L&T Finance Holdings: PAT growth of 57% & total income growth of 15% for 9M-24 at 16 PE

L&TFH is delivering ahead of Lakshya 2026, its FY26 guidance is available at reasonable valuations with a price to book of 1.6

1. Retail NBFC straddling the Rural & Urban ecosystem

ltfs.com | NSE: L&TFH

L&T Finance Holdings Ltd. (L&TFH) is a financial holdings company offering a diverse range of financial products and services across retail, corporate, housing and infrastructure finance sectors

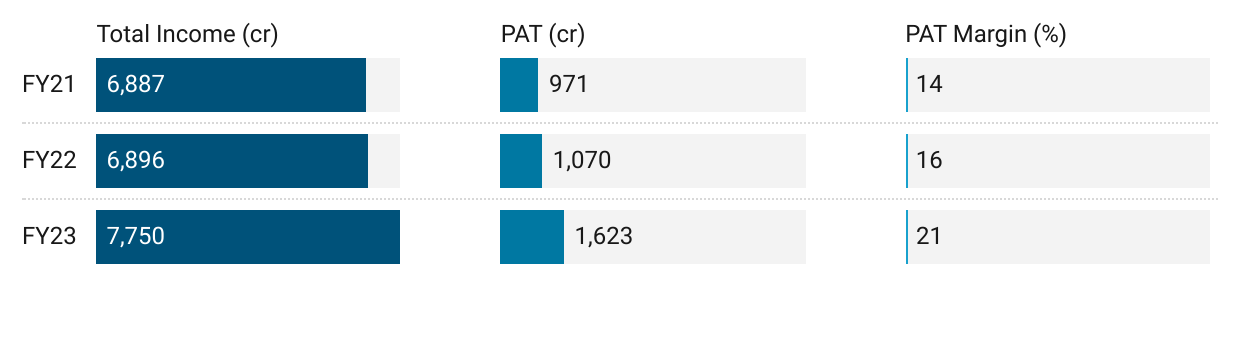

2. FY20-23: PAT CAGR of 29% & Total Income CAGR of 6%

3. FY23: PAT up 52% & Total Income up 12%

3. H1-24: PAT up 68% & Total Income up 18% YoY

4. Strong Q3-24: PAT up 41% & Total Income up 11% YoY

PAT up 29% & Total Income up 3% QoQ

5. Strong 9M-24: PAT up 57% & Total Income up 15% YoY

6. Business metrics: Strong & improving return ratios

Post delivery of Consol RoA of 2.53% in Q3FY24, focus would be on reaching the threshold RoAs by FY26

7. Strong outlook: Retail growth CAGR of 25%+

Delivering ahead of its FY26 guidance (referred as Lakshya 2026)

In line with what we have been communicating over the last few quarters, we continue to achieve and exceed the Lakshya 2026 targets well ahead of time and deliver consistent results quarter-on-quarter. This is an outcome of the strong execution engine that we have put in place over the last couple of years, and we will continue to bolster the execution bias in every initiative we take.

8. PAT growth of 57% & total income growth of 15% in 9M-24 at a PE of 16

9. So Wait and Watch

If I hold the stock then one may continue holding on to L&TFH

Based on 9M-24 performance, L&TFH looks on track to deliver the strongest PAT in FY24

The roadmap of Lakshaya 2026, guidance till FY26 provides a reason to continue with L&TFH

10. Join the ride

If I am looking to enter L&TFH then

L&TFH has delivered PAT growth of 57% and total income growth of 16% in 9M-24 at a PE of 16 which makes the valuations quite acceptable over the short term.

L&TFH has a net-worth of Rs 22,860 as of Q3-24 on a market cap of Rs 37,134 cr implies its trading at price to book of 1.6 which makes the valuations quite reasonable.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer