Natco Pharma: PAT growth of 94% & Revenue growth of 47% in FY24 at a PE of 13

FY25 PAT growth of 20%. Guiding for 15-20% revenue growth in FY25. Possibility of inorganic growth coming in FY26. Attractive valuations with potential for re-rating.

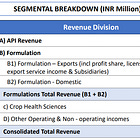

1. Pharmaceutical company

natcopharma.co.in | NSE : NATCOPHARM

Well established player in oncology with brands catering to diseases including breast, bone, lung and ovarian cancer

Focused on complex generics for the US Markets with niche Para IV and Para III filings

Targeting growth in Crop Health Sciences business with state-of-the-art manufacturing facilities for both technical and formulation

2. FY20-24: PAT CAGR of 32% & Revenue CAGR of 20%

Growth started from FY23

3. Strong FY23: PAT up 321% and Revenue up 38% YoY

4. Strong 9M-24: PAT 128% & Revenue up 62% YoY

5. Strong Q4-24: PAT up 40% & Revenue up 20% YoY

PAT up 82% and Revenue up 40% QoQ

6. Strong FY24: PAT 94% & Revenue up 47% YoY

7. Business metrics: Improving return ratios

Margin expansion in FY23 reflected in improvement of return ratios

8. Outlook: PAT growth of 20% & Revenue growth of 15-20%

The management is guiding for a strong FY25 with

15-20% growth in revenue

20% growth in PAT

9. PAT growth of 94% & Revenue growth of 47% in FY24 at a PE of 13

10. So Wait and Watch

If I hold the stock then one may continue holding on to NATCOPHARM.

Coverage of NATCOPHARM was initiated after Q2-24 results. The management delivering higher than the Rs 4,000 cr revenue and Rs 1,200 cr PAT guided for FY24 adds confidence in its ability to deliver 20% PAT growth in FY25 with 15-25% growth in revenue.

FY24 expectations: We are hoping to go past INR1,200 crores PAT, I mean that's our expectation. And our sales as well, I think, will probably be a little less than INR4,000 crores. I think that's our expectation where things are.

Along with the organic outlook with the FY25 guidance of 15-20% growth in revenue and 20% growth in PAT, there is potential for inorganic growth. The full impact of inorganic could be felt in FY26

Do we have a transaction we're going to close? we're looking hard, I think that's all I can share at this time. But hopefully, we'll be able to consummate something in the next 12 months, that's our expectation.

11. Or, join the ride

If I am looking to enter the stock then

NATCOPHARM has delivered PAT growth of 94% & Revenue growth of 47% in FY24 at a PE of 13 which makes valuations quite attractive in the short-term.

NATCOPHARM is guiding for PAT growth of 20% & Revenue growth of 15-20% in FY25 at a PE of 13 which makes valuations quite attractive in the medium term.

NATCOPHARM delivered Rs 854.9 cr of free cash flow in FY24 against a market cap of Rs 18,269 cr. As of FY24 end it is available on a free cash flow yield of 4.7% which makes the valuations quite reasonable. In the absence of significant capex in FY25, once expect larger free cash flow generation.

I don't see any large capex, that’s why you see the cash is increasing in the books because we're not spending so much in capex here.

The potential for 13 PE moving to a a mid teen PE is easily possible if NATCOPHARM is able to deliver growth as per FY25 guidance. The potential of a PE re-rating given its median PE of 20+ could provide multi-bagger upside in the stock over the medium term.

Previous coverage of NATCOPHARM

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

I have written my thesis on Natco Pharma. Could you please read my write-up on Natco Pharma and provide your feedback?

Highly appreciated!

https://open.substack.com/pub/manthanrastogi/p/natco-pharma-a-revlimid-story?r=1mklg7&utm_campaign=post&utm_medium=web