Madhusudan Masala Q1 FY26 Results: PAT up 227%, On-track FY26 Guidance

Strong guidance of 30% CAGR for next 3-5 years. Q1-26 performance ahead of FY26 guidance. Available at very attractive valuations with leeway for execution risks.

Share your best AI hacks for stock analysis.

Top hacks will be shared back with everyone — you get to learn from the best too.

1. Spices & Food Products

madhusudanmasala.com | NSE - SME: MADHUSUDAN

Madhusudan Masala - not be suited for all:

Microcap - Market cap ~₹200 Cr

Limited Trading Volume - Entry and exit is a problem

Minimum Purchase = 1,000 stocks = ~₹1.4 lakh required to enterManufactures and markets a wide range of products under four brands – Double Hathi, Maharaja, Mantavya, and 77 Green (via Vitagreen acquisition).

Product Portfolio:

Ground Spices – chili, turmeric, coriander, cumin.

Blended Spices – garam masala, pav bhaji masala, biryani masala, sambhar, etc.

Whole Spices – coriander seeds, cumin, chili, fenugreek.

Grocery & Allied Products – hing, tea, kasuri methi, papad, pickles, soya product

Instant Mixes – dosa, idli, khaman, gulab jamun (via Vitagreen).

Market Presence:

Stronghold in Saurashtra (35% market share) and Gujarat (~5% share overall).

Long-term vision: build a pan-India spice brand with 1% market share in the Indian spice industry.

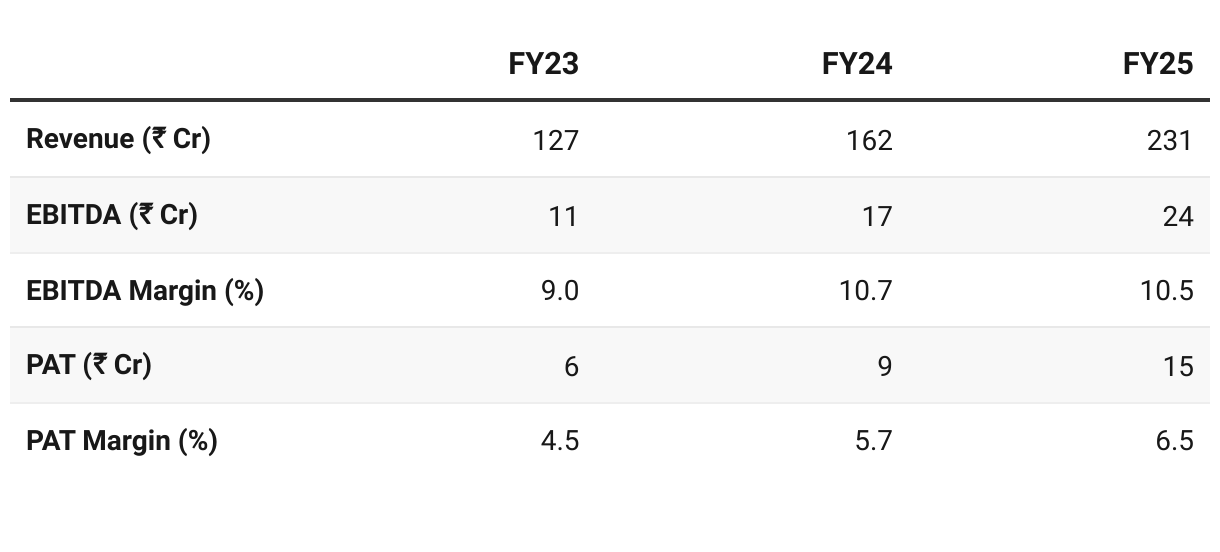

2. FY23–25: PAT CAGR of 63% & Revenue CAGR of 35%

Shift to branded spices from trading: Branded share 47% → 62% in FY25.

Portfolio widened: Entry into blended spices & instant mixes via Vitagreen acquisition.

Footprint expanded: From Gujarat-centric to presence in 7+ states.

Infrastructure built: New cold storage, second plant at Rajkot.

Distribution deepened: 25,000+ retail stores, e-commerce entry

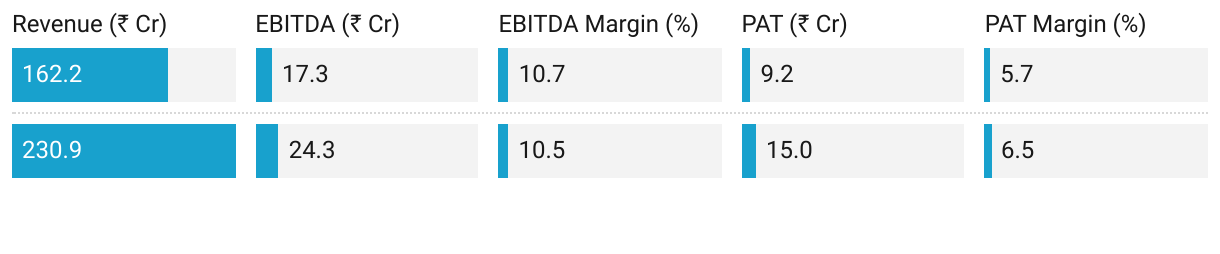

3. FY25: PAT up 63% & Revenue up 42% YoY

Strong topline growth with stable EBITDA margins

High capacity utilisation (>82%) → expansion/capex need in coming years.

Geographic footprint widening beyond Gujarat/Maharashtra, supported by Vitagreen integration.

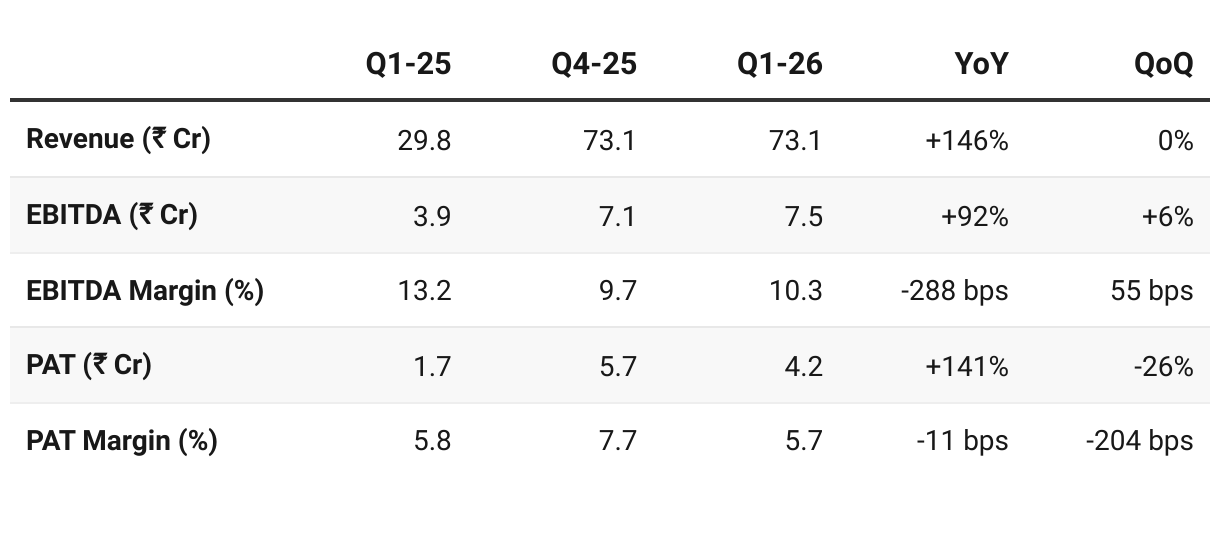

4. Q1 FY26: PAT up 141% & Revenue up 146% YoY

PAT down 26% & Flat Revenue QoQ

Growth driven by Vitagreen integration and expansion beyond Gujarat.

Margins stable at ~10% EBITDA despite higher marketing/expansion spend.

Capacity nearly full (>85% utilisation) → capex may be required in FY27.

Branded sales now 2/3 of total revenue, a positive for profitability trajectory.

Working capital heavy (high inventory & receivables) remains the key structural risk.

Inventories: structurally high due to seasonal procurement model

Trade Receivables: elevated due to 45-day distributor credit.

Borrowings: High short-term debt ₹66.1 Cr vs a market cap of ₹200 Cr

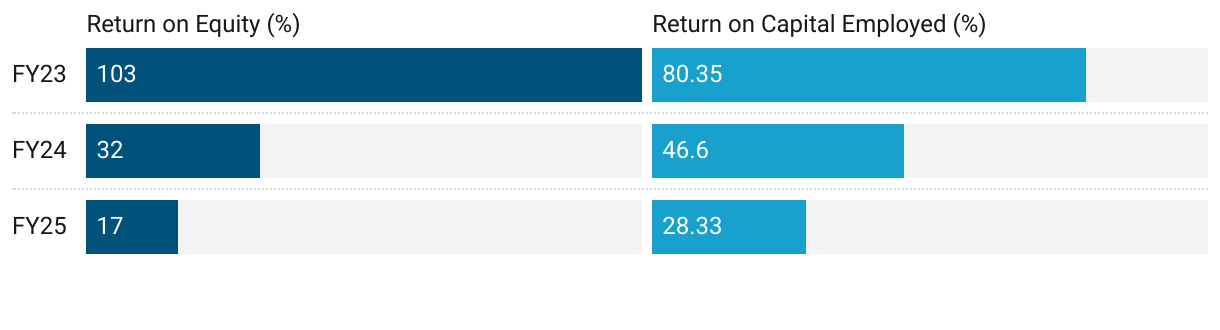

5. Business Metrics: Return Ratios Muted by Capital Raise

Funds from IPO in FY24 followed funds through Preferential issue in FY25 muted returns

6. Outlook: 30% CAGR for 3-5 Years

6.1 FY26 Guidance — Madhusudan Masala

We have a projected five year sales target is 30%, and definitely we

will achieve the CAGR of 30% of CAGR for the next 3 to 5 years.

As per our projection it will be 30% minimum. It will be the same for

standalone also. We have more expectations from Vitagreen. So there

we have a projection of 30% to 40% for this year.

EBITDA can be maintained. Because when we enter a new market, then obviously, after the expense of marketing activities and staff, there can be a little pressure on EBITDA.

We are constantly reducing our non-branded trading business. So where

there is a low margin in our business, we will reduce it and increase

the high margin category of our branded business. So our EBITDA

will remain maintained.

We have a plan to cover Rajasthan, Madhya Pradesh and Jharkhand states in this FY26. Maybe we will start Rajasthan from the Q1 of FY26.

6.2 Q1 FY26 vs FY26 Guidance — Madhusudan Masala

Ahead of FY26 guidance on revenue growth

Strong Start vs FY26 Guidance:

Q1 FY26 revenue was ₹75 Cr, in-line with ₹75 Cr/quarter run-rate needed for 30% growth.

Traditionally, H2 is stronger than H1. Madhusudan Masala could potentially exceed the 30% growth guidance.

Strong Margins: EBITDA margin in-line with guidance range (10–11%).

Branded Sales Mix: At 67% in Q1 FY26, above FY25’s 62%

Madhusudan Masala’s Q1 FY26 performance is ahead of FY26 guidance on revenue growth, while margins and branded mix are exactly within expected ranges.

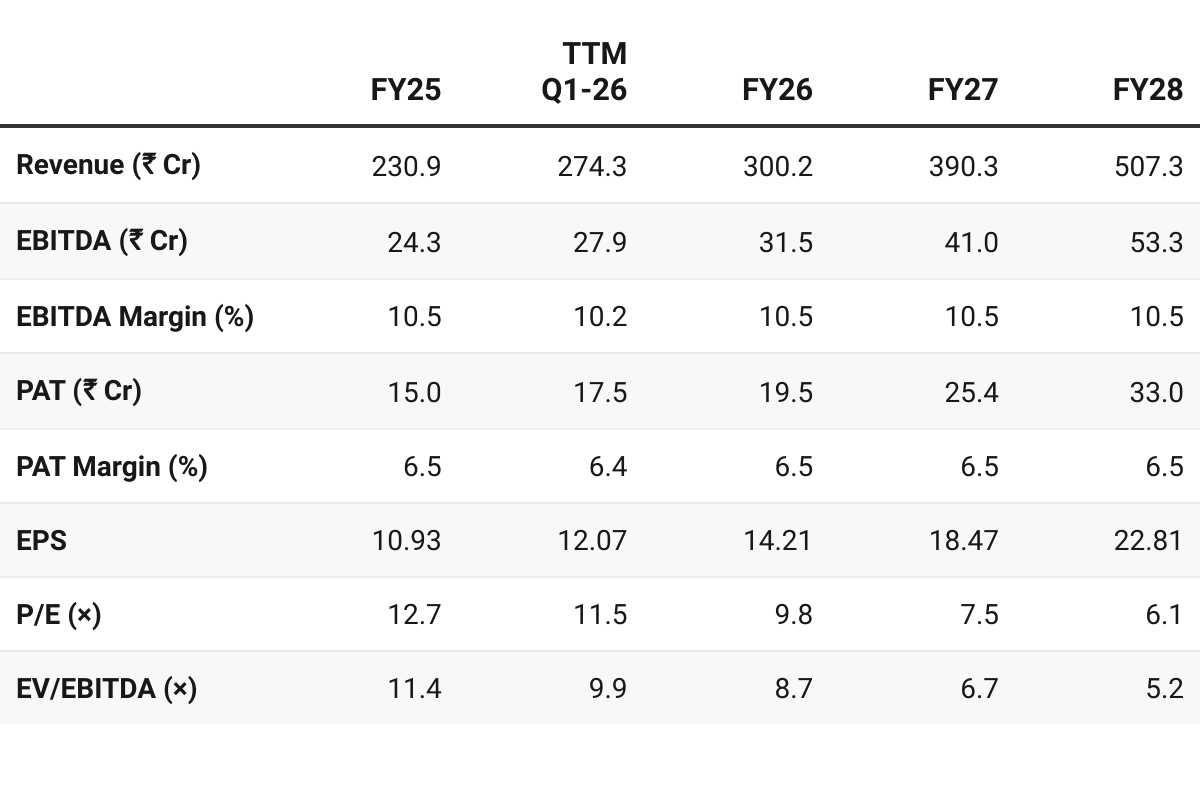

7. Valuation Analysis

7.1 Valuation Snapshot — Madhusudan Masala

CMP ₹138.5; Mcap ₹200.41 Cr

Attractive Forward Valuation:

Scope for valuation re-rating if growth trajectory sustains.

Valuations are undemanding — provide flexibility to sustain periods where performance is not as per guidance

Trades at a discount to FMCG peers and most branded food peers, reflecting regional scale and execution risks.

At ~10× FY26E earnings and <9× EV/EBITDA, which is attractive compared to larger FMCG peers. With 30% CAGR growth visibility, stable margins, and rising branded mix, the stock offers re-rating potential if execution in new geographies is successful. However, scaling up with the 30% momentum is a key risk.

7.2 Opportunities at Current Valuation

Attractive Forward Valuation: Trading at a discount, well below branded FMCG peers. Scope for re-rating if growth sustains.

Growth Visibility: 30% CAGR over 3-5 years — possibility to exceed FY26 guidance

Regional Strength: Strong in Saurashtra, now leveraging Vitagreen to expand in North & East.

Category Tailwinds: Growing consumer shift from unbranded to branded spices and convenience mixes supports long-term demand.

7.3 Risks at Current Valuation — Madhusudan Masala

Microcap Risk: May not grow into a small-cap; Illiquid, SME-listed; entry/exit difficult

Scale vs Valuation Gap: While valuations look cheap, discount may persist until Madhusudan demonstrates sustained growth outside Gujarat and builds a national brand.

Execution Dependence: Scaling outside Gujarat requires distributor build-up, marketing spends, and consumer acceptance.

Competitive Intensity: Faces national players (MDH, Everest, Aachi, Suhana) and entrenched regional players (Ramdev, Adani) — pricing and margin pressure possible.

Working Capital Heavy Model: High inventory and receivables → elevated short-term borrowings. Growth may strain cash flows further.

Commodity Price Volatility: Key inputs (chili, turmeric, coriander) subject to sharp seasonal swings, impacting gross margins despite storage strategy.

Share your best AI hacks for stock analysis.

Top hacks will be shared back with everyone — you get to learn from the best too.

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer