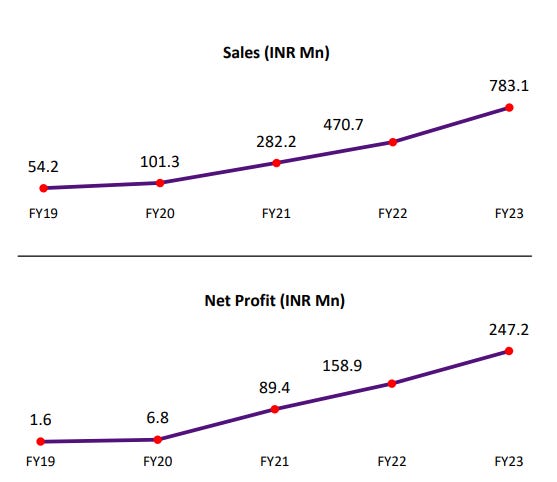

Ksolves India: 95% revenue growth & 250%+ PAT growth for FY19-23

It is relatively easier to deliver growth on a sub Rs 100 cr revenue. KSOLVES is an IT services company for high risk, high rewards with high growth & good quality earnings

1. IT services provider

ksolves.com |NSE: KSOLVES

On track to deliver Rs 100 cr revenue in FY24

2. FY19-23: revenue growing at 95% CAGR

FY23: Revenue growth 66% and PAT growth at 55%

3. Q1-24: Momentum going strong, 40%+ YoY growth

4. High quality of growth and earnings delivered

90% of free cash paid back as dividend

5. Nothing extraordinary about the way forward

The way forward for KSOLVES is nothing different from the way forward of the the larger IT services companies.

KSOLVES is just another IT services growing fast on the back of a small base.

6. 66% revenue growth in FY23 at a PE of 60

7. So Wait and Watch

If I hold the stock then one can hold on as KSOLVES has delivered 66% growth for FY23. Its Q1-24 performance is also good creating an expectation of a similar growth trajectory in FY24. One needs to wait and watch for quarterly results to see if the company is delivering the growth it has delivered for the period FY19-23.

8. Look before you get in

If I am looking to enter the stock then

For the growth it has delivered in FY23 and Q1-24, the PE is acceptable. However, it is relatively easier to deliver growth at less than Rs 100 cr revenue range.

Quality of growth is good in term of return ratios.

Company paying out 90%+ free cash flow is both a positive and a negative. Positive that earnings are real and are being paid out to share holders. Negative that the company does not have avenues to reinvest their earnings back in the business

Can be a very high risk, high reward bet. It has to grow from the sub Rs 100Cr revenue to around Rs 500 cr revenue for its business model to be proven.

Since its a bet one should not enter in the stock in one shot.

Since its a bet the size of the bet cannot be a significant part of the portfolio.

What if KSOLVES is able to keep the growth momentum going for another 3 years. One can easily have a multi-bagger in ones portfolio.

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades