Nuvama Wealth Management: PAT up 100% & Revenue up 55% in H1-25 at a PE of 28

Benefiting from industry tailwinds with successful execution. Outlook for strong growth. Bottom-line expected to growth faster than top-line. Overall growth to be slightly better than industry growth

Quick summary of latest Earning Calls & Sectoral Insights visit moneymuscle.in

1. Why is NUVAMA interesting?

nuvama.com | NSE: NUVAMA

Wealth management in India is still developing, offering significant opportunities. By 2028, India is expected to become the 4th largest private wealth market in the world. NUVAMA, a leading wealth management firm, has a strong record of growth and is well-positioned to take advantage of this opportunity.2. Leading wealth manager in Affluent & HNI segments

Amongst top 2 independent private wealth players

Business Segments

Wealth management - Distribution of financial products, Investment advisory, Lending against securities and Securities broking for clients

Asset management - Investment management for Alternative Investment Funds (AIFs) & Portfolio management services (PMS)

Capital markets - Institutional broking business, Merchant banking business and Advisory

3. FY21-24: Operating PAT CAGR of 44% & Revenue CAGR of 27%

Operating PAT

Reported Financial Statements

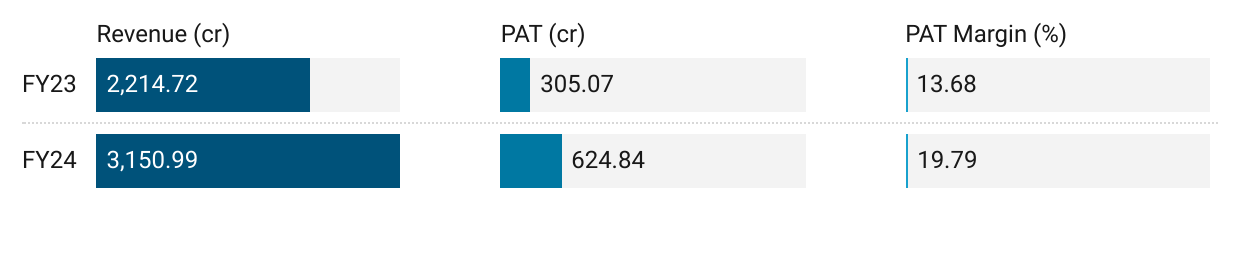

4. Strong FY-24: PAT up 105% & Revenue up 42% YoY

Strong margin expansion

5. Strong Q2-25: PAT up 77% & Revenue up 50% YoY

PAT up 17% & Revenue up 11% QoQ

6. Strong H1-25: PAT up 100% & Revenue up 55% YoY

7. Business metrics: Strong & improving return ratios

8. Outlook: Strong business

i. Outlook for strong business growth

Wealth and Asset Management to be key drivers and would constitute 75 - 80% of the earnings

Wealth Management : In 5 years grow clients and client assets to 2-2.5x

Asset Management: In 5 years grow AUM to 6-8x

Asset Services: In 5 years grow clients assets to 2-2.5x

ii. PAT to grow faster than top-line growth

Operating leverage to deliver significant improvement in cost to income ratio

9. PAT growth of 100% & Revenue growth of 55% in H1-25 at a PE of 28

10. Hold?

If I hold the stock then one may continue holding on to NUVAMA

H1-25 execution gives indications that NUVAMA is on track to deliver a strong FY25 in line with the momentum delivered in FY24

NUVAMA is in the middle of a strong run and has delivered sequential QoQ growth in top-line & bottom line for the last 6 quarters starting Q1-24

NUVAMA is riding on the industry tailwinds and investors can also hold on and ride NUVAMA till the tailwinds last.

The wealth management sector is experiencing robust growth driven by factors like rising GDP, increased financialization of savings, and a shift from unorganized to organized players.

Nuvama is well-positioned to capitalize on these trends, with its diversified business model, strong brand presence, and aggressive expansion strategy.

The sector is expected to grow 6-8x in the next decade

11. Buy?

If I am looking to enter NUVAMA then

NUVAMA has delivered PAT growth of 100% and revenue growth of 55% in H1-25 at a PE of 28 which makes the valuations quite acceptable over the short term.

NUVAMA has given an outlook for strong business growth with PAT growing faster than the top-line. A PE of 28 can be sustained by NUVAMA over the longer term even if sustains the performance delivered since FY21

NUVAMA is guiding to to grow slightly better than the industry which implies an increasing market share

We will be in line with the industry growth is what we can say or slightly better than that. And if there is a marginal or there is a significant improvement in the industry uptrend, we will follow that.

Previous coverage of NUVAMA

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer