Nippon Life India Asset Management: PAT growth of 46% & Revenue growth of 17% in 9M-24 at a PE of 34

NAM-INDIA has delivered market share gains in the last 3 consecutive quarters. It is the fastest growing among the Top 10 AMC for 9M-24.

1. One of the largest Asset Managers in India

mf.nipponindiaim.com | NSE: NAM-INDIA

Maintained industry ranking of 4th Largest AMC based on QAAUM

No.1 Non-Bank Sponsored MF in India

Has the largest investor base in the industry: Unique investors at 15.5 mn, with a 36.9% market share

Overall assets under management market share at 7.67% (↑ 40 bps YoY & ↑ 21 bps QoQ)

Equity Market Share (excl ETF) 6.67% ( ↑15 bps QoQ)

ETF Market Share at 15.4% (↑ 134 bps QoQ)

Over 1 in 3 mutual fund investors invest with us.

2. FY19-23: PAT CAGR of 10% & Revenue CAGR of -3%

Weak track record of growth

3. Weak FY23: PAT down 3% & Revenue up 3%

4. Strong H1-24: PAT up 50% & Revenue up 17% YoY

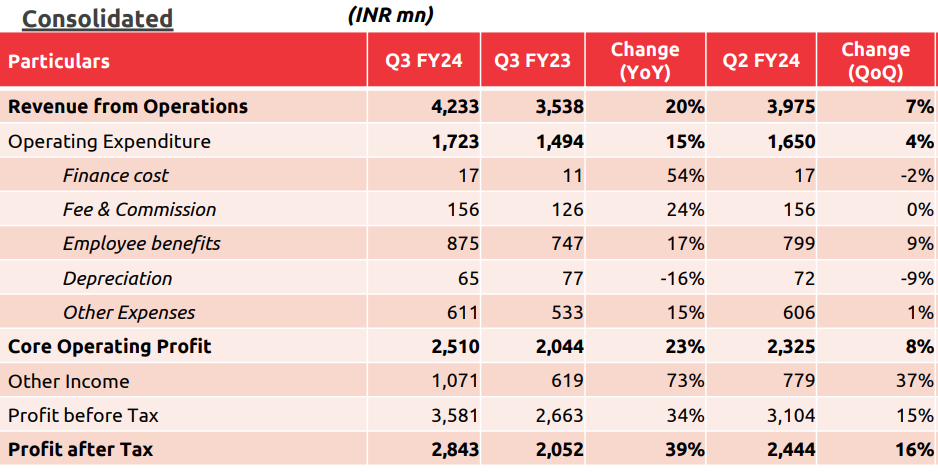

5. Strong Q3-24: PAT up 39% & Revenue up 20% YoY

PAT up 16% & Revenue up 7% QoQ

6. Strong 9M-24: PAT up 46% & Revenue up 17% YoY

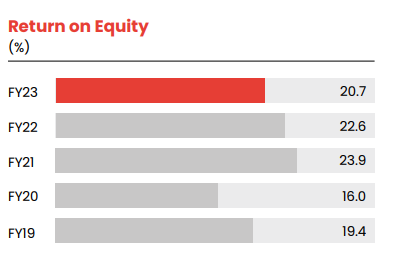

7. Business metrics: Strong return ratios

8. PAT growth of 46% & Revenue growth of 17% in 9M-24 at a PE of 34

9. So Wait and Watch

If I hold the stock then one may continue holding on to NAM-INDIA

Based on 9M-24 performance, NAM-INDIA looks on track to deliver the strongest revenue & PAT in FY24

NAM-INDIA is in the middle of a strong earnings streak and has delivered sequential QoQ growth in PAT in the last four consecutive quarters starting from Q4-23

The strong earnings streak in NAM-INDIA is being delivered on the back of business performance.

On a YTD basis, we have been the fastest growing AMC among the Top-10 players with 29% growth over March 2023.

This is the third successive quarter of market share increase that we have witnessed.

There has been a continued uptick in our systematic flows over the last 10 quarters, which has led to an increase in market share

NAM India was appointed as one of the four AMCs for managing EPFO corpus for ETF investments. These investments commenced in the beginning of July 2023, and we are seeing approximately one-fourth of the incremental EPO flows going forward.

EPFO will be investing around INR 15,000 Crores per annum

10. Join the ride

If I am looking to enter NAM-INDIA then

NAM-INDIA has delivered PAT growth of 46% and revenue growth of 17% in 9M-24 at a PE of 34 which makes the valuations fairly valued in the short term.

If NAM-INDIA continues the business momentum of FY24 into FY25 delivering market share gains and being among the fastest growing AMC among the Top-10 players, there would be value in the stock over the medium to longer term.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer