Nuvama Wealth Management: PAT up 102% & Revenue up 39% in 9M-24 at a PE of 27

NUVAMA benefiting from sectoral tailwinds & operating leverage. To grow top-line at 20%+. Bottom-line expected to growth faster than top-line. Overall growth to be slightly better than industry growth

1. Amongst top 2 independent private wealth players

nuvama.com | NSE: NUVAMA

Nuvama Group got carved out of Edelweiss Group over a 2-year period from FY '21 to FY '23.

Business Segment

Wealth management business - Distribution of financial products, Investment advisory, Lending against securities and Securities broking for clients in wealth management business

Asset management business - Investment management for Alternative Investment Funds (AIFs) and Portfolio management services (PMS) across strategies

Capital markets business - Institutional broking business, Merchant banking business and Advisory

2. FY21-23: Operating PAT CAGR of 36% & Revenue CAGR of 26%

Difference between operating PAT & on account of Nuvama Group getting carved out of Edelweiss Group resulting in a number of exceptional items and non-recurring items getting reflected in the P&L.

Nuvama Group got carved out of Edelweiss Group over a 2-year period from FY '21 to FY '23. And to attain current holding business and entity structure, a number of arrangements, including through de-merger schemes, were put in place. This resulted in a number of exceptional items and non-recurring items getting reflected in the financial statements.

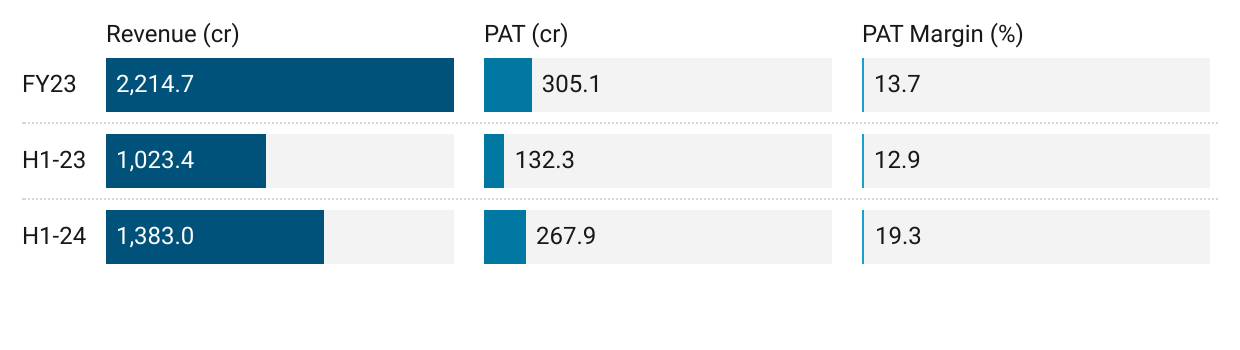

3. H1-24: PAT up 103% & Revenue up 35%

Strong margin expansion

4. Strong Q3-24: PAT up 70% & Revenue up 31% YoY

PAT up 18% & Revenue up 14% QoQ

5. Strong 9M-24: PAT up 102% & Revenue up 39% YoY

Strong margin expansion

6. Business metrics: Strong & improving return ratios

7. Strong outlook: Revenue growth of 40-50%

i. Revenue growth of 20%+

We will double our RM capacity in five years, which broadly means about 20% year on year. We've added about 15 RMs this year, and we should add another five. That would take us, that would, I mean, do our first 20% achievement for this year itself.

Revenue growth: it will be higher than the rate of RM growth

ii. PAT growth will be higher than the revenue growth of 20%+

8. PAT growth of 102% & Revenue growth of 39% in 9M-24 at a PE of 27

9. So Wait and Watch

If I hold the stock then one may continue holding on to NUVAMA

Based on 9M-24 performance, NUVAMA looks on track to deliver the strongest operating PAT & revenue in FY24

NUVAMA is in the middle of a strong run and has delivered sequential QoQ growth in top-line & bottom line in all the three quarters of FY24

NUVAMA is not ready to give a guidance at this point in time but is bullish on the outlook. We are expecting some sort of guidance from FY25.

We've not formalized the policy of quarterly guidance right now. This is our first call. And maybe over one quarters to two quarters, we will reach a conclusion. And then by end of the year, we will start guiding.

I think our fundamentals remain strong with both wealth and asset management businesses continue to benefit from the sectoral tailwinds and operating leverage.

10. Join the ride

If I am looking to enter NUVAMA then

NUVAMA has delivered PAT growth of 102% and revenue growth of 39% in 9M-24 at a PE of 27 which makes the valuations quite acceptable over the short term.

With an outlook for 20%+ top-line growth and a higher bottom-line growth a PE of 27 can be sustained by NUVAMA over the longer term

An outlook to grow slightly better than the industry

But we will be in line with the industry growth is what we can say or slightly better than that. And if there is a marginal or there is a significant improvement in the industry uptrend, we will follow that.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer