Manorama Industries Q3 FY26 Results: PAT up 131%, FY26 Guidance Revised Upward

Revenue growth of 65%+ in FY26 followed by 30% growth in FY27. Growth driven by capex. Value-added products to support margins. At reasonable forward valuations

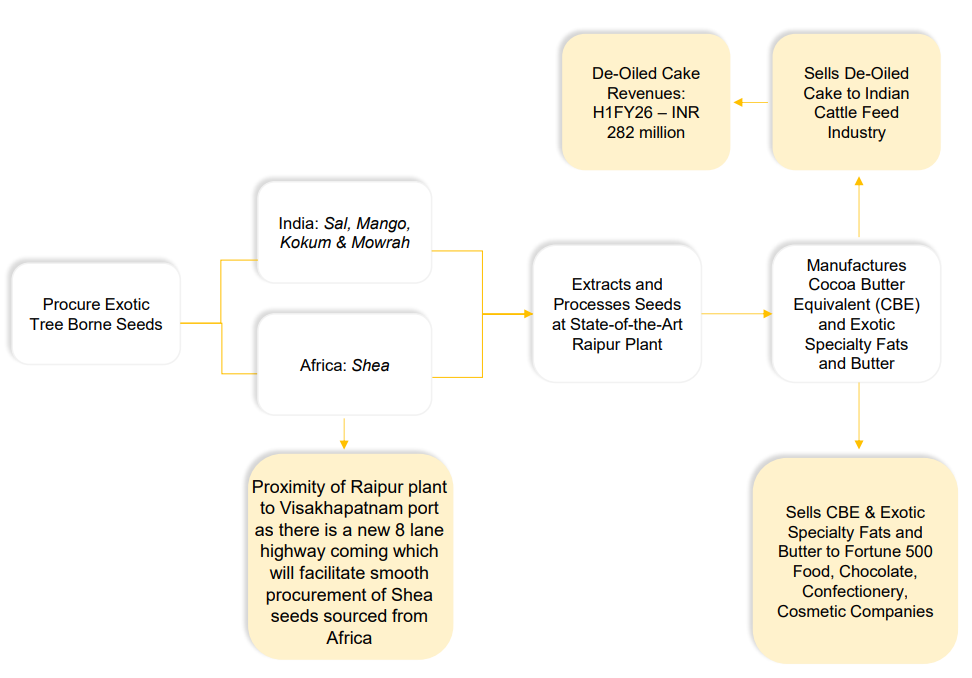

1. Manufacturing Cocoa Butter Equivalent (CBE), Specialty Fats & Butters

manoramagroup.co.in | NSE: MANORAMA

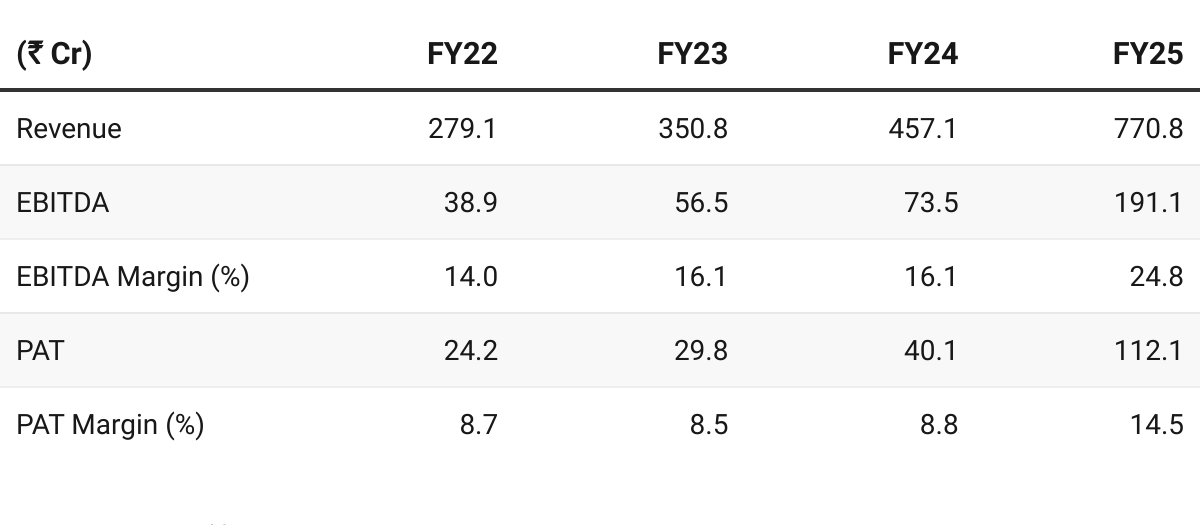

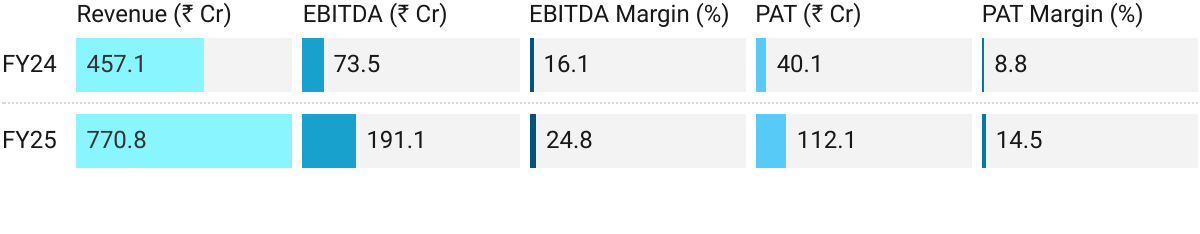

2. FY22-25: PAT CAGR 67% & Revenue CAGR 40%

3. FY-25: PAT up 180% & Revenue up 69%

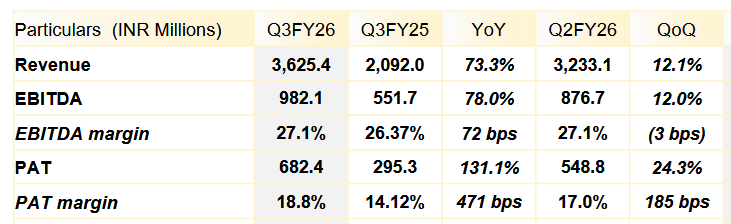

4. Q3 FY26: PAT up 131% & Revenue up 73% YoY

PAT up 24% & Revenue up 12% QoQ

Out of the 73%, 90% is the volume growth. Rest is inflation and other entities.

Value-added portion to sales is around 75%, which is like includes our value-added products like the stearin and the cocoa butter equivalent.

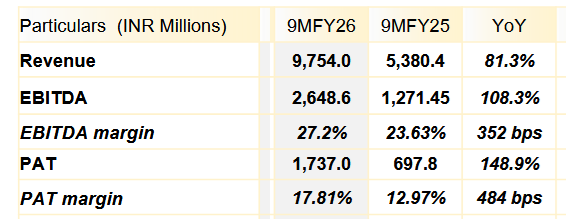

5. 9M FY26: PAT up 149% & Revenue up 81% YoY

6. Business Metrics: Strong & Improving Return Ratios

7. Outlook: FY26 Guidance raised

7.1 Management Guidance and Future Outlook

FY26 Guidance

We are excited to announce that we have upwardly revised our financial year ‘26 revenue guidance from INR 1,150 crores to INR 1,300 crores.

FY27 and Beyond Guidance

FY27 Revenue Growth: So you can take approximately range on and above 30% that should come.

FY28: on 52,000 tons 100% capacity utilization we see a revenue potential of around 1,800 2,000 cr plus of course provided everything goes well

We intend to do approximately 85%, 90% of our sales with respect to value-added going forward, our core products, the soft fats, which is also going to be converted into a value-added product. So the idea and the intent approximately to do 90%, 95% of the business towards value-added product

7.2 9M FY26 Performance vs FY26 Guidance

Upward revision of guidance

Revenue Growth — Strong

FY26 revenue guidance twices in FY26

₹1,050 Cr+ raised to ₹1,150 Cr in Q2

₹1,150 Cr raised to ₹1,300 Cr in Q3

FY27 revenue growth expectation in-place after upward revision of guidance.

Profitability — Guidance Met

EBITDA margin (27.2%) in-line with 25-27% margin guidance

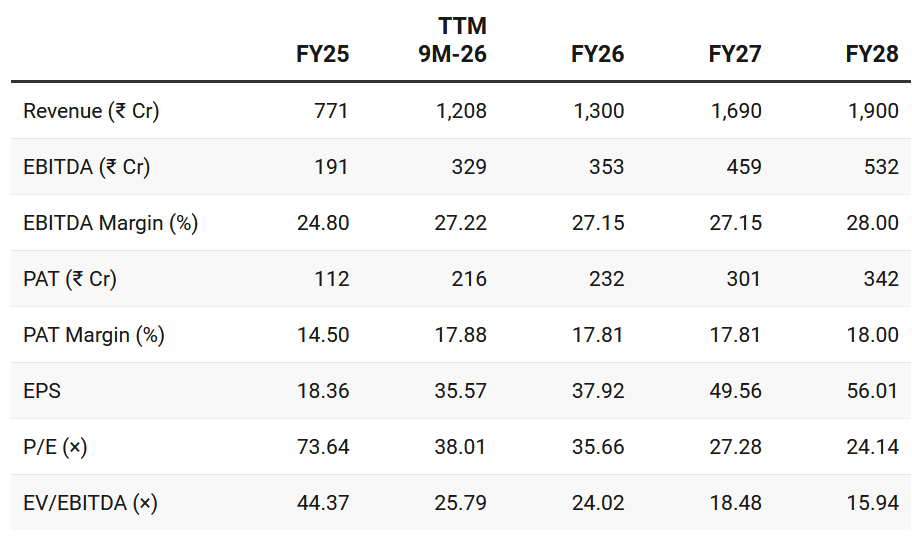

8. Valuation Analysis

8.1 Valuation Snapshot

Current Market Price ₹1,352;

Market cap ₹8,072.6 Cr

FY27 revenue in-line with the 30% capacity expansion

FY28 revenue at midpoint of revenue expectations based on new capacity

Improvement in margin on account of increased value addition

MANORAMA generated ₹164 Cr of free cash flow in H1 FY26

Available at free cash-flow yield of ~2% (not annualized) on current market price which makes the valuations quite reasonable.

The valuations would start looking attractive from a FY27 and beyond perspective. Hence it should be looked at from a longer term perspective.

8.2 Opportunity at Current Valuation

Impact of new capacities not fully discounted

Debottlenecking: Boosting current fractionation capacity by 30% (an addition of 12,000 MTPA) through debottlenecking, bringing total capacity to 52,000 MTPA by the end of FY26. — expanded capacity to be fully available in Q1 FY27.

Incremental ₹2,300 Cr+ revenue potential not discounted

Capex Plan ₹460 Cr — Funded through internal cash accruals

Capacities expected to be ready by FY28.

Forward Integration (CBA & Fractionation):

75,000 MTPA manufacturing facility for cocoa butter alternatives (CBA)

Matching 75,000 MTPA fractionation facility for exotic seeds like shea, palm, and mango.

Refinery Expansion: Additional 90,000 MTPA refinery facility will be built to support the new fractionation and CBA capacities.

Backward Integration (West Africa): To secure its supply chain — setting up a 90,000 MTPA processing factory in Burkina Faso, West Africa.

MANORAMA targets asset turnover of more than 5x for these new investments

8.3 Risk at Current Valuation

Premium Current Valuations

Valuations – Trading at 36× FY26E earnings, even a small earnings miss or margin compression could easily contract the P/E.

Execution & Timing Risk – Growth is dependent on fractionation capacity expansion. Any delay could defer the FY28 earnings ramp, triggering temporary de-rating.

Raw-Material Volatility – Procurement of Shea, Sal and Mango seeds is seasonal and climate-sensitive; disruption in African or Indian harvest cycles can affect throughput and working-capital intensity.

Commodity Correlation – Although CBE prices are structurally insulated from cocoa, prolonged swings in global cocoa prices can influence customer contract negotiations and short-term realizations.

FX & Geo-political Exposure – With 60 %+ exports, INR appreciation or African supply-chain disruptions can temporarily erode competitiveness.

While operating fundamentals are sound, the margin of safety is limited at current multiples. Investors should monitor expansion milestones, margin stability, and debt control closely; sustained 25–30% earnings growth is essential to justify today’s premium positioning.

Previous Coverage of MANORAMA

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer