Netweb Technologies Q4 FY25 Results: PAT up 59%, RoE at 24%, FY26 Outlook Strong on AI Infra Tailwinds

Backed by a strong AI infra order book & proprietary platforms, Netweb eyes global expansion & software monetization. Execution is key to sustaining premium valuations.

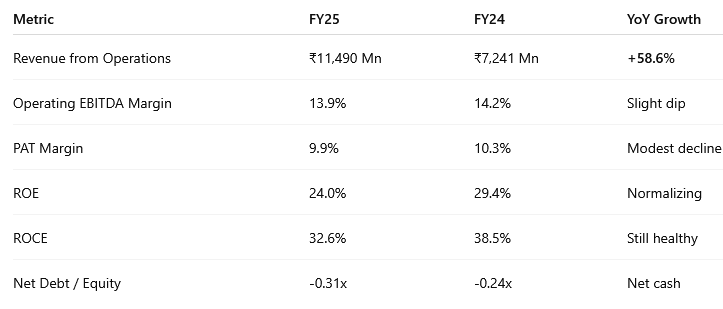

1. Financial Performance: FY25 in Review

Netweb Technologies delivered a strong FY25 performance, marked by robust revenue growth, healthy profitability, and consistent expansion across its core high-end computing segments. The company continued to ride the wave of India’s digital and AI infrastructure buildout, supported by a strong government push, institutional demand, and deep product innovation.

1.1 Q4 Highlights and Drivers for Early FY26 Momentum

While detailed Q4-only financials were not disclosed separately in the investor deck, management commentary and the full-year numbers suggest a solid exit run-rate heading into FY26.

Key Q4 tailwinds setting the tone for Q1 FY26:

High order book conversion rate (~₹325.2 Cr confirmed orders)

Continued traction in AI systems (GPU-based) and private cloud installations

Ramp-up of the new SMT-enabled manufacturing facility commissioned in May 2024

First deliveries of custom AI infra under the OEM partnership with NVIDIA

The strong quarterly momentum has also been aided by increased government orders under the IndiaAI Mission and early-stage wins in the international markets (Middle East, Europe).

1.2 Full-Year FY25 Performance: Revenue, Margins, Profitability

Takeaways:

FY25 saw broad-based growth across AI infra, cloud systems, and supercomputing

Despite supply chain costs, Netweb maintained double-digit margins, indicating strong operating leverage

Continued reinvestment in R&D and infra held back margin expansion, but positions Netweb for FY26–28 compounding

1.3 Segmental Trends: HPC, AI Systems, Cloud & Services

Netweb’s diversified product stack delivered across all major verticals:

Netweb’s ability to cross-sell integrated solutions across compute, storage, and orchestration continues to be its core differentiator.

FY25 confirms Netweb’s evolution into a full-stack AI and cloud infra player. With an expanding addressable market, strong order pipeline, and focused R&D bets, the company has entered FY26 on a structurally strong footing.

2. Management Commentary & Outlook

Netweb’s leadership painted a confident and execution-focused picture for FY26 and beyond. Backed by strong demand tailwinds, new product launches, and a robust order pipeline, the company aims to consolidate its position as India’s top-tier OEM for AI and HPC infrastructure, while making its first serious push into global markets.

2.1 FY26 Guidance: Revenue Visibility & Execution Focus

While Netweb did not give explicit numerical revenue guidance, management emphasized strong growth visibility for FY26, built on:

Implied takeaway: Management is preparing for 30–40% revenue growth in FY26, given the current base and deal momentum.

2.2 Strategic Priorities for FY26

The company’s FY26 playbook is focused on scaling execution, deepening AI product capabilities, and tapping global markets.

Top strategic levers:

AI Product Scale-up:

Commercial rollout of Skylus.ai—a unified orchestration and provisioning layer for GPU-based AI infrastructure.Partnership-led Innovation:

Joint roadmap with NVIDIA to develop systems based on Blackwell platform—targeting next-gen GPU systems.Capacity Expansion:

Commissioning of the state-of-the-art SMT-enabled plant in May 2024 boosts throughput and localization.Geographic Expansion:

Foray into Europe and the Middle East, with service networks planned in 4 countries to begin with.Platform Modernization:

Accelerated shift from traditional virtualization to container-based deployment models, aligned with GenAI workloads.

2.3 Commentary Highlights from Management

Key tones from the earnings call and presentation:

“Netweb is at the forefront of India’s AI transformation—building from chip to cluster, across infra layers.”

“Our proprietary stacks like Tyrone Skylus and Kubyts are getting strong interest from PSUs and private players.”

“We believe we are entering a multi-year infra cycle driven by AI, sovereign cloud, and compute densification.”

“The IndiaAI mission is a major catalyst for our supercomputing and GPU-based products.”

2.4 Vision 2030: India’s AI Infra Backbone & Global OEM Aspirations

The management’s long-term ambition is clear:

To become a globally respected, Indian-origin OEM for high-performance AI and compute infrastructure.

Vision Highlights:

Serve as the backbone of India’s sovereign cloud and AI infra

Be a full-stack infrastructure provider: compute, storage, networking, orchestration, services

Achieve deeper IP monetization via platform offerings like Skylus, Collectivo, and Tyrone Cluster Suite

Establish India-exported AI infra brand credibility via global expansions

Netweb’s FY26 strategy balances near-term execution with long-term ambition. The roadmap is built on tech depth, proprietary platforms, and demand certainty—but will require operational precision and global GTM muscle to sustain the current valuation.

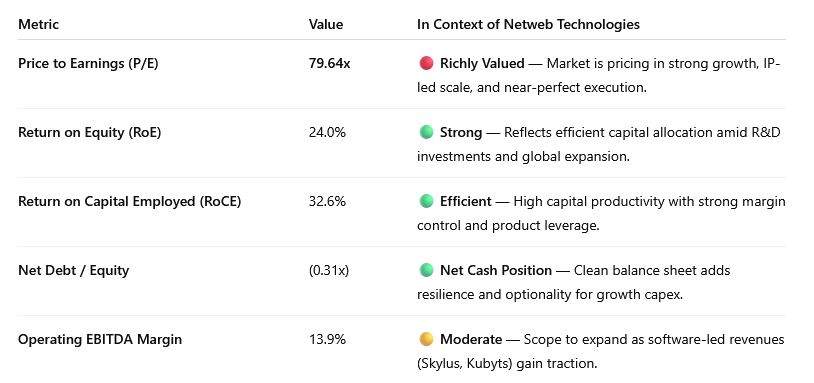

3. Valuation Analysis

3.1 Current Valuation Snapshot:

3.2 What’s Built Into the Price Today

With a trailing P/E of ~80x, Netweb’s current market valuation already reflects aggressive expectations from both execution and market expansion. Investors are not buying a typical hardware OEM—they’re betting on a category leader in AI infrastructure, much like a domestic parallel to Supermicro or Nvidia (infra layer).

Here’s what the market appears to be pricing in:

1. Sustained Hypergrowth (30–40% CAGR)

The company delivered ~59% YoY revenue growth in FY25, and the ₹6,800 Cr combined order book + L1 gives high visibility into strong topline performance for FY26. A sustained 30–40% growth through FY27 is baked into the valuation.

Anything below 25% CAGR for 2+ years may trigger a P/E derating.

2. Commercial Success of Proprietary IP

Skylus.ai (private cloud + orchestration layer)

Kubyts (GPU-accelerated ML workloads)

Tyrone Cluster Suite (HPC deployment tool)

The current multiple assumes these platforms will evolve into enterprise-scale IP—either through subscription-based monetization or bundled solution value.

No traction in IP monetization could raise questions on long-term margins.

3. Global Expansion Execution

Management’s plan to enter Europe and the Middle East, with service presence in 4 countries, is seen as a leap toward becoming a global OEM. The valuation implies confidence in:

Securing export orders

Building international sales capability

Competing against mature global peers

Initial delays or high CAC (customer acquisition costs) may lead to margin pressure and weaker sentiment.

4. IndiaAI Tailwinds & Domestic Dominance

Netweb is positioning itself as India’s national backbone for:

Supercomputing (AIRAWAT, PARAM)

AI infra (Skylus systems, Blackwell-based GPU servers)

HPC adoption across PSUs, academia, and research bodies

The IndiaAI mission amplifies confidence that Netweb will capture a disproportionate share of the AI infrastructure wallet.

Any policy delays or shift toward global cloud OEMs could deflate that narrative.

5. Profitability Stability Despite Hardware Exposure

At ~13.9% EBITDA margins and ~10% PAT margins, the market assumes that Netweb can:

Maintain or modestly expand margins

Avoid commodity-like pricing pressures

Cross-sell high-margin services or cloud tools

Hardware-only businesses without IP monetization are usually valued far lower (20–30x).

3.3 What’s Not Fully Priced In Yet (Optional Upside)

While Netweb is trading at premium multiples, some high-value growth drivers are still in early execution stages. If these materialize, they could unlock meaningful upside in both earnings and valuation over FY26–28.

1. Recurring Revenue from Software & Services

Netweb’s proprietary platforms like:

Skylus.ai (private cloud orchestration),

Tyrone Kubyts (GPU workload management), and

Tyrone Cluster Manager

...have the potential to shift part of the business into a recurring software and services model—with gross margins significantly higher than hardware.

Even partial success in converting Skylus into a SaaS-like infra platform could drive a re-rating.

2. Export Ramp-Up & Global Brand Creation

Netweb’s planned entry into Europe and the Middle East, starting with service networks in 4 countries, is in early innings. The current valuation reflects confidence, but not full monetization.

Upside triggers include:

First large overseas order wins

Strategic partnerships with hyperscalers or OEMs

Export incentives or government support for Indian hardware brands

Global sales contributing 15–20% of revenue could de-risk the business from PSU/government cyclicality.

3. NVIDIA Blackwell-Based AI Systems

Under its OEM partnership with NVIDIA, Netweb is developing next-gen AI infrastructure based on Blackwell GPUs, the most advanced platform yet for LLMs and GenAI.

If Netweb becomes the go-to Indian partner for Blackwell systems across:

BFSI

Research Labs

PSU Cloud AI

...it could trigger a volume-led and margin-led earnings acceleration.

This optionality is not yet modeled into consensus projections or market price.

4. Skylus Marketplace Ecosystem

Skylus is more than an infra deployment tool—it can become a container-native platform for deploying AI/ML apps. Think of it as a GPU-native version of Red Hat OpenShift or VMware Tanzu.

If Netweb evolves this into a developer ecosystem, it could:

Tap into the LLM/SLM build-out wave

Monetize by charging infra and orchestration fees

Become sticky at the platform layer

This could create high-margin annuity income not currently reflected in models.

5. Acquisitions or Strategic Alliances

Management hasn’t disclosed M&A plans, but:

Acquiring a domestic AI services firm or HPC software startup

Partnering with hyperscalers (AWS, Azure) or PSU cloud agencies

...could enhance product breadth and deepen enterprise relationships.

Such moves would support valuation expansion by strengthening Netweb’s stack defensibility.

4. Implications for Investors: Risk-Reward Outlook for FY26

4.1 Bull, Bear, Base Case: Scenario Framework for FY26

4.2 Reasons to Stay Invested or Add

Strong Revenue Visibility & Order Momentum

Netweb enters FY26 with one of the best revenue pipelines in Indian tech manufacturing:

This provides 12–18 months of topline visibility, reducing near-term execution risk and enhancing confidence in FY26 guidance.

Positioned at the Center of India's AI Infrastructure Build-out

Netweb is strategically aligned with mega-trends like:

The IndiaAI Mission

Rapid digital transformation in PSUs, academia, and defense

Sovereign cloud and on-prem AI infra adoption by large enterprises

Netweb is one of the few credible “Make in India” OEMs equipped to capitalize on this transformation.

Integrated Hardware + Software Stack

Unlike typical hardware manufacturers, Netweb offers a full-stack value proposition, including:

High-performance compute systems (Tyrone)

Private cloud orchestration tools (Skylus.ai)

AI workload provisioning platforms (Kubyts)

Cluster management software (TCM)

This integrated stack not only enhances wallet share per customer but also improves margin resilience and future monetization potential.

Optional Upside from IP Monetization

Currently, most of Netweb’s revenue is hardware-driven. But its IP-led software layer (Skylus, Kubyts, Collectivo) holds promise for:

SaaS or license-based revenue

Recurring income with high gross margins

Platform stickiness across workloads (GenAI, ML, CFD, etc.)

Success in monetizing software can elevate Netweb’s margin profile and justify further valuation upside.

Global Expansion = TAM Multiplier

Netweb’s planned entry into Europe and the Middle East adds a significant layer of growth:

Higher ASPs (average selling prices)

Dollar-denominated contracts = natural hedge

Global validation of its OEM credentials

Execution success here can position Netweb as India’s Supermicro/Nvidia equivalent in infra, unlocking global capital interest and rerating.

4.3 Key Risks & What to Monitor

While the long-term narrative for Netweb is compelling, investors must remain vigilant about several near- and medium-term risks that could impact both execution and valuation.

Execution & Order Conversion Risk

While the ₹680 Cr order book and L1 pipeline offer visibility, delays in delivery, conversion, or payments—especially from PSU and government clients—can disrupt revenue recognition and cash flows.

Watch for: Slippage in quarterly revenue run-rate vs order intake.

Margin Pressure from Hardware-Led Growth

Hardware sales, especially in HPC and data center equipment, carry lower margins and are sensitive to input costs. If IP-led monetization (Skylus, Kubyts) underperforms, EBITDA margins may stay flat or decline.

Watch for: Margin trends in Q1/Q2 FY26; segmental contribution from software/IP.

Global Expansion Growing Pains

Initial efforts to set up a presence in Europe and the Middle East may face higher-than-expected costs, slower customer wins, or regulatory friction. This could impact profitability in the near term.

Watch for: First export order wins or revenue contribution in international geographies.

Concentration of Demand from Government & Academia

With ~50% of FY25 revenue coming from government-linked customers, any policy shift, funding slowdown, or delay in AI infra rollouts could hit volumes.

Watch for: PSU budget allocation to AI/infra in FY26 and government-led AI mission execution.

Valuation Risk from High Expectations

At ~80x earnings, the stock is priced for perfection. Any misstep in delivery, margin compression, or weak Q1/Q2 numbers could trigger sharp P/E derating.

Watch for: P/E compression catalysts—like slower YoY growth or muted IP traction.

4.4 Investor Segmentation Outlook

Netweb isn’t for everyone—but for investors looking to own India’s digital infra backbone, this is one of the few credible public plays. Risks are real, but so is the upside.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer