Nucleus Software Exports: PAT growth of 350% & Revenue growth of 59% in H1-24 at PE of 19

Strong outlook for FY24. Good revenue visibility based on a strong order book. Tailwinds of a good general business environment. At reasonable valuations with cushion of cash in the balance sheet.

1. Software solutions to Banking and Financial Services

nucleussoftware.com | NSE : NUCLEUS

Products

FinnOne Neo™ - Solution for lending businesses

FinnAxia™ - Solution for transaction banking operations of corporate banks

Services

Data Analytics and Automation

Cloud Services

Application Modernization

Infra Services

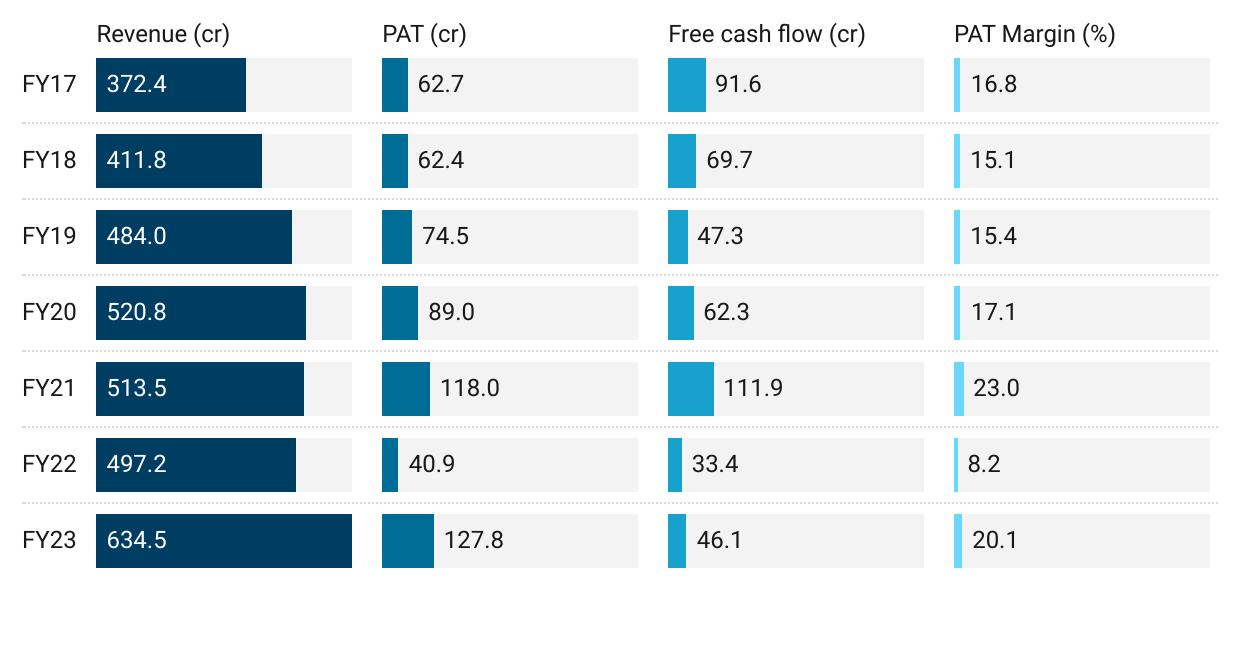

2. FY17-23: Years of low or no growth. Pick up in FY23

Irrespective of growth, NUCLEUS has a track record of generating cash.

3. Strong FY23: PAT up 212% and Revenue up 28% YoY

4. Strong Q1-24: PAT up 397% and Revenue up 61% YoY

5. Strong Q2-24: PAT 304% & Revenue up 58% YoY

6. Strong H1-24: PAT up 350% & Revenue up 59% YoY

7. Business metrics: Solid return ratios

Irrespective of tepid growth, NUCLEUS has delivered solid return ratios

8. Outlook: PAT growth of 32% & revenue growth of 29%

Nucleus Software does not provide any specific revenue earning guidance.

i. FY24: PAT growth of 32% & revenue growth of 29%

In the absence of any guidance one can estimate FY24 assuming status quo over the last few quarters. For the last 3 quarters revenue run rate is at around Rs 205 cr. In the absence of any indications from the management if one assumes a similar run-rate we end up with a top-line of Rs 820 cr for FY24 which is a 29% growth over FY23.

Based on indications from NUCLEUS management that margins will be sustained, one can assume Q2-24 PAT margin will be sustained at 20.5%. We end up with a PAT of Rs 168 cr on a revenue of Rs 820 cr which is a growth of 32%

we do not give any guidance, but our effort would always be to maintain the positive margins that we have maintained in last couple of quarters.

ii. Strong revenue visibility: Order book 1.1X FY23 revenues

The Order book position is at INR 705.1 crore including INR 648.2 crore of products business and INR 56.9 crore of projects and services business. On June 30, 2023 the order book position was INR 758.6 crores including INR 689.1 crore of product business and INR 69.5 crore of project and services business.

iii. General business outlook is positive

As of now, we are not experiencing any slowdown. We continue to get queries for our offering.

We are getting a good interest and there would be announcement about some orders as well in the near future.

9. PAT growth of 109% & Revenue growth of 65% in H1-24 at a PE of 18

10. So Wait and Watch

If I hold the stock then one may continue holding on to NUCLEUS

Based on H1-24 performance, NUCLEUS looks on track to deliver the strongest yearly performance since FY17

The past record during has not been great in delivering strong growth. Hence one needs to watch and decide on NUCLEUS at a quarter to quarter level. One doesn’t want to get stuck with a stock where the business is not showing a clear growth trajectory. The management indicating that the general business environment is good along with a strong order book provides a positive outlook for FY24.

11. Or, join the ride

If I am looking to enter NUCLEUS then

NUCLEUS has delivered PAT growth of 350% & Revenue growth of 59% in H1-24 at a PE of 18 which makes valuations quite reasonable.

Outlook for PAT growth of 32% & revenue growth of 29% in FY24 makes the valuations reasonable.

NUCLEUS delivered Rs 128 cr of free cash flow against a market cap of Rs 3,775 cr. As of H1-24 end it is available on a free cash flow yield of 3.4% (not annualized) which makes the valuations quite attractive.

Rs 718 cr of cash on books as of end of Q2-24 implies that 19% of market cap is in cash which provides a margin of safety in the valuations.

Total cash and cash equivalent as on September 30th, 2023 are INR 718.1 crore against INR 701.5 crores as on June 30, 2023.

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades