LT Foods: PAT growth of 41% & Revenue growth of 12% in FY24 at PE of 16

Guidance for 10-12% revenue CAGR with EBITDA margin expansion in FY25. At an attractive free cash flow of 6.2%

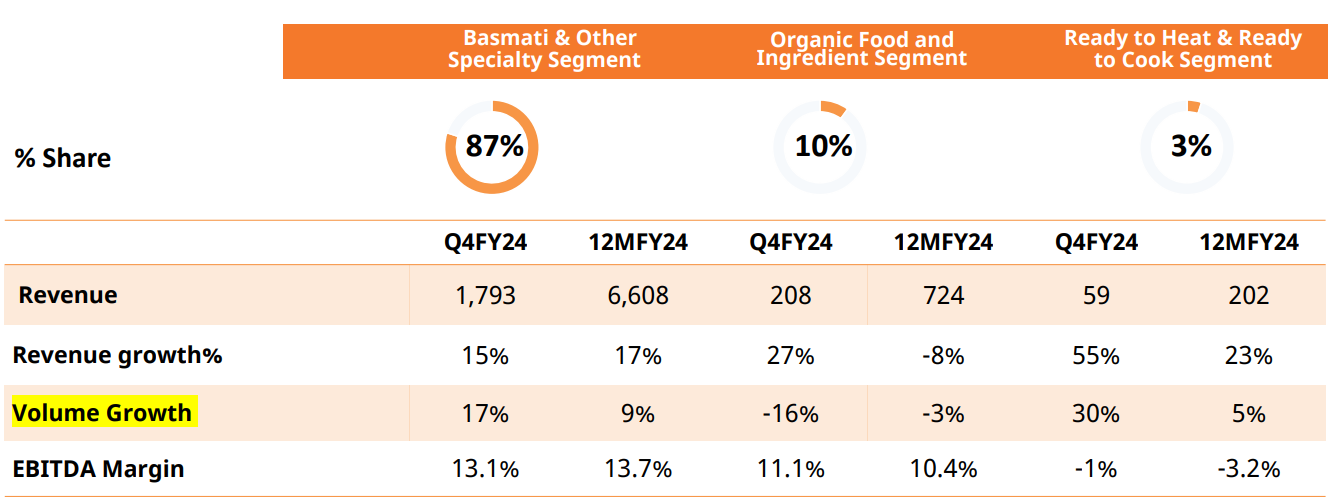

1. Basmati & Other Specialty Rice, Organic Food & Ingredient business & Ready to eat/Ready to cook segment

ltgroup.in | NSE : LTFOODS

Powerful brands like Daawat (30%+ Market Share), Royal (50%+ Market Share), Golden Star, 817 Elephant, Devaaya

Our RTE/RTC food expected to grow at a CAGR of 33-35% for next 5 years

2. FY20-24: PAT CAGR of 32% & Revenue CAGR of 17%

Our revenue CAGR in the last 18 years is 18% and PAT CAGR is 21%.

3. Strong FY23: PAT up 37% and Revenue up 28% YoY

4. Strong 9M-24: PAT up 54% & Revenue up 11% YoY

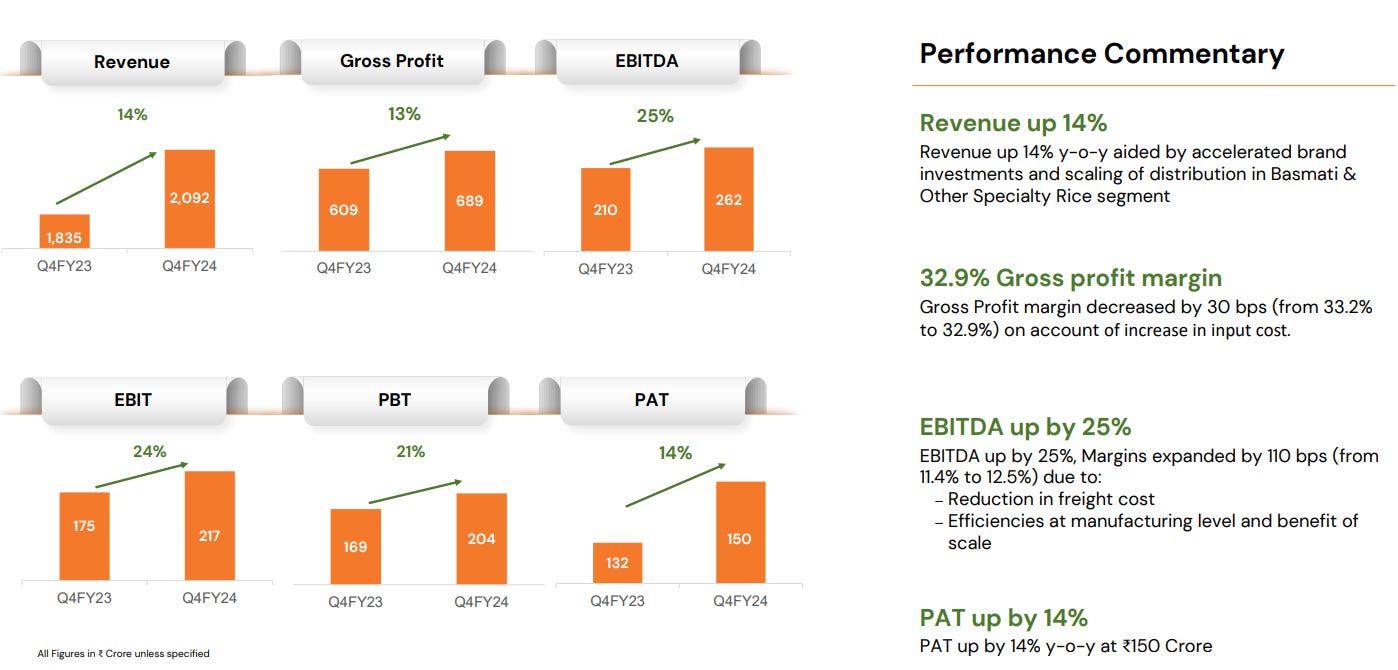

5. Strong Q4-24: PAT up 14% & Revenue up 14% YoY

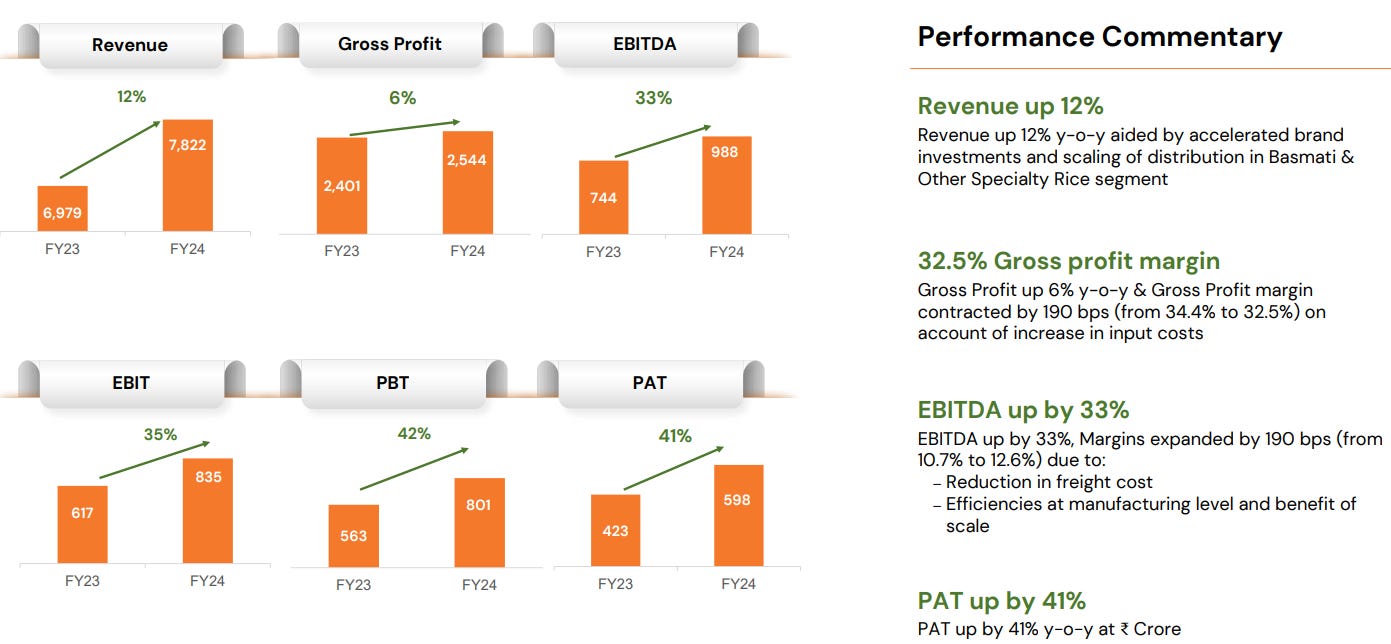

6. Strong FY24: PAT up 41% & Revenue up 12 YoY

7. Business metrics: Strong & improving return ratios

8. FY25 Outlook: 10-12%revenue growth with PAT growing faster than revenue

i. FY24: 10-12%revenue growth

So on the demand side, in the international market, we are optimistic that double digit 10% to 12% growth will remain intact.

ii. EBITDA Margin Expansion

EBITDA Margin of 12.6% in FY24 expected to move up to 14-15% in next 4 years

Compelling growth opportunity both in India and Internationally, expected to achieve EBITDA of 14-15% in next 4 years

9. PAT growth of 41% & Revenue growth of 12% in FY24 at a PE of 12

10. So Wait and Watch

If one holds the stock then one may continue holding on to LTFOODS

Coverage of LTFOODS was initiated after Q2-24 results. The investment thesis has not changed after a strong FY24. The delivery of a strong FY24 has increased confidence in the management to deliver a FY25 as per the guidance

LTFOODS has a solid track record of growing its bottom line ahead of its top-line. The trend is expected to continue in FY25 with management indicating for a 5 year revenue CAGR of 10-12% with with EBIDTA margin expansion over the 5 years.

Our revenue CAGR in the last 18 years is 18% and PAT CAGR is 21%.

11. Or, join the ride

If I am looking to enter LTFOODS then

LTFOODS has delivered PAT growth of 41% & Revenue growth of 12% in FY24 at a PE of 16 which makes valuations reasonable.

Given the historic track record of LTFOODS one can expect FY25 to be similar to FY24 at a PE of 16 which makes valuations reasonable.

LTFOODS delivered Rs 556 cr of free cash flow in FY24 against a current market cap of Rs 9,020 cr. As of FY24 end it is available on a free cash flow yield of 6.2% which makes the valuations quite attractive.

Previous coverage of LTFOODS

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer