Likhitha Infrastructure Limited - Big order book

Strong order book position, revenue visibility and superior return ratios

Company Overview

The first thing that captures one’s attention in the overview is that Likhitha Infrastructure Limited had an order book Rs 1,457 crores as of Oct-22. Since then LIKHITHA has received total orders worth Rs. 457.39 cr. during the quarter Oct-Dec 2022 followed by an order worth Rs. 129.63 cr in Feb-23. We are looking at order book of around Rs 2,000 cr against a FY23 revenue of Rs 365 cr. and the company’s market cap of Rs 1,060 cr.

The company claims that it has a policy of announcing the Outstanding Order Book at the end of each quarter including the quantum of the orders received during the quarter but the data as of 31-Mar-23 has yet not been released. Hence we are working with an estimate of Rs 2,000 cr order book.

Share Details

NSE: LIKHITHA( likhitha.co.in)

Quality: Returns on capital employed in cash

Return ratios have have held steady over the last four financial years. Likhitha has delivered on its return ratios, though cash conversion is an area of concern.

Growth

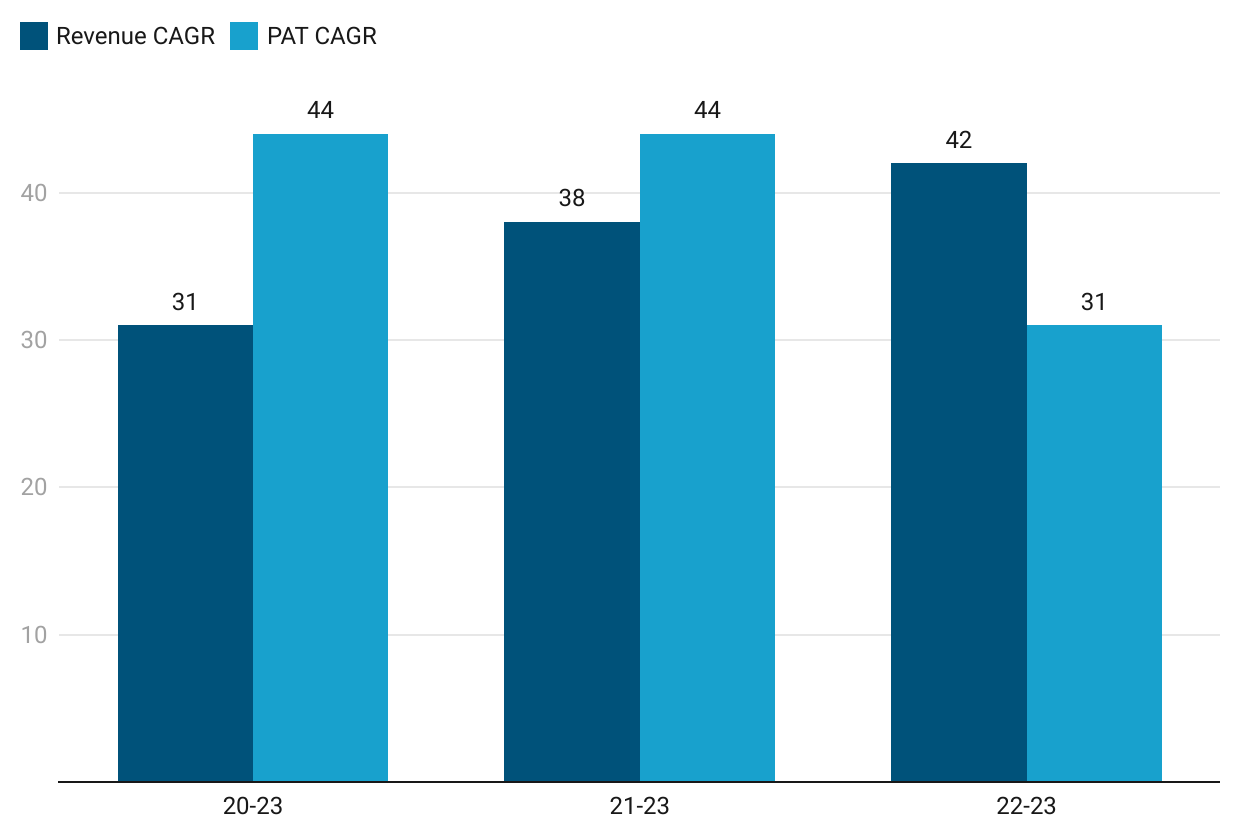

Growth is impressive for both the top-line and the bottom-line. Given an order book of more that 5X the revenue of the company in FY23, the growth is expected to continue for at least 2-3 years

Growth Momentum

The past growth momentum has been consistently high.

Future Outlook

The future outlook for the company is limited to size of its order book assessed to be around Rs 2,000 cr

The outlook is limited by the following factors

investor presentation for Q4-23 has not yet been released.

order book information as of Q4-23 has not yet been released

there is no other source of public management commentary on the company

These factors are nothing extraordinary when analyzing a small cap stock.

So What????

If I currently hold the stock, I may continue holding it based on my past returns, expectations for future returns, and the availability of alternative stock ideas. If I intend to hold it then one needs to keep a watch on the order book size and the speed and efficiency at which its getting executed.

If I don't currently own the stock, I might consider entering it given that it has a strong order book, revenue and margin visibility for at least FY24 and FY25. LIKHITHA is available at a PE of around 18 which makes it quite attractive against the Rs 2,000 cr order book it haswith a book-to-bill ratio of more than 5+.

While we look at company on its merit based on the strength of our analysis, those who look for external validation of their ideas can take comfort from the fact that Ashish Kacholia held a 2.01% stake as of 31-Mar-23.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades