Natco Pharma: PAT growth of 128% & Revenue growth of 62% in 9M-24 at a PE of 13

NATCOPHARM guiding for 68% growth in PAT and 48% growth in revenue for FY24. Possibility of inorganic growth coming in FY26. Attractive valuations with potential for re-rating & multi-bagger returns

1. Pharmaceutical company

natcopharma.co.in | NSE : NATCOPHARM

Well established player in oncology with brands catering to diseases including breast, bone, lung and ovarian cancer

Focused on complex generics for the US Markets with niche Para IV and Para III filings

Targeting growth in Crop Health Sciences business with state-of-the-art manufacturing facilities for both technical and formulation

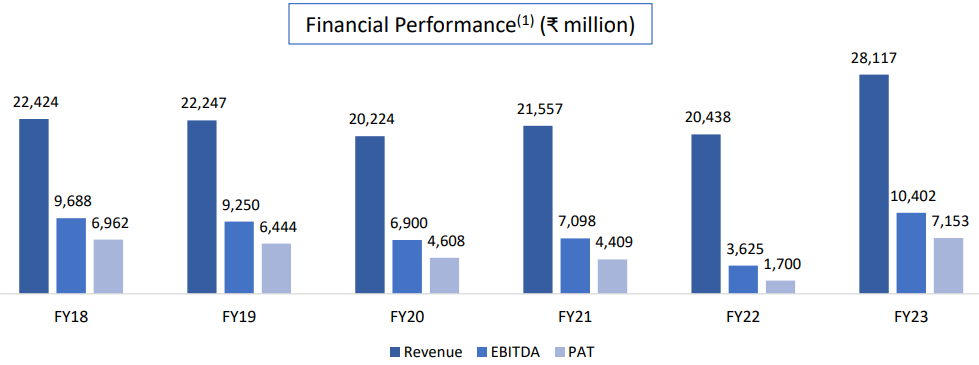

2. FY18-23: Top-line & bottom line trended down with growth after many years in FY23

3. Strong FY23: PAT up 321% and Revenue up 38% YoY

4. Strong H1-24: PAT up 109% & Revenue up 65% YoY

PAT Margin expansion of 8% YoY

5. Strong Q3-24: PAT up 241% & Revenue up 55% YoY

PAT down 42% and Revenue down 25% QoQ

6. Strong 9M-24: PAT 128% & Revenue up 62% YoY

7. Business metrics: Improving return ratios

Margin expansion in FY23 reflected in improvement of return ratios

8. Outlook: PAT growth of 68% & Revenue growth of 48%

i. FY24: PAT growth of 68% and Revenue growth of 48%

Rs 1200+ cr of PAT in FY24 implies a PAT growth of 68%+ over the Rs 715 cr PAT in FY23. Revenue growing from Rs 2707.1 cr in FY23 to a little less than Rs 4,000 cr im implies revenue growth of about 48%

We are hoping to go past INR1,200 crores PAT, I mean that's our expectation. And our sales as well, I think, will probably be a little less than INR4,000 crores. I think that's our expectation where things are.

iii. Management positive about FY25 and FY26

Management is pointing towards growth in FY25 and FY26 which is reassuring given that the top-line & bottom line trended down from FY18-22 with the first year of clear growth in FY23

Next financial year, I think it will all depend on how the pricing environment is. I think we'll give more color to it, I think, closer to the end of the year. But we are expecting that we should do well in the following couple of years. I think that was the general broad trajectory of the business. And so I think, yes, I think we'll speak more in detail about the actual growth, I think, closer to the end of the year. But overall, I think, yes, the impact will be minimal.

9. PAT growth of 128% & Revenue growth of 62% in 9M-24 at a PE of 13

10. So Wait and Watch

If I hold the stock then one may continue holding on to NATCOPHARM.

Based on 9M-24 performance, NATCOPHARM looks on track to deliver the strongest yearly performance

Possibility of M&A with revenues of somewhere between Rs1,000-1,200 cr in the next 12 months will add to the top-line for FY26

But hopefully, we'll be able to consummate something in the next 12 months, that's our expectation.

US FDA issued 8 observations for NATCOPHARM Kothur facility is a cause of concern and to be watch closely, though management is quite confident of handling it as they have a back up facility in place for all its top revenue products

In terms of impact, I think the impact will be minimal because I think the company has always done this mitigation with their top products. As you're aware, I think all our top revenue items, our top five, six revenue items have an approval from our Vizag side in addition to the Hyderabad Kothur side. Lelanomide also, which is the biggest revenue item, is also having approval from both Vizag and Hyderabad. Except for two strengths, which are 2.5 mg and 20 mg, which is about 7% of the total lelanomide. So even that also we have done the batches. It's on stability, started stability. So we believe if you do 90 days stability and it's a procedure called CB30. If that is also done, then even that can be moved.

Overall, I think our impact will be minimal. So I think let's wait for the classification of the inspection and we'll make a decision. But as we plan every project, I think we always have a two-side strategy for all our top five.

11. Or, join the ride

If I am looking to enter the stock then

NATCOPHARM has delivered PAT growth of 128% & Revenue growth of 62% in 9M-24 at a PE of 13 which makes valuations quite attractive.

NATCOPHARM delivered Rs 484 cr of free cash flow in H1-24 against a market cap of Rs 17,068 cr. As of H1-24 end it is available on a free cash flow yield of 2.8% (not annualized) which makes the valuations quite attractive.

The potential for 13 PE moving to a a mid teen PE is easily possible if NATCOPHARM is able to deliver growth as per FY24 PAT guidance and follow it up with growth in FY25 and FY26 . The potential of a PE re-rating could provide multi-bagger upside in the stock over the medium term.

NATCOPHARM has net cash of Rs 1,800 cr on a market cap of Rs 17,068 cr. With net cash at at about 11% of market cap provides a margin of safety.

As on December 31, our cash position and investments are at INR1,929 crores and our borrowing is about INR129 crores, including foreign bill discounting. So I mean net cash we're at INR1,800.

USFDA is a clear risk even though management is saying that impact will be limited.

Previous coverage of NATCOPHARM

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer