Motilal Oswal Financial Services: PAT growth of 197% & revenue growth of 33% for FY24 at a PE of 15

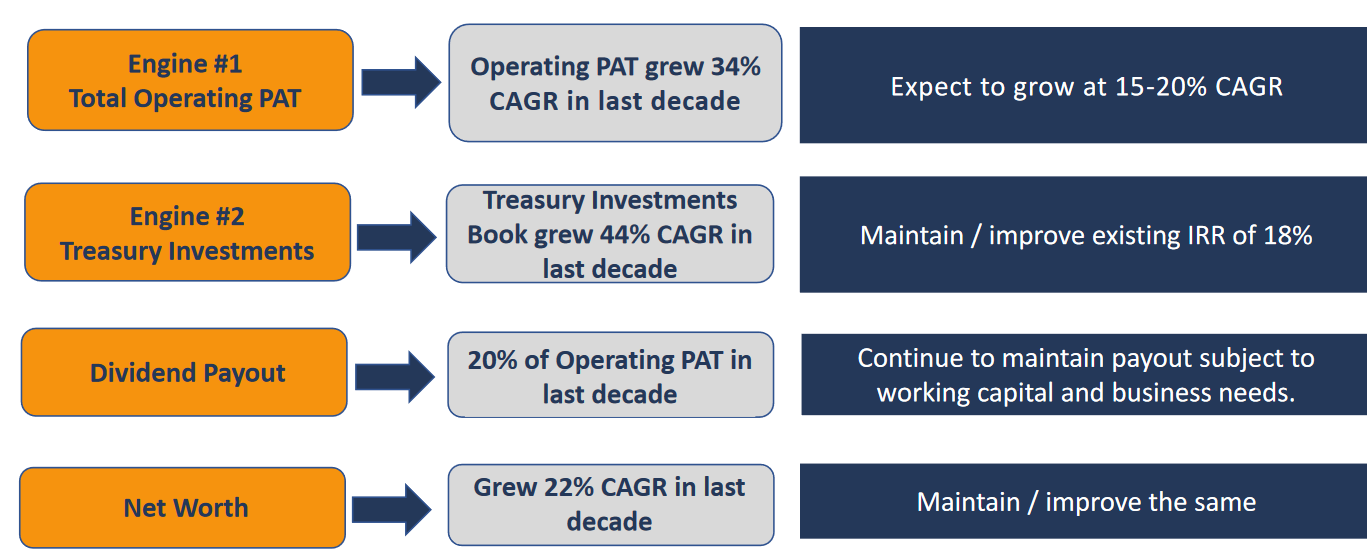

MOTILALOFS is guiding for 15-20% operating PAT growth. MOTILALOFS is guiding to grow its net worth at a CAGR of 22% in line with historical growth trends.

1. Financial Services firm

motilaloswalgroup.com | NSE: MOTILALOFS

Capital Markets

#3 – Overall industry

#1 – Full service broker

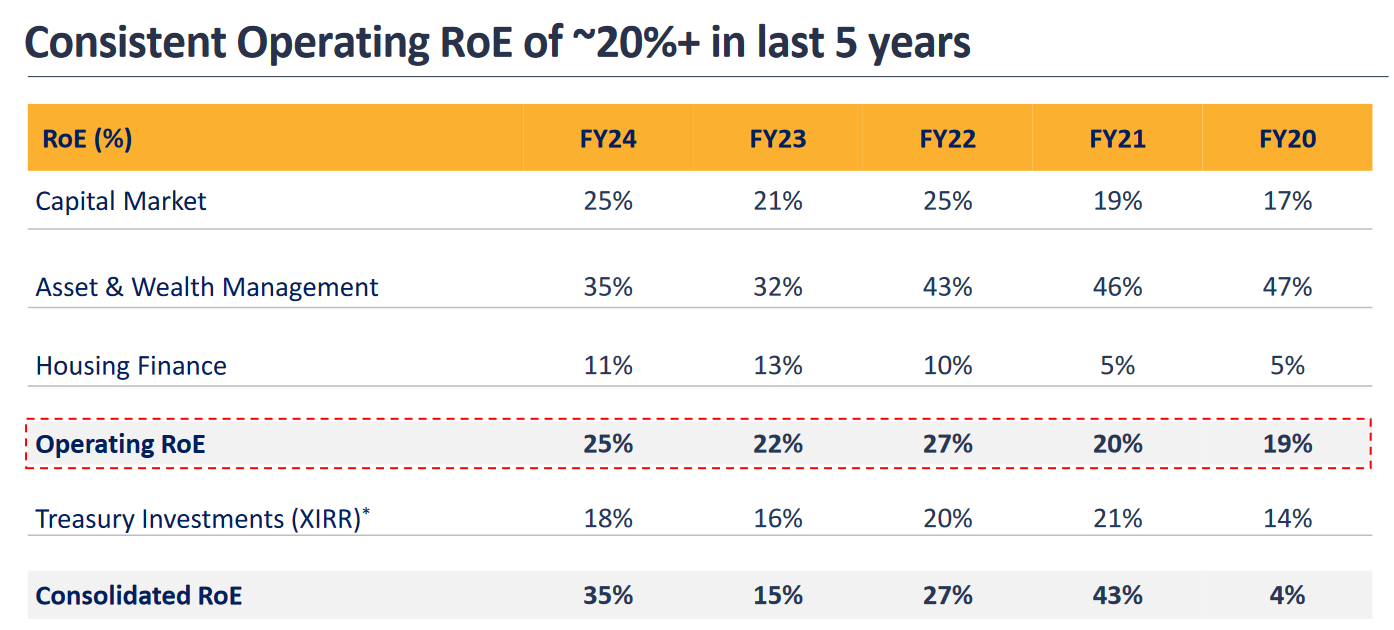

2. FY20-24: Operating PAT CAGR of 24%

3. Weak FY23: PAT down 29% & Revenue up 8%

4. Strong 9M-24: PAT up 159% & Revenue up 32% YoY

5. Strong Q4-24: PAT up 448% & Revenue up 60% YoY

PAT down 19% & Revenue up 29% QoQ

6. Strong FY24: PAT up 197% & Revenue up 33% YoY

7. Business metrics: Strong return ratios

Our net worth at the end of the year was Rs. 8,732 crores, up 40% YoY

8. Strong outlook: Net worth growth CAGR of 22%

9. PAT growth of 197% & Revenue growth of 33% in FY24 at a PE of 14

10. So Wait and Watch

If I hold the stock then one may continue holding on to MOTILALOFS

MOTILALOFS has delivered the strongest PAT in FY24

Performance in FY24 is supported by a strong outlook for FY25

MOTILALOFS is in the middle of a strong run and has delivered sequential QoQ growth in operating PAT in the last four consecutive quarters starting from Q4-23

11. Join the ride

If I am looking to enter MOTILALOFS then

MOTILALOFS has delivered PAT growth of 197% and revenue growth of 33% in FY24 at a PE of 15 which makes the valuations attractive in the short term.

MOTILALOFS has a long term track record of PAT CAGR of 34% and are guiding for operating PAT growth of 15-20% along with 18% IRR on their investment book at a PE of 15 which makes the valuations attractive from the longer term

MOTILALOFS guiding to grow its net worth at the same pace as its long term net worth growth at 22% CAGR at a PE of 15 makes the valuations attractive from the longer term

Previous coverage of MOTILALOFS

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer