Newgen Software Technologies: 51% PAT growth & 24% Revenue growth in H1-25 at a PE of 85

Revenue CAGR of 36-50% for the next 3-4 years as NEWGEN targets $500 mn revenue. FY25 revenue growth in line with historical growth of around 20%.

1. Enterprise software company

newgensoft.com | NSE: NEWGEN

Newgen is the leading provider of a unified digital transformation platform with native process automation, content services, communication management, and AI/ML capabilities.

Annuity revenues comprise of ATS/AMC and Cloud/ Subscription License revenue streams and Support revenues2. FY22-24: PAT CAGR of 24% & Revenue CAGR of 26%

3. Strong FY-24: PAT up 42% & Revenue up 28% YoY

4. Strong Q2-25: PAT up 47% & Revenue up 23% YoY

PAT up 48% & Revenue up 15% QoQ

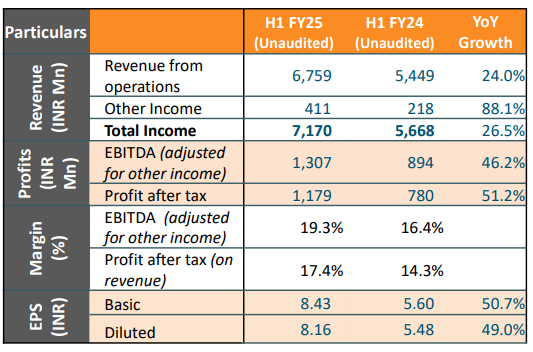

5. Strong H1-25: PAT up 51% & Revenue up 24% YoY

6. Strong return ratios

7. Outlook: Revenue CAGR of 36-50% for next 3-4 years

i. $500 million revenue by FY27/ FY28

NEWGEN on FY24 revenue of $148 million is targeting is targeting $500 million by FY27 or Fy28. This implies a revenue CAGR of 36-50%.

ii. FY25: 20% revenue growth

the company to maintain its historical growth rate of around 20% in FY25.

8. PAT growth of 51% & Revenue growth of 24% in H1-25 at a PE of 8

5

9. Hold?

If I hold the stock then one may continue holding on to NEWGEN

NEWGEN has delivered a reasonable strong H1-25, looks on track to deliver FY25 with 20% revenue growth.

A 20% growth rate is nothing exciting for a company at a PE of 80. The opportunity is on account of PAT growth exceeding revenue growth. If the trend of margin expansion continues on account of the annuity business within NEWGEN there will be an opportunity.

For FY24: Annuity revenues were at INR750 crores, comprising of 60% of our revenues.

Order book has grown at 20%+ and is strong to support revenue growth for FY25

has grown by roughly around 20%, 22% for H1 for this part of the year which is -- and also you should understand this is not the pending order book, some part of it will be executed and some would be also pending to be execution, but if you look at just linear order book growth that has been roughly around 22% for H1

As of Q4-24 end: We've taken the order book, again, from a very high base of INR1,300 crores to INR1,560 crores. We don't see order book as a constraint to not meet our next year's goals

One needs to keep a watch for the momentum in top-line and bottom-line. If momentum slows down then we should be looking at exit options as a PE of 80+ cannot be justified with sub-par growth.

10. Buy?

If I am looking to enter the stock then

NEWGEN has delivered PAT growth of 51% & Revenue growth of 24% in H1-25 at a PE of 85 which makes valuations fully priced in the short term.

NEWGEN is guiding for a FY25 in line with historical performance. If one takes the H1-25 performance as an indicator for the full year performance at PE of 85 makes the valuations fully priced from a FY25 perspective.

NEWGEN is indicating towards revenue CAGR of 36-50% with expectations of higher PAT growth for the next 3-4 years to reach a revenue of $ 500 mn at a PE of 85which makes the valuations reasonable from the longer term perspective.

At a PE of 85, there is little room for NEWGEN to miss on its growth momentum. One or two not so good quarters may raise questions about the valuations of the stock.

Previous Coverage of NEWGEN

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

You could have present peer analysis or how Newgen operates differently than traditional ITs

What are the growth triggers?