Netweb Technologies: 139% PAT & 76% revenue growth CAGR for FY21-23, ~50% PAT & 40% revenue growth in FY24

Confident of achieving strong revenues and profit growth in FY24 despite a weak Q1. Can surprise on the upside on account of restriction of import of Servers, Laptop, & Tablets from Nov 2023

1. High-end computing solutions (HCS) provider with integrated design & manufacturing capabilities

netwebindia.com | NSE: NETWEB

2. FY21-23 :139% PAT & 76% revenue growth CAGR

Bottom-line growing faster than the top line on account of margin expansion

3. FY23: 80% revenue growth, 2X PAT & order book

For FY23, the company’s revenue from operations increased by 80% to Rs 445 crore, mainly due to an increase in the sales of private cloud and HCI, supercomputing systems. Net profit for the period more than doubled year-on-year to nearly Rs 47 crore.

Between March 2022 and May 2023, the company almost doubled its order book value from Rs 48.5 crore to Rs 90.2 crore.

4. Q1-24: A weak quarter, PAT down 9%

Shift Of Rs 10-12 cr Billing From Q1 To Q2 Impacted Revenue

As already explained, our revenue from operations fell by 13.7% year-on-year basis from Rs. 693 million in Q1 financial year 2023 to Rs. 598 million in Q1 financial year 2024, due to the spillover of billing into the next quarter.

Around one third of business comes in H1 and around two-thirds of business comes in H2, actually.

Despite the decline observed in the current quarter, we maintain our confidence in achieving robust growth in the current financial year

Weak quarter irrespective of what NETWEB management says. Even if we add the Rs 10-12 cr to Q1-24 revenue of Rs 59.8 cr, the YoY growth would have been 1-4% in Q1-24. Very weak for a company which has grown at CAGR of 76% for FY21-23

5. Revenue visibility of Rs 639 cr for FY24 (1.6X FY23)

Out of that 5,392 million we are already L1, means we have already won the orders but the purchase orders have not come. Since the order cycle is around 6 to 9 months, we expect most of the orders against this to be received in the next two quarters. While July being a strong month, 994 million orders in hand, a large L1 pipeline, we are very confident to close H1 on strong growth.

As soon as it comes in the order book, basically, within 6 to 12 weeks, normally the order is getting billed.

The strong topline visibility has a direct impact in FY24. Rest of the growth drivers will make an impact from FY25 onwards

6. Outlook: ~50% PAT growth in FY24

i. 40% revenue growth for FY24: ~Rs 625 cr

So, if you really see, basically the area which we have been working, like basically supercomputing, private cloud, all these are very, very relevant areas today, actually. And basically, with AI progressing and the way we are seeing that. So, we feel that all these sectors will remain very, very long since we are growing already at the CAGR of somewhere around 40% approximately, which we are targeting.

ii. Gross margin up to 27-28% in FY24 from 25-27% for FY21-23

So, for the year, we expect that the margins will remain in the range of 27-28%.

ii. PAT growth of ~50% for FY24

Increasing of gross margin by 1% being passed on to the PAT margin would result in PAT growth of ~50%

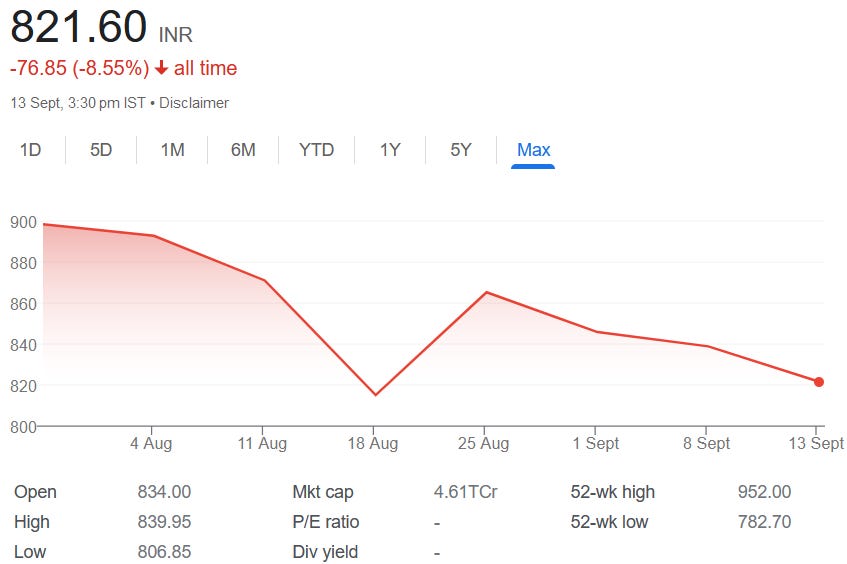

7. ~50% PAT growth on a PE of 92

8. So Wait and Watch

If I hold the stock then one may hold on to NETWEB and see the impact of Restriction of Import of Servers, Laptop, & Tablets from Nov 2023 by DGFT. However, one should be ready to see weakness in the short term. It is hard to justify a 50% PAT growth in FY24 for a PE of 92

9. Or, join the ride

If I am looking to enter the stock then

NETWEB is expected to deliver PAT growth of ~50% in FY24 with a revenue growth of 40% which makes the PE of 92 look quite rich.

There are no triggers to justify an upside in the short term.

However, the industry tailwinds are for real and can drive multi-bagger returns from a long term perspective

The stock needs to be watched from a long term perspective. However, it will give better entry points both from the perspective of price and business prospects.

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades