Nippon Life India Asset Management: PAT growth of 44% & Revenue growth of 43% in H1-25 at a PE of 39

NAM-INDIA delivered market share gains in the last six consecutive quarters. Fastest growing among the Top 10 AMC for FY24.

1. What is NAM-INDIA interesting?

mf.nipponindiaim.com | NSE: NAM-INDIA

Despite only 3.1% of India's population investing in mutual funds, the industry's Assets Under Management (AUM) have seen a robust 20% compound annual growth rate over the last decade, highlighting significant growth potential. In this high growth market, NAM-INDIA is riding the industry tailwinds to consistently increase its market share for the last six consecutive quarters.2. One of the largest Asset Managers in India

No.1 Non-Bank Sponsored MF in India

Maintained industry ranking of 4th Largest AMC based on Quarterly Average Assets Under Management (QAAUM)

Have the largest base in the Mutual Fund industry, with 17.5 mn unique investors.

Over 1 in 3 mutual fund investors invest with us.

We continue to be one of the largest ETF players

3. FY20-24: PAT CAGR of 28% & Revenue CAGR of 8%

4. Strong FY24: PAT up 53% & Revenue up 22% YoY

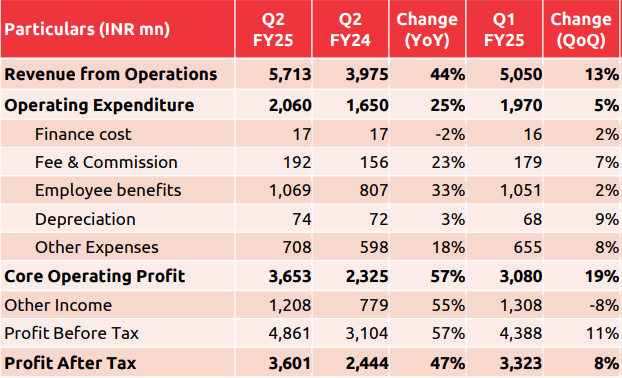

5. Strong Q2-25: PAT up 47% & Revenue up 44% YoY

PAT up 8% & Revenue up 13% QoQ

6. Strong H1-25: PAT up 44% & Revenue up 43% YoY

7. Business metrics: Strong & improving return ratios

8. PAT growth of 44% & Revenue growth of 43% in H1-25 at a PE of 39

9. Hold?

If I hold the stock then one may continue holding on to NAM-INDIA

Based on FY24 and H1-25 performance, NAM-INDIA is delivering extremely strong business momentum and one needs to ride out the momentum till it lasts

NAM India achieved its highest ever quarterly Profit After Tax of Rs 360 cr and Operating Profit of Rs 365 cr

Market share increased for the sixth successive quarter, reaching 8.29% in the quarter.

Equity market share increased to 6.96%, its highest level since December 2020.

SIP market share increased by 52 bps to 9.88% QoQ, reflecting an 81% YoY growth in the monthly systematic book.

Continued uptick in systematic flows over the last 13 quarters.

Our Mutual Fund QAAUM grew 14% QoQ & 57% YoY to reach INR 5.49 trillion. This made us the fastest growing AMC among the Top-5 AMCs over a 6 month, 1 year and 3 year time frame. We also had the highest increase in QAAUM market share on a YoY basis among all AMCs.

We continue to have the largest base in the Mutual Fund industry, with 18.9 mn unique investors.

10. Buy?

If I am looking to enter NAM-INDIA then

NAM-INDIA has delivered PAT growth of 44% and revenue growth of 43% in H1-25 at a PE of 39 which makes the valuations reasonable in the short term.

If NAM-INDIA continues the business momentum of FY24 into FY25 delivering highest QAAUM market share increase among all AMCs, there would be value in the stock over the medium to longer term.

Previous coverage of NAM-INDIA

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer