Man lnfraconstruction: Strong growth trajectory

Good revenue visibility, strong YoY performance for Q1-24, available at attractive valuations

Company Overview

Man Infraconstruction Limited is engaged in EPC of residential & commercial real estate and infrastructure projects. MANINFRA ventured into real estate sector as a developer under its own brand name in the residential segment. The company through its subsidiaries/associates enters into joint development agreement with land owner(s)/tenant(s) for developing real estate projects in Mumbai Metropolitan Region. MANINFRA is also building its international presence with real estate projects in the USA.

Share Details

NSE: MANINFRA ( maninfra.com)

Quality: Returns on capital employed in cash

Strong return ratios in the last two financial year. Solid performance continued in Q1-24

Consolidated ROE & ROCE: 25%+ (Annualized nos. for June-23)

Growth

In the last five years, the Company has accomplished a strong financial track record with nearly 50% CAGR in revenue from operations with the corresponding 43% CAGR and 58% CAGR in EBITDA and Net Profit respectively. This was mainly driven by timely execution of our EPC orders and recognition of revenues from ongoing real estate projects and those delivered in the past. As the Company follows percentage completion for accounting, the performance may fluctuate on a quarterly basis. Hence I urge everyone to look the Company from an annual perspective.

Sales performance is dipping in the last three financial years while collections are improving. We need to keep a watch on this trend or else the top-line growth will start slowing down.

Q1-24 Update

Results are quite positive from YoY perspective and giving confidence that the growth trajectory of previous years should continue in FY24. While numbers look weak on a QoQ basis yet the bottom line is strong even on a QoQ basis

Quarter 1 of financial year 2024 has been the ninth quarter of consecutive year-on-year growth in the revenue from operations.

The Company has consistently focused to reduce debt and improve liquidity, which has helped in maintaining balance sheet strength. Secured debt stands at Rs. 136 crore as on June 2023.

The Company continued to be net cash positive and has liquidity of over Rs. 530 plus crore as on June 2023.

Growth Momentum

The top-line growth momentum is extremely strong and this momentum continues into Q1-24. While YoY growth for Q1-24 PAT is good one needs to keep a watch on the bottom-line growth in FY24.

Outlook

EPC order book = ~1.2X FY23 EPC revenue

Talking about the EPC pipeline, we've got a significant pipeline going on and upcoming of our own projects where we see a secured pipeline of nearly next five years, which consists of our own projects as well and port projects as well.

Real estate portfolio - Upcoming project 1.3 Mn. Sq. ft.

Anticipate to unfold over the course of the next 4 years, the project holds substantial revenue potential estimated at around Rs. 1,200 crores.

Growth momentum will run strong in FY24

We are very confident on what numbers that we have clocked in the last financial year where we would definitely be sustaining that and we are seeing a much better revenue growth overall in the top line and bottom line as well for the upcoming financial year

Margins will be sustained in FY24 and indications for a strong Q2-24 given by management.

We are strongly pursuing to bid good infrastructure EPC orders as well as at the same time focusing on taking some good projects in Mumbai in real estate division. The margins that you're seeing, yes, is definitely sustainable because the kind of projects that we've taken now stands at a very premium location in the city of Mumbai and will definitely contribute to a good margin. And that's how we see the upcoming quarters also looks alike

Investments from US projects will come in at Rs 1,000 ($ 125 million) in FY26-27

It is a US accounting system, there is a project completion method. So, once you complete the project you have to show it in your balance sheet because we have to follow the norms over there. So, we expect around year 2026-27 we will be able to complete all the three projects which is having a top line between the two projects for which I'm not 100% sure, but it is around USD 500 million plus where we are 25% partner.

So What????

If I currently hold the stock, I may continue holding it based on my past returns, expectations for future returns, and the availability of alternative stock ideas. MANINFRA is on a strong growth trajectory and one needs to keep riding it and ignore the temporary ups and downs.

If I don't currently own the stock, I may want to enter it at the current level.

Efficiently run company with good return ratios since FY21, continuing into Q1-24

Outlook for the future is very strong and management is quite confident sustaining top-line and margin growth on the back of good revenue visibility

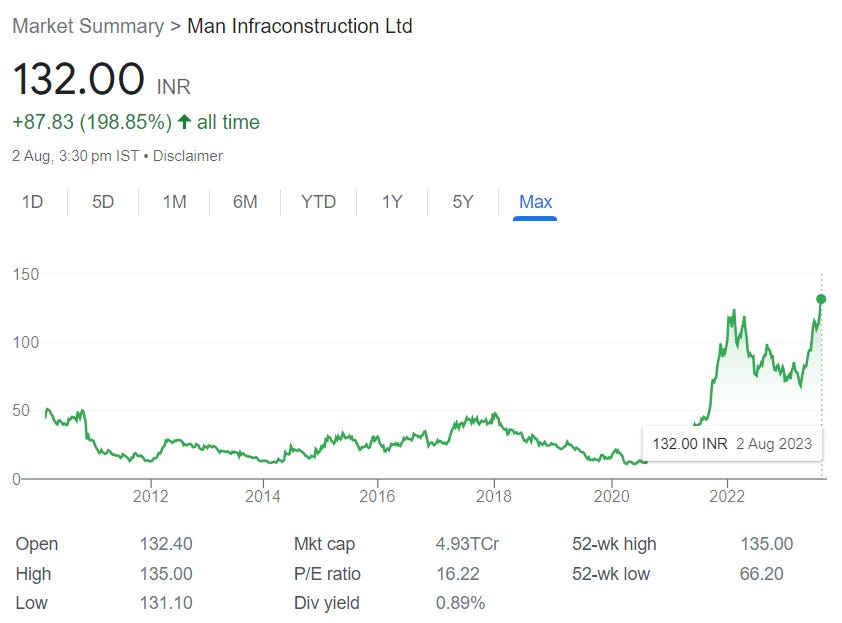

On a trailing 12 months basis MANINFRA is trading at PE of 16. The valuations are attractive given the strong guidance by the management.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades