Nippon Life India Asset Management: PAT growth of 53% & Revenue growth of 22% in FY24 at a PE of 33

NAM-INDIA delivered market share gains in the last 4 consecutive quarters. Fastest growing among the Top 10 AMC for FY24. QoQ growth in PAT & revenue in the last 5 consecutive quarters

1. One of the largest Asset Managers in India

mf.nipponindiaim.com | NSE: NAM-INDIA

Maintained industry ranking of 4th Largest AMC based on QAAUM

No.1 Non-Bank Sponsored MF in India

Largest investor base in the industry: Unique investors at 16.5 mn, with a 37.0% market share

Over 1 in 3 mutual fund investors invest with us.

2. FY20-24: PAT CAGR of 28% & Revenue CAGR of 8%

3. Weak FY23: PAT down 3% & Revenue up 3%

4. Strong 9M-24: PAT up 46% & Revenue up 17% YoY

5. Strong Q4-24: PAT up 73% & Revenue up 34% YoY

PAT up 21% & Revenue up 11% QoQ

6. Strong FY24: PAT up 53% & Revenue up 22% YoY

7. Business metrics: Strong & improving return ratios

8. PAT growth of 53% & Revenue growth of 22% in FY24 at a PE of 33

9. So Wait and Watch

If I hold the stock then one may continue holding on to NAM-INDIA

Based on FY24 performance, NAM-INDIA has delivered the strongest revenue & PAT in FY24

Highest Ever Annual Operating Profit & Profit After Tax

NAM-INDIA is in the middle of a strong earnings streak and has delivered sequential QoQ growth in PAT and revenue in the last 5 consecutive quarters starting from Q4-23

Highest ever Quarterly Operating Profit & Profit After Tax

The strong earnings streak in NAM-INDIA is being delivered on the back of business performance.

Highest QAAUM market share increase among all AMCSs

This is the fourth successive quarter of market share increase

On a YoY basis, we have been the fastest growing AMC among the Top-10 players.

10. Join the ride

If I am looking to enter NAM-INDIA then

NAM-INDIA has delivered PAT growth of 53% and revenue growth of 22% in FY24 at a PE of 33 which makes the valuations fairly valued in the short term.

If NAM-INDIA continues the business momentum of FY24 into FY25 delivering highest QAAUM market share increase among all AMCSs, there would be value in the stock over the medium to longer term.

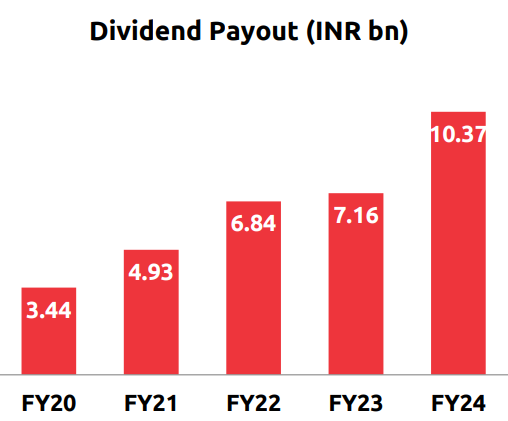

It is a good stock for those who like dividends

~99% of FY24 earnings shared with shareholders

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer