Marathon Nextgen Realty: PAT up 184% & Revenue up 26% in H1-24 at a PE of 13

Marathon NextGen Realty driven by a favourable demand landscape expecting substantial cash flow revenues coming over next three years available at very reasonable valuations

1. Real estate company

Projects spread across the Mumbai Metropolitan Region (MMR)

marathon.in | NSE: MARATHON

Building townships in the fastest growing neighborhoods, ultra luxury skyscrapers in the heart of the city, affordable housing projects, small offices and large business centers.

Marathon has land banks in Mumbai Metropolitan Region (MMR)

2. Revenue CAGR= 87%, PAT CAGR= 179% for FY20-23

Erratic top-line & bottom-line YoY growth over FY19-23

Area sold is a lead indicator for future revenue and was down in FY23 and needs to be tracked

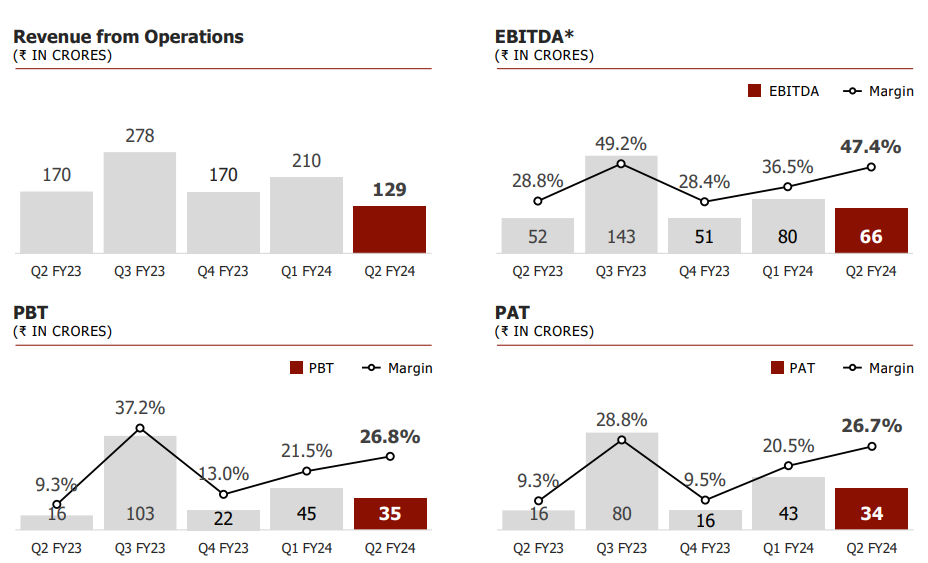

3. Strong Q1-24: PAT up 258% & Revenue up 114% YoY

PAT up 169% & Revenue up 24% QoQ

4. Q2-24: PAT up 119% & Revenue down 38%

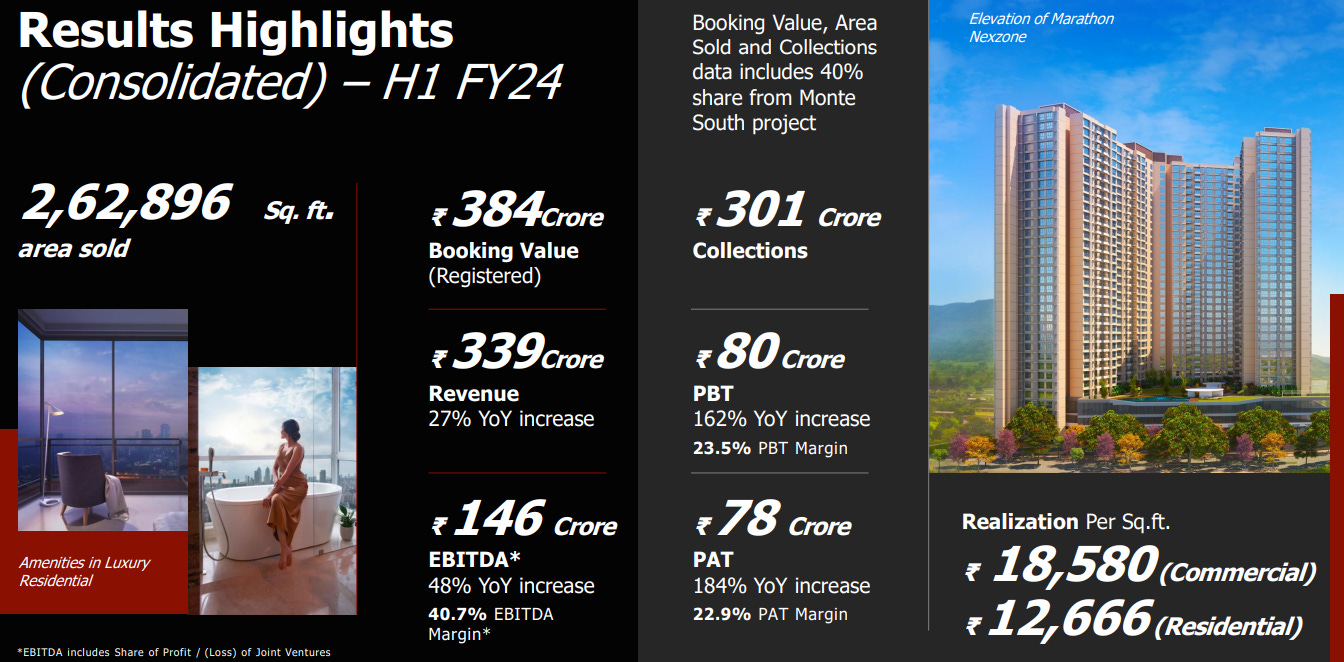

5. Strong H1-24: PAT up 184% & Revenue up 26%

Net Revenues stood at Rs.339 crores compared to Rs.268 crores in H1FY23

Profit After Tax (PAT) stood at Rs.78 crores compared to Rs.27crores in H1FY2

6. FY24: Strong outlook

i. Pipeline visibility is strong

Based on ownership, out of the Rs 4660 cr pipeline, MARATHON share is Rs 2402 cr which is 3.35X FY23 sales

there is a 31.5 lakh square feet of launch saleable area available, and this will be most likely be launching in 12 to 36 months and further 36 to 48 months for completion at the estimated value of this pipeline itself is 4,660 crores.

ii. Management commentary across Q4-23 to H1-24, demand tailwinds remain strong

Quarter of strong performance on the back of robust and resilient demand environment. This consolidation, along with the reduction in inventory levels, has created an optimistic landscape for us and the entire industry.

Management commentary in Q2-24

Marathon NextGen Realty results driven by a favourable demand landscape. The ongoing consolidation within the real estate sector, coupled with the reduction in inventory levels signals a promising landscape. These trends point towards a sustained positive trajectory in the real estate cycle, characterized by escalated prices and absorption rates amidst constrained supply

Management commentary in Q1-24

We remain positive on demand environment and would continue to focus on strengthening our financial performance by reducing debt, enhancing our collection efficiency and generating healthy operating cash flows. With a strong launch pipeline and strong execution capabilities, we are confident to achieve outstanding and profitable growth over the mid to long term.

Management commentary in Q4-23

7. PAT up 184% & Revenue up 26% in H1-24 at a PE of 13

8. So Wait and Watch

If I hold the stock then one may continue holding on to MARATHON

Coverage of MARATHON was initiated after Q1-24 results. The investment thesis has not changed after a strong H1-24. The only changes are the delivery of a strong H1-24 and the increased confidence in the management to deliver a stronger FY24

The pipeline of Rs 2,400+ cr which will get completed in 36 to 48 months provides a longer term visibility into the prospects of MARATHON

Q2-24 was a mixed quarter, weak in terms of top-line but strong in terms of bottom line. We need to keep a watch on Q3 results given that we have a mixed quarter in Q2 and don’t want a trend of weakening top-line. Beyond a point a weakening top-line cannot sustain a strong bottom-line.

Quickly, I just wanted to add one more thing real estate due to its nature of business ideally should not be seen quarter-on-quarter while I think we have done much better than the last Q2, there will be one or two quarters where things may not align because sometimes these deals are long gestation timelines and things like that, but overall on an annual basis, I think we should more than or if not cover up and do much better than last year.

9. Join the ride

If I am looking to enter MARATHON then

MARATHON has delivered PAT growth of 184% and revenue growth of 26% in H1-24 at a PE of 13 which makes the valuations reasonable.

To benefit from the industry tailwinds, MARATHON has a pipe-line of projects which will deliver Rs 2400+cr or 3.35X FY23 revenue in 36-48 months.

Previous coverage of MARATHON

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades