MapmyIndia C.E. Info Systems: PAT up 12% & Revenue up 14% in Q1-25 at a PE of 82

Guidance of Revenue CAGR of 35-40%. Target to cross revenue of Rs 1,000 Cr by FY27/FY28. Operating in a nascent market with significant opportunities

1. Why is MAPMYINDIA interesting

mapmyindia.com | NSE: MAPMYINDIA

As a leading provider of advanced digital maps, geospatial software & location-based IoT technologies, MAPMYINDIA is operating in a nascent market with massive opportunity. MAPMYINDIA is targeting to cross Rs 1,000 cr revenue by FY27/F28 at a 35-40% revenue CAGR. However, the opportunity would continue well beyond FY28 and provide headroom for growth. 2. Digital maps, geospatial software & location-based IoT

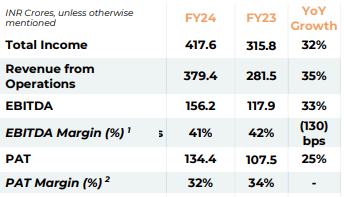

3. FY22-24: PAT CAGR of 24% & Revenue CAGR of 38%

4. Strong FY24: PAT up 25% & Revenue up 32%

5. Strong Q1-25: PAT up 12% & Revenue up 14% YoY

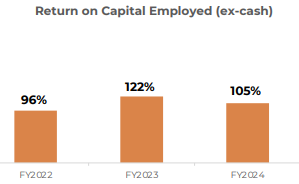

6. Return Ratios

7. Strong outlook: Revenue CAGR of 35-40%

i. Revenue CAGR of 35-40% to cross Rs 1,000 cr revenue

Plan to cross Revenue Milestone of Rs 1000 Cr by FY27/FY28, a CAGR of 35-40%

ii. Strong order book to support FY25 growth

Our Open Order Book grew 49% to Rs 1,372 Cr at end of FY24, which bodes well for our future revenue. This was based on Annual New Order Bookings in FY24 of Rs 834 Cr, a growth of 63% year-on year.

iii. Strong Future Outlook

Targeting Rs 1,000 cr with industry revenue potential of Rs 8,700 cr implies a market share of 11%

An extremely nascent market that has just begun understanding the massive opportunity present in the near future.

8. PAT growth of 12% & Revenue growth of 14% in Q1-25 at a PE of 82

9. Do I stay?

If I hold the stock then one may continue holding on to MAPMYINDIA

Following a strong FY24, Q1-25 performance has been weak which was attributed to ramp down of certain programs. However, MAPMYINDIA is confident of delivering a strong FY25

During Q1FY25, there were known ramp down of some old Auto OE programs. Ramp up of new programs has begun in Q2.

A small request to please look at us on a year-to-year basis, and this quarter-to-quarter volatility will happen through either lumpiness or whatever reasons.

The outlook of 30% revenue CAGR for the next 3-4 years is a strong reason to continue with MAPMYINDIA.

MapmyIndia is the premium map provider in the country, offering the best value to customers. We are pretty confident about our market position, and these different dynamics that are at play, we don't see as a risk to our business.

We only see more adoption happening with more noise and more awareness. We believe we will be the disproportionate winner in the market that gets added on due to all this activity.

PAT growth has lagged revenue growth for MAPMYINDIA historically. The bottom-line performance has to be watched closely and is an area of concern

10. Do I enter?

If I am looking to enter MAPMYINDIA then

MAPMYINDIA has delivered PAT growth of 12% and revenue growth of 14% in Q1-25 at a PE of 82 which makes the valuations quite expensive in the short term.

this is an annual business, so there can be lumpiness. So quarter-on-quarter movement can be there from here and there. We are not concerned overly about it because we know if something doesn't work out in a quarter, it will work out in the coming quarters.

With an outlook of 30% revenue CAGR to hit Rs 1,000 cr of revenue by FY27/F28 at a PE of 82 the valuations of MAPMYINDIA look acceptable from a longer term perspective.

We are confident about our revenue milestone, and the business is building up in that direction very nicely.

The opportunity in MAPMYINDIA is a longer term opportunity and hence entry in the stock can be could be around times where the stock is showing weakness owing to market conditions

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer