LT Foods: PAT growth of 55% & Revenue growth of 15% in H1-24 at PE of 14

Strong outlook for FY24.Bottom-line growing faster than the top-line. Margin expansion for FY24 and beyond. At reasonable PE valuations and attractive cash flow yield.

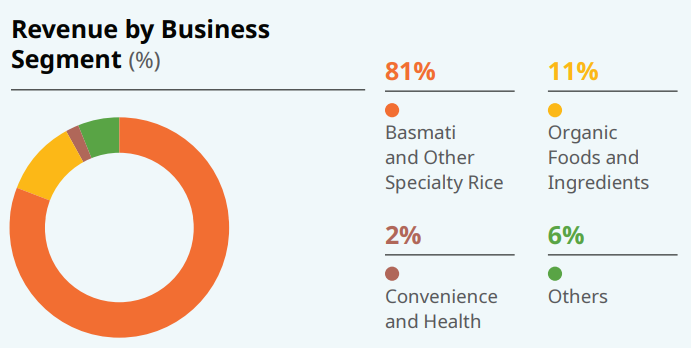

1. Selling Basmati & other rice with other food products

ltgroup.in | NSE : LTFOODS

Basmati Rice: According to AC Nielsen, our market share in India has surged by 160 basis points to 30.2%, while the market share in the Americas has witnessed a growth of 1.6%

2. FY19-23: Strong PAT growth even though revenue growth has been tepid

3. Strong FY23: PAT up 37% and Revenue up 28% YoY

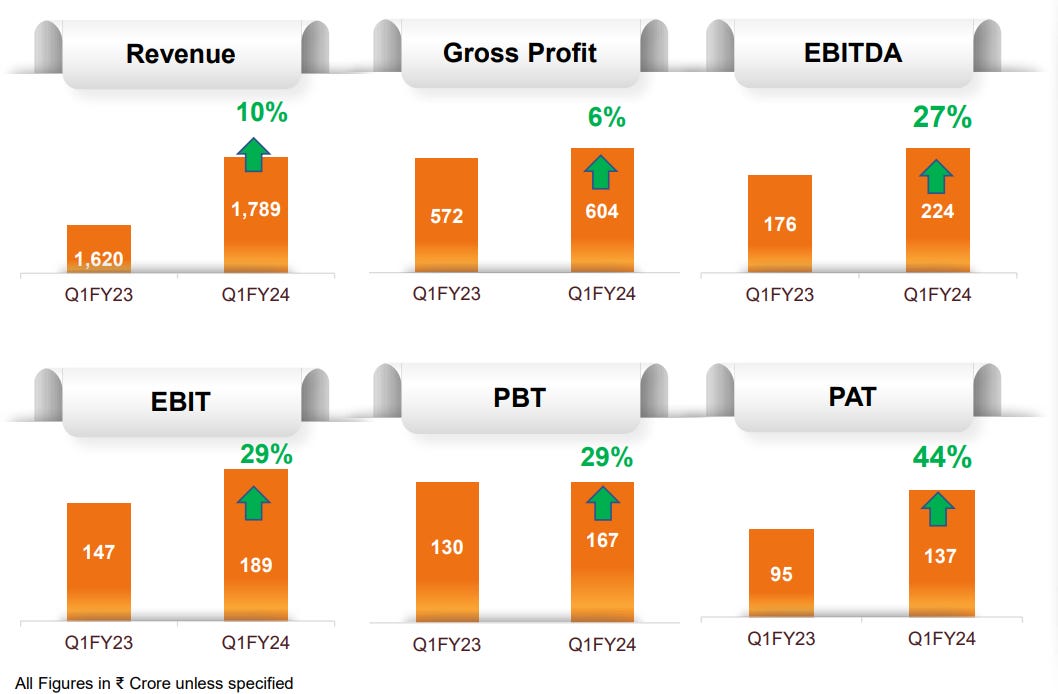

4. Strong Q1-24: PAT up 44% and Revenue up 10% YoY

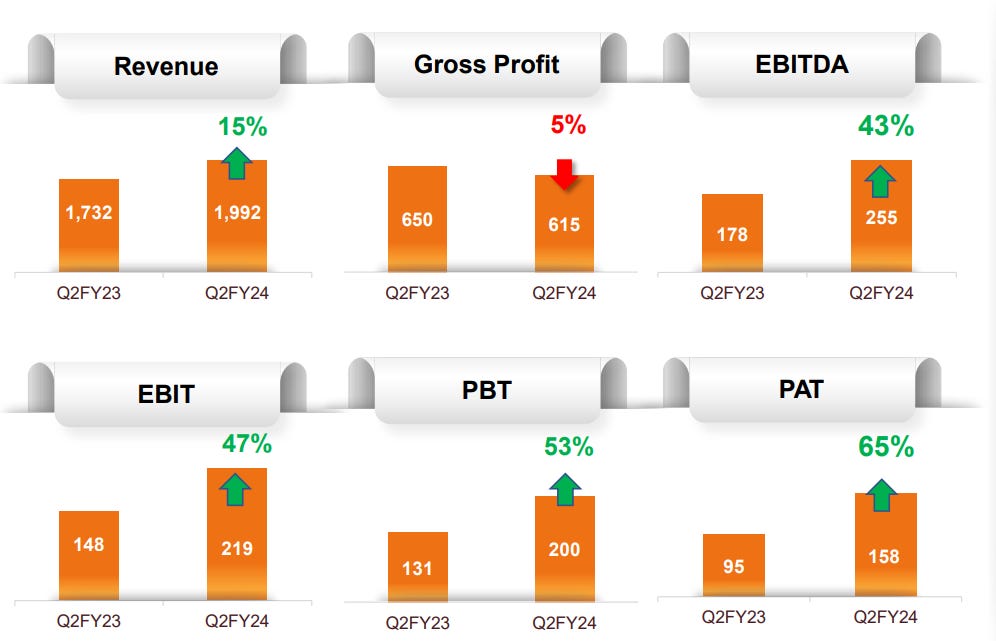

5. Strong Q2-24: PAT up 65% & Revenue up 15% YoY

6. Strong H1-24: PAT up 55% & Revenue up 13% YoY

7. Business metrics: Solid return ratios

H1-24: The return on capital employed improved to 21.9% on net debt basis from 17.7% in the first half of financial year 2023. Return on equity has also improved to 19.5% versus 16.5% in the previous year.

8. Outlook: 20% revenue growth in FY24 with PAT growing faster than revenue

i. FY24: Revenue growth of 20% expected

Given that H1 is 45% of the year, expected revenue for FY24 would be around Rs 8,402 cr based on the H1-24 revenue of Rs 3,781 cr. This would be a 20% growth over the FY23 revenue of Rs 6,979 cr.

historically we have seen that H1 to H2 is 45:55 ratio. So, we are expecting the same.

ii. Bottom line to grow faster than top-line on account of margin expansion

9. PAT growth of 55% & Revenue growth of 13% in H1-24 at a PE of 14

10. So Wait and Watch

If I hold the stock then one may continue holding on to LTFOODS

Based on H1-24 performance, LTFOODS looks on track to deliver as strong FY24

LTFOODS has a solid track record of growing its bottom line (30%+ CAGR for last 5 years) even though top-line growth has been tepid (15%+ CAGR for last 5 years). The trend is expected to continue with management guiding for a 5 year revenue CAGR of 10-12% with with EBIDTA margin expansion over the 5 years.

11. Or, join the ride

If I am looking to enter LTFOODS then

LTFOODS has delivered PAT growth of 55% & Revenue growth of 15% in H1-24 at a PE of 14 which makes valuations reasonable.

Outlook for revenue growth of 20% and a PAT growth of 20%+ in FY24 at a PE of 14 makes the valuations reasonable.

LTFOODS delivered Rs 380 cr of free cash flow against a market cap of Rs 7,426 cr. As of H1-24 end it is available on a free cash flow yield of 5% (not annualized) which makes the valuations quite attractive.

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades