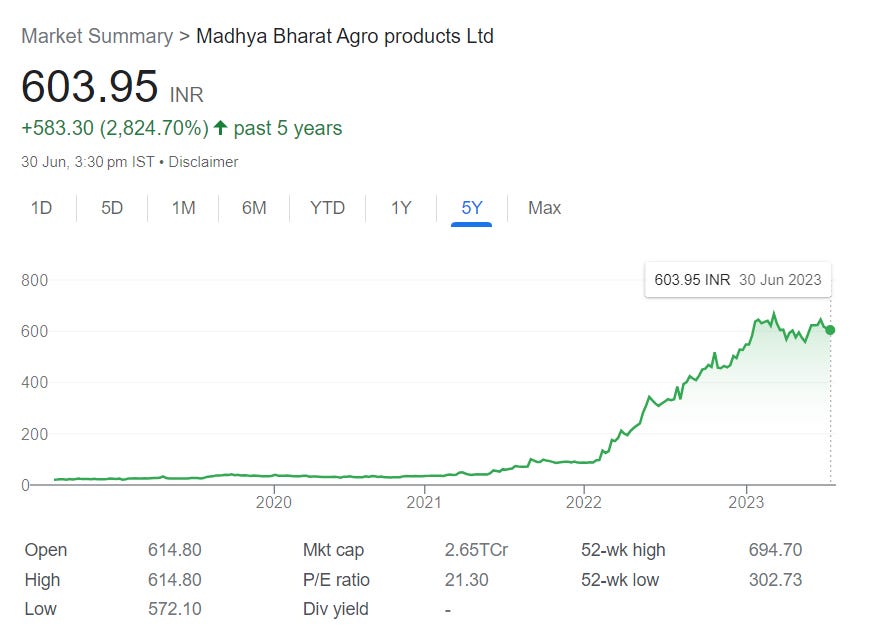

Madhya Bharat Agro Products Ltd. - Opportunity in the Midst of a Growth Cycle

High growth yet attractively priced

Company Overview

Madhya Bharat Agro Products Ltd, part of Ostwal Group, is engaged in the business of manufacturing fertiliser and chemical products.

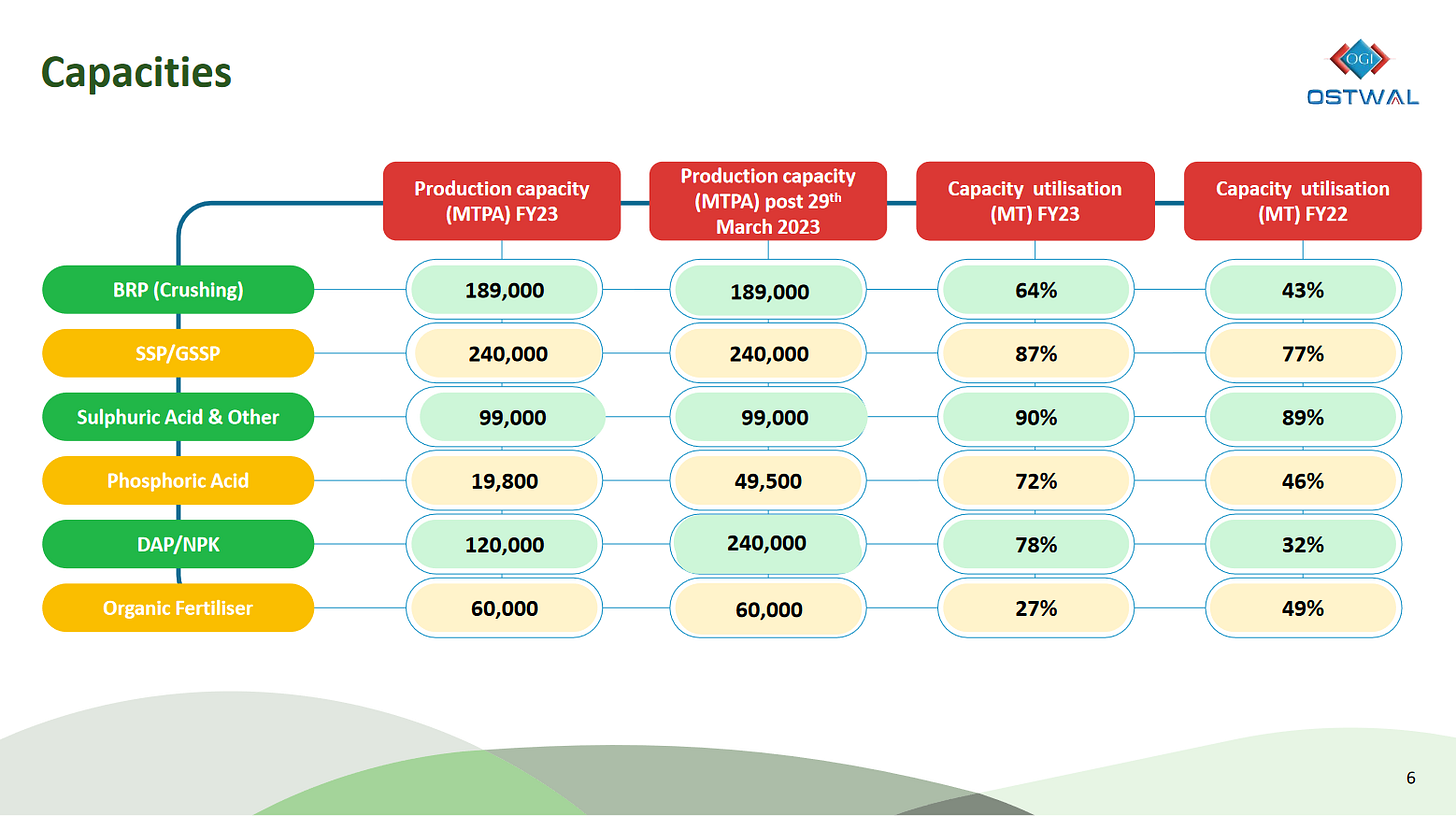

MBAPL is manufacturing beneficiated rock phosphate (BRP), sulphuric acid (SA), single super phosphate (SSP) and phosphate rich organic manure (Prom). MBAPL is also engaged in production of sulphur bentonite and some value-added chemicals like oleum etc.

From FY 22 MBAPL has started manufacturing phosphoric Acid, di-ammonium phosphate and nitrogen phosphorus potassium (DAP/NPK) complex fertilizer and added capacity in manufacturing of sulphuric acid.

Share Details

NSE: MBAPL( mbapl.com)

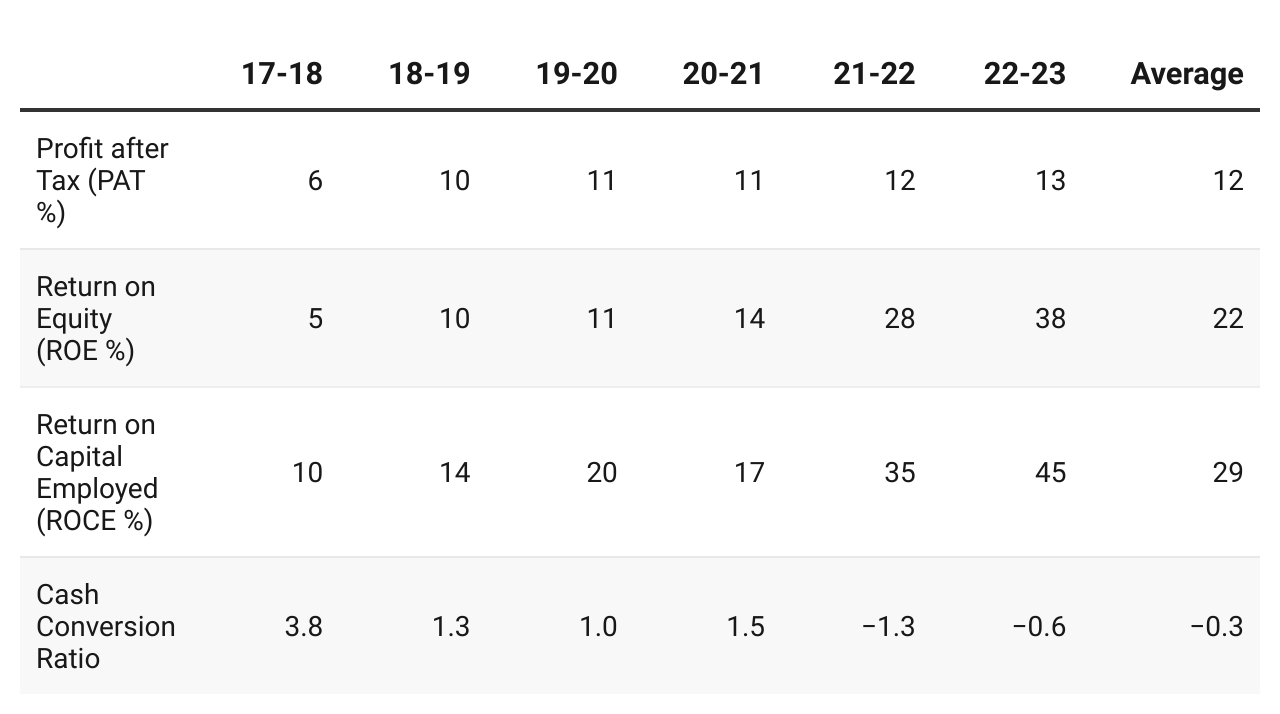

Quality: Returns on capital employed in cash

FY21-22 is the year of transition for MBAPL as result of introduction of DAP/NPK fertilizer in its product range. The return ratios pre and post FY21-22 are completely different and make the company interesting for investors. Cash conversion ratio has turned negative on account of the increase in working capital requirements due to increase in the scale of operations with the addition of DAP/NPK in its product portfolio.

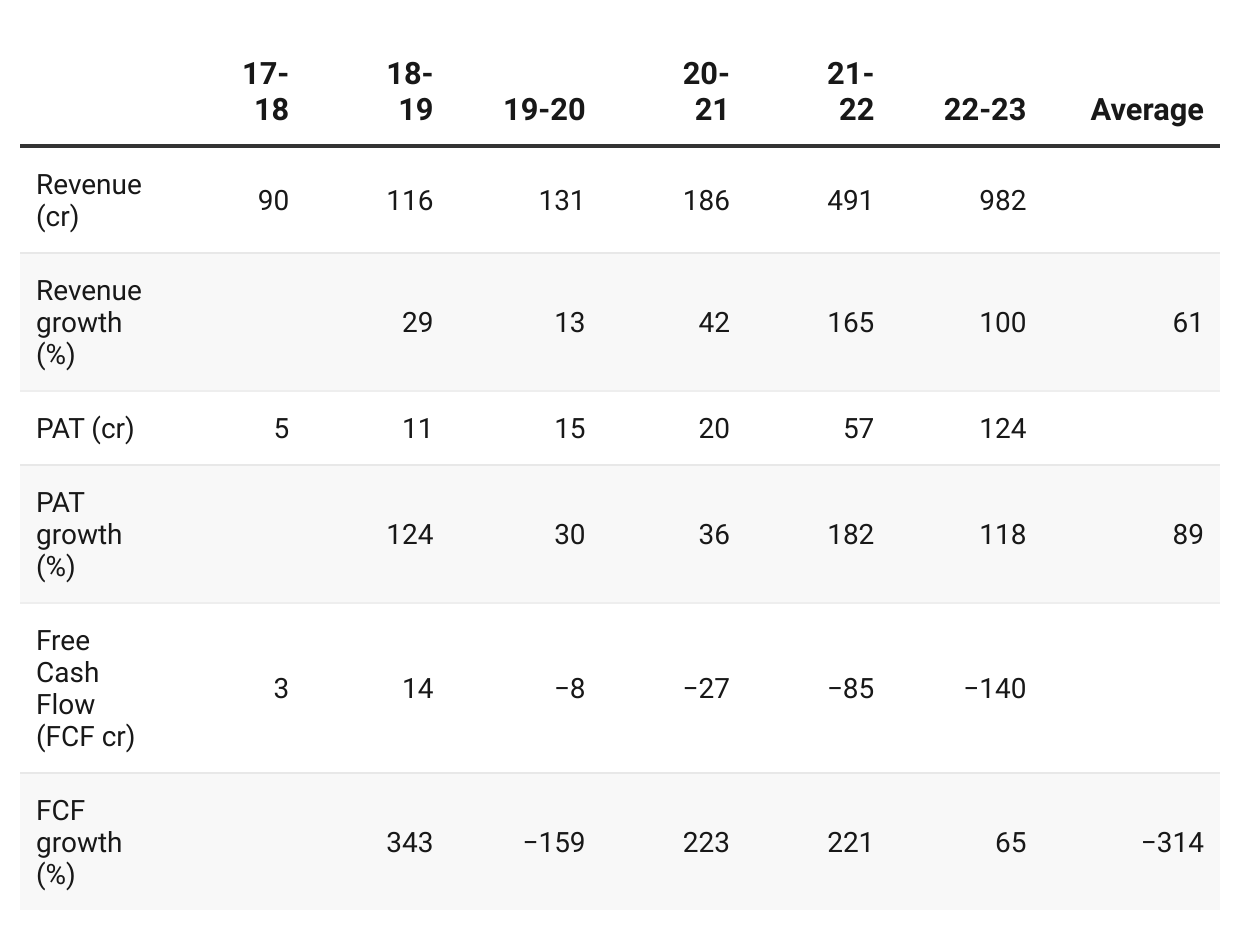

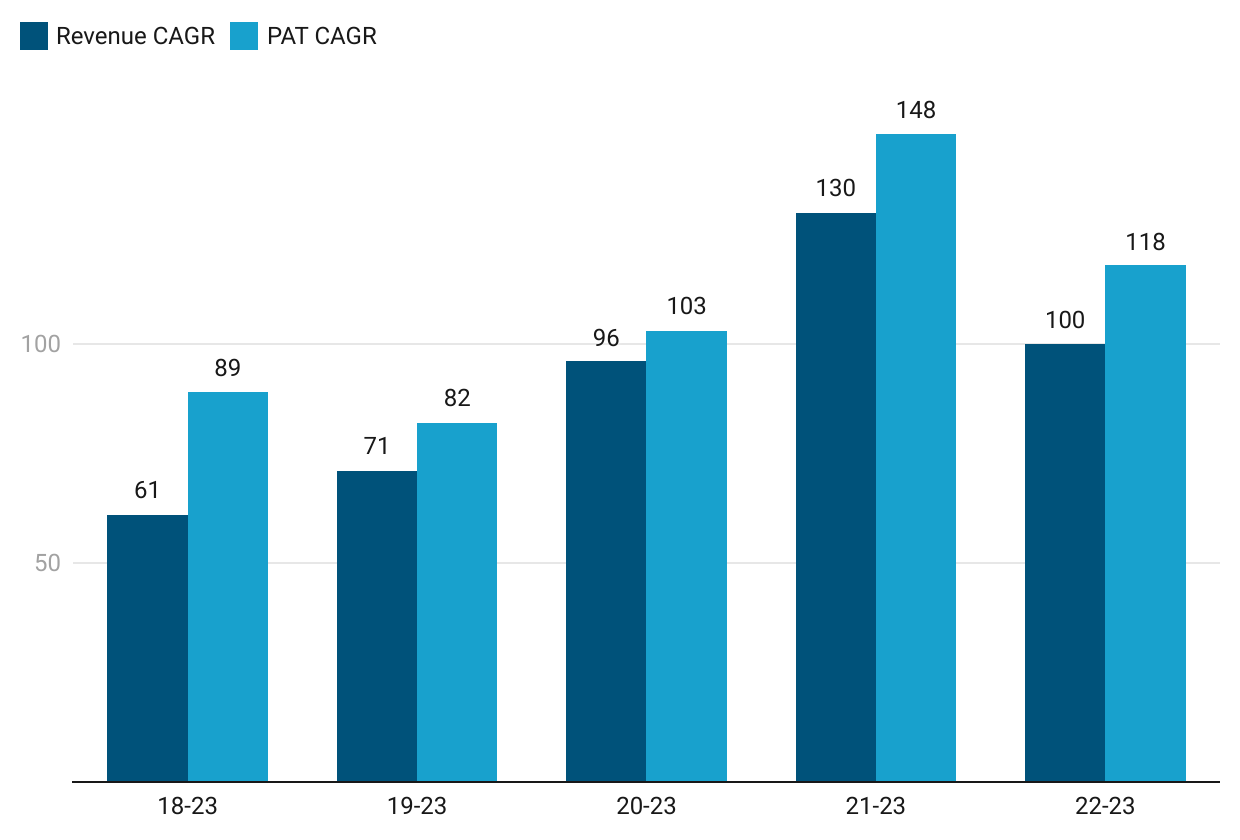

Growth

The adoption of new Product Line DAP & NPK Complex fertilizer in FY22, resulted in the growth in MBAPL.

Growth Momentum

FY24 would be the first full-fledged year of production of DAP & NPK Complex fertilizer variants. FY24 should see peak top-line and bottom-line in value from MBAPL, though from percentage terms FY24 growth could be lower than FY23.

Outlook

We are ignoring the inorganic opportunities mentioned in the earnings presentation for Q4-23. We are focused on the first full year of production of DAP/NPK

We are excited about the future growth of our business. While we are confident of maintaining growth and profitability from our continuing operations we continue to explore inorganic opportunities within the fertiliser space that will enhance our scale and presence.

So What????

If I currently hold the stock, I may continue holding it based on my past returns, expectations for future returns, and the availability of alternative stock ideas. The intention is to retain it for as long as one can see the full impact of the DAP/NPK capacity contributing to both top-line and bottom-line growth.

If I don't currently own the stock, I might consider entering it. One can view MBAPL as an attractively priced stock at a PE of 21, considering that its growth potential has not yet fully materialized. In FY23, the company achieved growth based on a DAP/NPK capacity of 120K MTPA. In FY24, the anticipated growth will be supported by a doubled capacity of 240K MTPA, indicating significant potential.

Throughout FY24, close attention will be given to the quarterly impact resulting from the utilization of the new 240K MTPA capacity.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades