Motilal Oswal Financial Services: PAT growth of 84% & revenue growth of 40% in H1-25 at a PE of 16

Historic 34% PAT CAGR to be sustained with support of tailwinds in all capital market businesses. All business segments delivered strong growth in Q2-25. H1-25 pointing to a very strong FY25.

Summary of latest Earning Calls & Sectoral Insights at moneymuscle.in

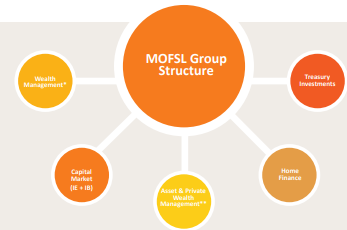

1. Financial Services firm

motilaloswalgroup.com | NSE: MOTILALOFS

Capital Markets

#1 – Full service broker

Ranked No. 2 on QIP League Table in H1FY25

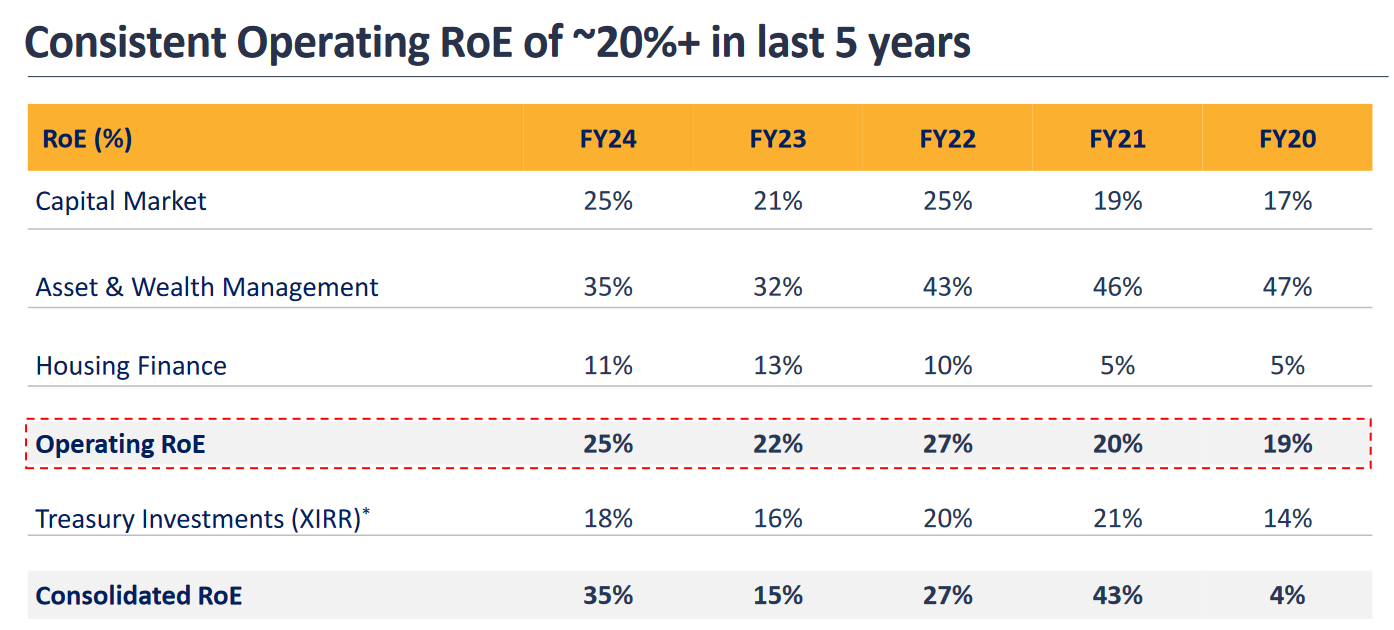

2. FY20-24: Operating PAT CAGR of 24%

3. Strong FY24: PAT up 197% & Revenue up 33% YoY

4. Strong Q2-25: PAT up 123% & Revenue up 46% YoY

PAT up 22% & Revenue up 21% QoQ

5. Strong H1-25: PAT up 84% & Revenue up 40% YoY

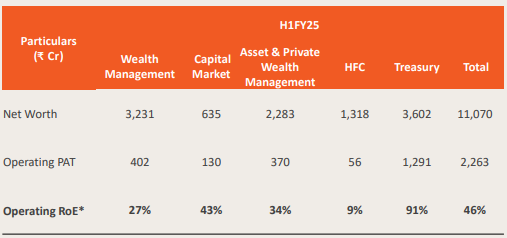

6. Business metrics: Strong return ratios

7. Strong outlook for growth

8. PAT growth of 84% & Revenue growth of 40% in H1-25 at a PE of 16

9. Hold?

If I hold the stock then one may continue holding on to MOTILALOFS

The business performance of MOTILALOFS has delivered a strong H1-25 and is giving indications of an equally strong FY-25.

Q2-25: Recorded the highest ever quarterly profit of ₹ 1,242 Cr

FY24: Recorded the highest ever yearly profit of ₹ 2,626 Cr

MOTILALOFS is in the middle of a strong run and has delivered strong performances in the last 5 quarters

Strong tailwinds supporting MOTILALOFS. One can ride the momentum till it lasts

The tailwinds are strong in all of our capital market businesses. Our operating businesses of wealth management, capital market, asset & private wealth management have delivered strong growth in Q2FY25

10. Join the ride

If I am looking to enter MOTILALOFS then

MOTILALOFS has delivered PAT growth of 84% and revenue growth of 40% in H1-25 at a PE of 16 which makes the valuations attractive in the short term.

MOTILALOFS has a long term track record of PAT CAGR of 34% and are guiding for operating PAT growth of 15-20% along with 18% IRR on their investment book at a PE of 16 which makes the valuations attractive from the longer term

MOTILALOFS guiding to grow its net worth at the same pace as its long term net worth growth at 22% CAGR at a PE of 16 makes the valuations attractive from the longer term

Previous coverage of MOTILALOFS

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Business is Cyclical, Based on Market sentiment. Can you decode the year Which not performed and there respective performance how they tackled