Laurus Labs Q4 FY25 Results: Profit Up 122%, CDMO Momentum Strong, FY26 Outlook Bright

Laurus Labs is shifting from generics to high-margin CDMO. New FDF capacity, fermentation bets, and improved ROCE signal a strong multi-year growth cycle.

Table of Content

Laurus Labs Q4 & FY25 Financial Performance: A Strong Finish

Laurus Labs Segmental Breakdown: Where Growth Came From

Laurus Labs Guidance & Outlook: FY26 & Beyond

Valuation Analysis & Implications for Laurus Labs Investors: Quality Compounder in Transition

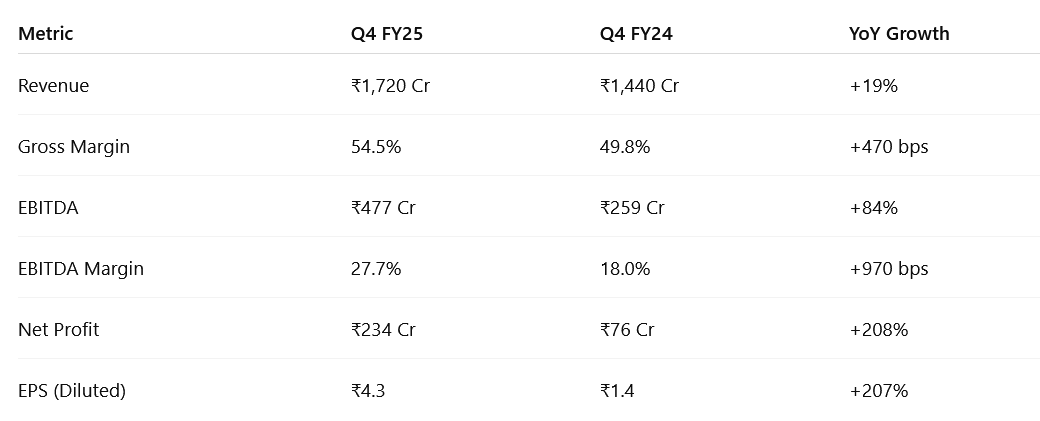

1. Laurus Labs Q4 & FY25 Financial Performance: A Strong Finish

Laurus Labs delivered a stellar financial performance in Q4 FY25, marking a strong rebound from the subdued trends seen in early FY25. The company outperformed on both revenue and profitability fronts, fueled by a sharp recovery in its CDMO and FDF businesses.

1.1 Q4 FY25: Profit Surge Driven by Mix & Scale

Q4 saw sharp operating leverage, with higher throughput from new CDMO contracts and FDF volumes.

Margins expanded significantly, also aided by a ₹59 Cr one-time gain from the sale of a land parcel (₹0.9 EPS boost).

Segmental growth was led by CDMO small molecules (+95% YoY) and FDF (+27% YoY), while API remained soft.

1.2 Full-Year FY25: Core Strengths Re-Established

Key drivers:

CDMO revenues grew 42%, now contributing 28% of total revenue, with better realization and contract stickiness.

EBITDA margin improvement was driven by:

Recovery in asset utilization

Operating scale from late-phase and commercial CDMO projects

Product mix shift toward high-margin segments

FDF grew 12% YoY, while API was down 4% due to volume prioritization

Despite a drop in operating cash flow (₹602 Cr vs ₹666 Cr), the management remains confident about working capital normalization as project cycles mature and asset turnover improves.

2. Laurus Labs Segmental Breakdown: Where Growth Came From

Laurus operates across three core verticals — CDMO, Generics (API + FDF), and Bio. FY25 performance showed a clear pivot toward high-margin, high-growth CDMO work, while generics stabilized and bio remained a long-term play.

2.1 Segmental Contribution (FY25 Revenue Mix)

2.2 CDMO (Contract Development and Manufacturing Organization)

CDMO is the engine of growth, now contributing 28% of total revenues (up from 22% last year).

Growth driven by:

Execution of several mid-to-late stage NCE deliveries

New capacity ramp-ups

Increasing contract wins across US/EU

Bio segment remained flat YoY but saw strong interest in enzyme engineering and long-term pipeline building. Fermentation capex begins FY26, with commercialization expected FY27 onward.

“CDMO momentum is structural. We’re building a differentiated, tech-led franchise in flow, bio-catalysis, peptides, and high potent compounds.”

2.3 Generics (API + FDF)

FDF delivered strong growth in both Q4 and full-year terms, aided by:

Increased demand in ARV formulations

Recovery in developed market launches

API remained soft due to:

Strategic reallocation of capacity toward higher-margin opportunities (CDMO)

Price erosion in certain molecules

“API was consciously deprioritized. Growth ahead will come from differentiated formulations and integrated CMO contracts.”

2.4 Bio Division: Building for the Future

Revenue flat at ₹160 Cr for FY25; low base due to divestment of low-margin non-core businesses.

Pipeline growing in AOF (Advanced Organic Functions), with new interest in enzyme engineering and precision fermentation.

Groundbreaking of fermentation facility (₹250 Cr investment) planned for June 2025 → Revenue impact expected from FY27.

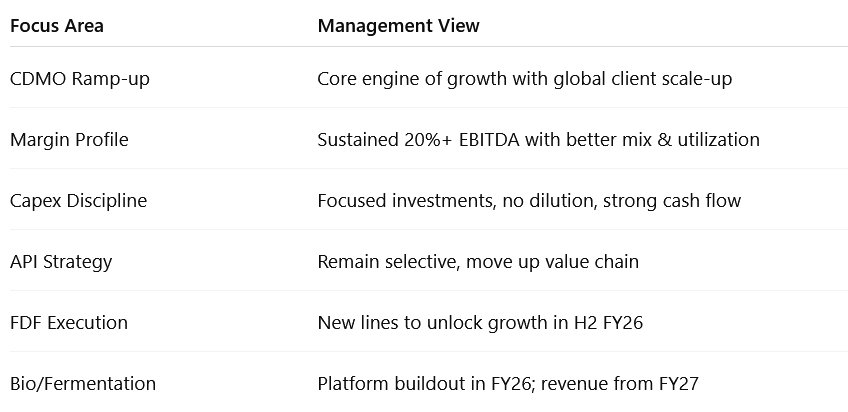

3. Laurus Labs Guidance & Outlook: FY26 & Beyond

3.1 Strategic Priorities for FY26

3.2 Revenue Growth Expectations: FY26

Management expects double-digit revenue growth in FY26.

Growth to be H2-weighted, driven by:

Scale-up of CDMO contracts

Ramp-up in new FDF capacity (commissioning by Dec 2025)

Higher asset utilization across newly added sites

“We expect continued momentum in CDMO and a recovery in generics-led formulations from H2.”

3.3 CDMO Segment: Still the Star

CDMO expected to maintain 20–25%+ growth trajectory.

Over 110 active pipeline projects to fuel revenues.

Execution in:

Late-phase commercial supplies

Peptide synthesis

High potent APIs

Flow chemistry and continuous manufacturing

“We’re well-positioned as an integrated CDMO partner. Utilization will rise and expand our margin profile.”

3.4 Generics (API + FDF): Recovery Mode

API to remain selective, focused on high-value molecules.

FDF business to accelerate from Q3 FY26 as new lines come online.

Multiple CMO contracts signed — full benefit expected from FY26.

“We’ve de-prioritized low-margin APIs. FDF will drive growth once new lines go live.”

3.5 Bio & Fermentation: Longer-Term Play

Bio segment revenue to stay flat to moderate in FY26.

₹250 Cr fermentation facility to break ground in June 2025.

Commercial production begins FY27.

Interest building in enzyme engineering + AOF applications.

3.6 Margins: Operating Leverage to Continue

FY25 EBITDA margin was 20.1%; Q4 margin hit 27.7%.

Management expects sustained 20%+ EBITDA margins in FY26.

Higher asset turnover

Favorable mix (CDMO/FDF > API)

Gradual operating leverage from past capex

“Margins are durable. As utilization improves, so will ROCE and free cash flows.”

3.7 Capex Guidance

FY25 capex: ₹659 Cr (12% of revenue)

FY26 capex to moderate, focused on:

Completing ongoing CDMO projects

Fermentation infra

KrKa JV facility (groundbreaking by June 2025)

Capex to stay within ₹500–600 Cr range; largely funded from internal accruals.

3.8 Capital Efficiency & Financial Outlook

Net Debt/EBITDA to improve further from 2.3x in FY25.

ROCE guided to improve to mid-teens over 2 years as past capex yields benefits.

Working capital to normalize as long-cycle CDMO projects mature.

4 Valuation Analysis & Implications for Laurus Labs Investors: Quality Compounder in Transition

4.1 Current Valuation Metrics

4.2 What’s Included in the Price

4.3 What’s Not Fully Included (Still Emerging/ Underappreciated)

4.3 Why Investors Can Consider Laurus

i. CDMO Momentum is Structural, Not Cyclical

Laurus has successfully moved up the pharma value chain.

Over 110 active CDMO projects, across small molecules, peptides, flow chemistry, and high potent APIs.

Growing late-phase and commercial programs mean multi-year revenue visibility.

CDMO now contributes 28% of Laurus' total revenues, and the trend is accelerating.

ii. Margin Expansion and Operating Leverage Are Sustainable

FY25 EBITDA margin recovered to 20.1%, Q4 hit 27.7%.

Higher asset utilization, better product mix (more CDMO, more formulations), and new capacities coming online point to sustained 20–22% EBITDA margin range going forward.

As more long-lead projects commercialize, margin resilience will further strengthen.

iii. Focused Capital Allocation Strengthens the Investment Case

₹3,200 Cr capex over FY22–25 has been intelligently deployed into:

CDMO expansions

Fermentation (bio) platforms

FDF scaling

No equity dilution, no reckless expansions — high capital discipline.

Fermentation and biotech investments create long-term optionality beyond traditional pharma.

iv. Improving Return Ratios and Deleveraging

Net Debt/EBITDA improved to 2.3x in FY25; expected to decline further.

ROCE improved to 9.7% — still early, but moving in the right direction.

Cash flows should strengthen as working capital cycles normalize.

Laurus is entering a phase where both growth and balance sheet metrics improve simultaneously.

4.4 Key Risks Investors Should Watch

4.5 Premium Valuation Justified?

Yes, to some extent, because Laurus now offers:

High visibility growth runway in CDMO (20–25% CAGR potential)

Margin stability in the 20–22% range

Diversified revenue base beyond ARVs and low-margin APIs

Early investment into bio and fermentation platforms (medium-term catalysts)

Premium valuations are justified by execution, CDMO momentum, and improved financial discipline.

However, some caution is warranted:

Near-term working capital cycles remain heavy

Return ratios (ROCE, ROE) are still recovering; not yet best-in-class

High valuation multiples leave little room for execution slip-ups

Fresh entry may require waiting for market pullbacks or accumulating gradually, given rich multiples and working capital overhang.

For long-term investors, Laurus remains a high-conviction CDMO compounding story — albeit one where execution discipline must be watched carefully.

If you are a long-term investor (3–5 years+ view), Laurus fits the profile of a high-quality compounder transitioning to its next growth phase.

Disclaimer

Content Accuracy and Reliability: This summary of the earnings call is generated using an artificial intelligence large language model (LLM). While every effort has been made to ensure the accuracy and completeness of the information, the summary may not fully capture all nuances or details of the original earnings call. The content provided is for informational purposes only and should not be construed as financial advice or a recommendation to buy or sell any securities. Verification: Readers are encouraged to refer to the official earnings call transcript, company filings, and other authoritative sources for comprehensive and accurate information. The creators of this summary do not guarantee the accuracy, completeness, or timeliness of the information and accept no responsibility for any errors or omissions. No Liability: The use of this summary is at your own risk. The creators and distributors of this content disclaim any liability for any loss or damage arising from the use of or reliance on this summary. Consult Professional Advice: For investment decisions or financial advice, please consult a qualified financial advisor or other professional

very well & crisply crafted the message.

Thanks for this detailed review

Laurus has best in class management so demanding high premium. It’s a long term game