up 5% & Revenue 7% QoQ

6. 9M-25: PAT up 57% & Revenue up 30% YoY

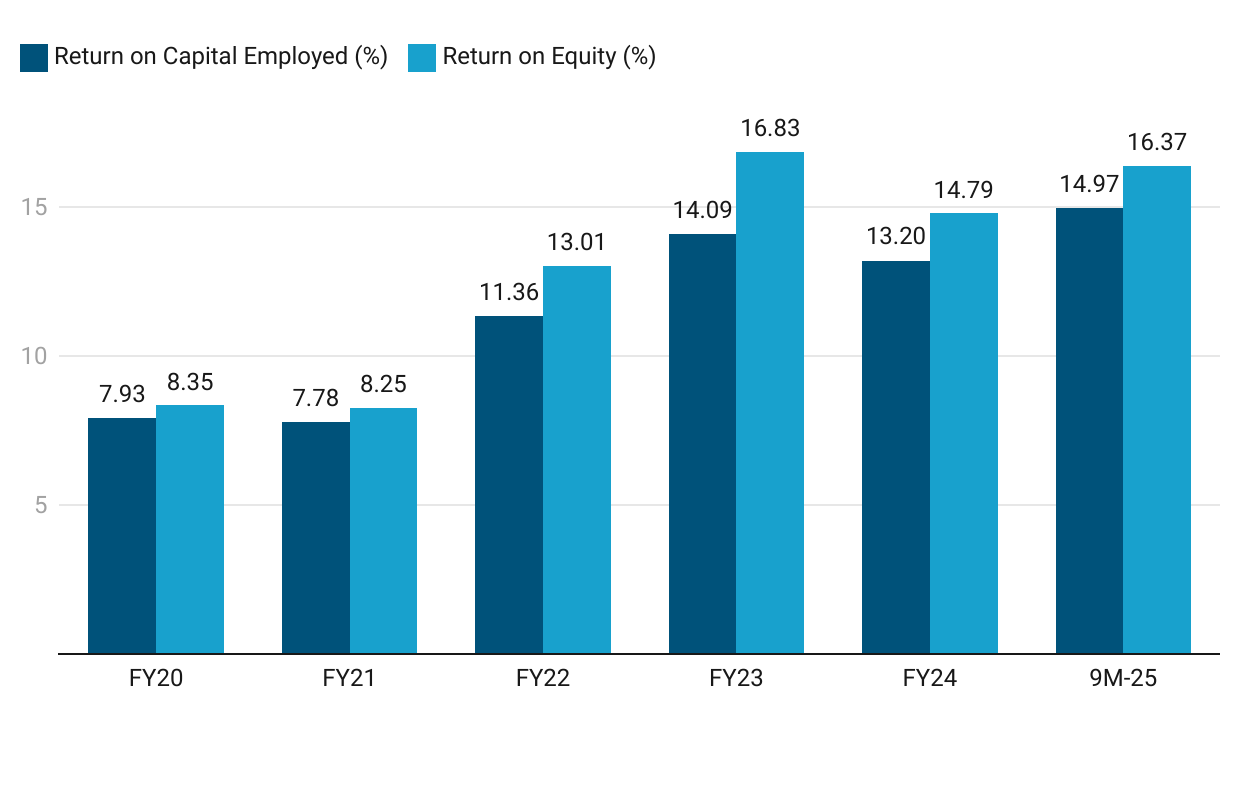

7. Business metrics: Strong & improving return ratios

8. Outlook: Strong pricing environment & cash flow

OBEROIRLTY is agnostic to market demand fluctuations and that they see a flight to quality during market corrections.

OBEROIRLTY has strategically increased prices in various projects, driven by strong resale values often exceeding their initial sale prices by 20-25%. They are also pricing their remaining stock at current market rates set by buyers in the resale market, rather than the developers directly.

Substantial amount of ready inventory with minimal debt, which provides a strong cash flow.

Planning to launch several projects within the next 12 to 18 months, with some possibly launching even sooner.

These are diverse and located in different areas, to avoid direct competition.

9. PAT growth of 57% & Revenue growth of 30% in 9M-25 at a PE of 25

10. Hold?

If I hold the stock then one may continue holding on to OBEROIRLTY

Based on 9M-25 performance OBEROIRLTY looks on track to deliver a strong FY25 after a flat FY25

The outlook for strong pricing environment, upcoming launches and the outlook for strong cash flows is a reason to continue with OBEROIRLTY

The OBEROIRLTY management claim that they are “agnostic to demand” as their reputation, brand and product quality meant that they would always receive demand regardless of the market. One needs to keep a watch on this claim on quarter to quarter basis.

The demand for premium and bespoke residences continues to be robust, and our luxury homes are setting new benchmarks in design and quality. With a strong portfolio of upcoming projects, and strategic land acquisitions, we stand well-positioned to meet the rising demand and foster long-term profitable growth.

11. Buy?

If I am looking to enter OBEROIRLTY then

OBEROIRLTY has delivered PAT growth of 57% and Revenue growth of 30% in 9M-25 at a PE of 24 which makes the valuations quite reasonable in the short term.

Bases on historical execution of FY20-24 PAT CAGR of 29% & Revenue CAGR of 19% at a PE of 24 makes the valuations quite reasonable from a historical performance perspective.

The new launches and 20-25% increases in prices provide a strong outlook for a 20%+ growth in FY26 at a PE of 24 makes the valuations quite reasonable from a FY26 perspective.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer