Krsnaa Diagnostics: 30-35% revenue CAGR for FY23-25 at a PE of 35

After a weak FY24 guidance in Q4-23, KRSNAA gave a strong guidance for FY24 in Q1-24. Change shows the confidence the management has about its prospects & creates opportunities in the stock.

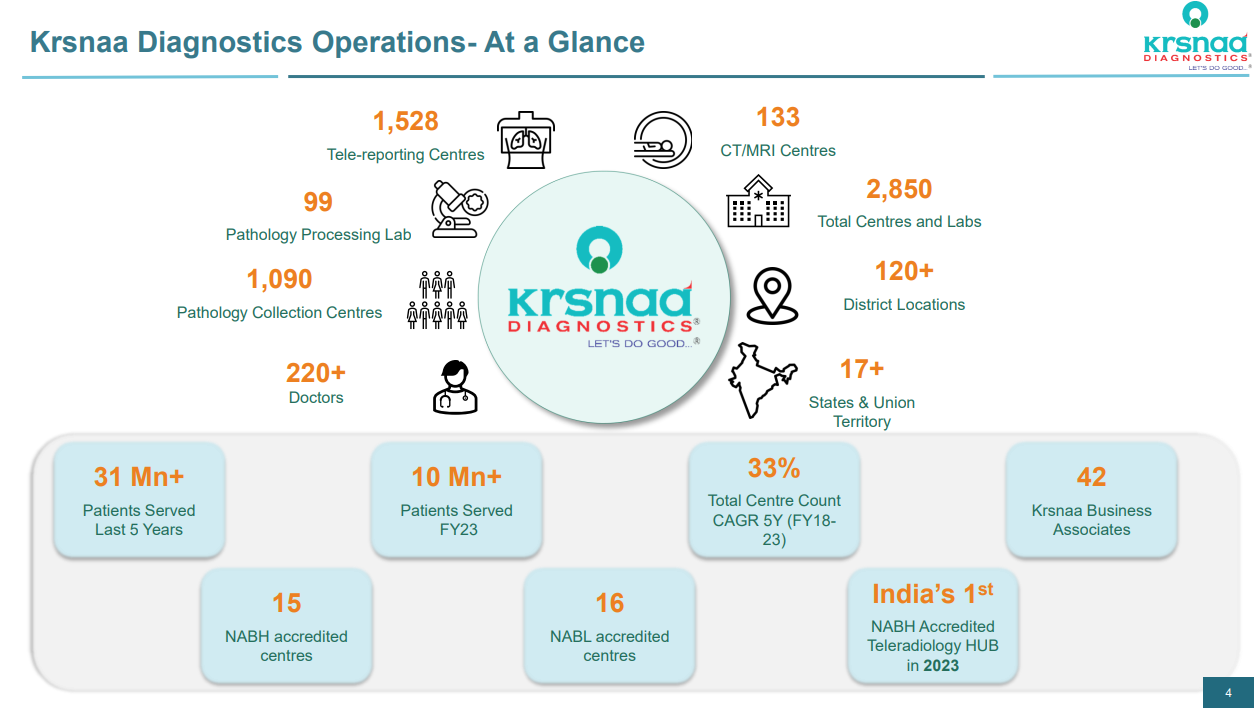

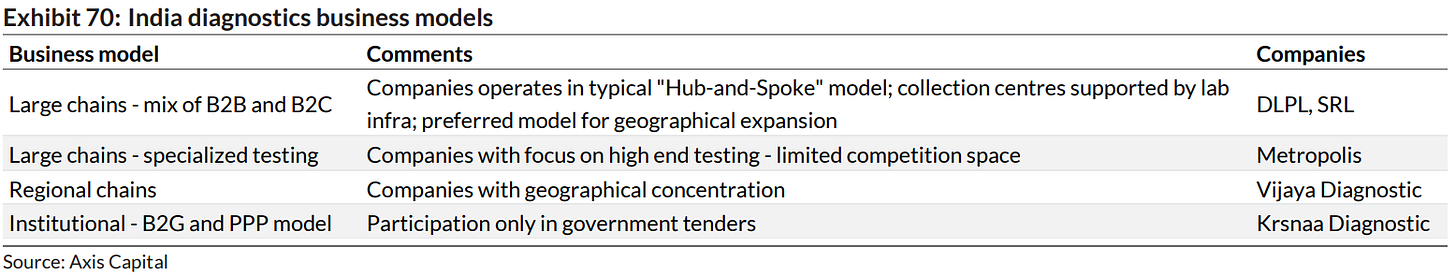

1. Diagnostic services provider with largest presence in PPP (Public‑Private Partnership) diagnostics segment

krsnaadiagnostics.com | NSE: KRSNAA

Governments at the central and state levels are exploring public-private partnerships to enhance healthcare and diagnostic services. Krsnaa Diagnostics, as a fore frontier in PPP diagnostics, has established a strong presence across India and our efforts ensure access to advanced and highly feasible diagnostic services even in the remotest regions of our country.

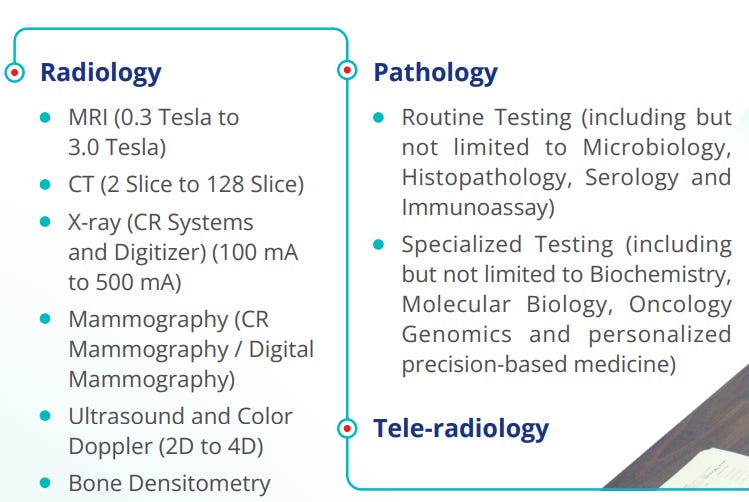

Offerings:

India’s 1st NABH accredited Teleradiology hub

the majority of our business today still is radiology driven, which contributes to the overall, yeah, almost 60-65% of our business comes from radiology

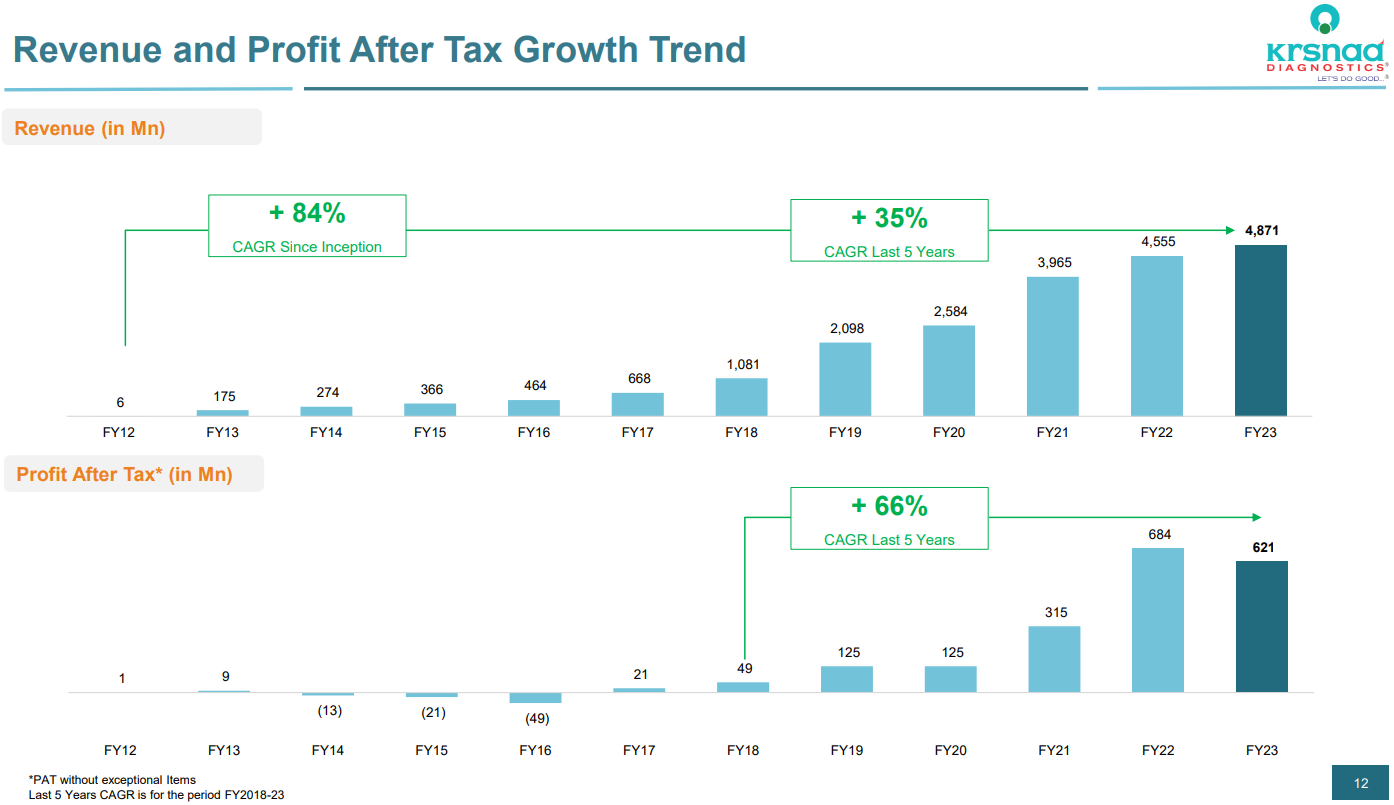

2. FY18-23: PAT up 66% and revenue up 35% CAGR

Revenue growth delivered YoY since FY12

Top-line & bottom growth momentum slowing down in FY23

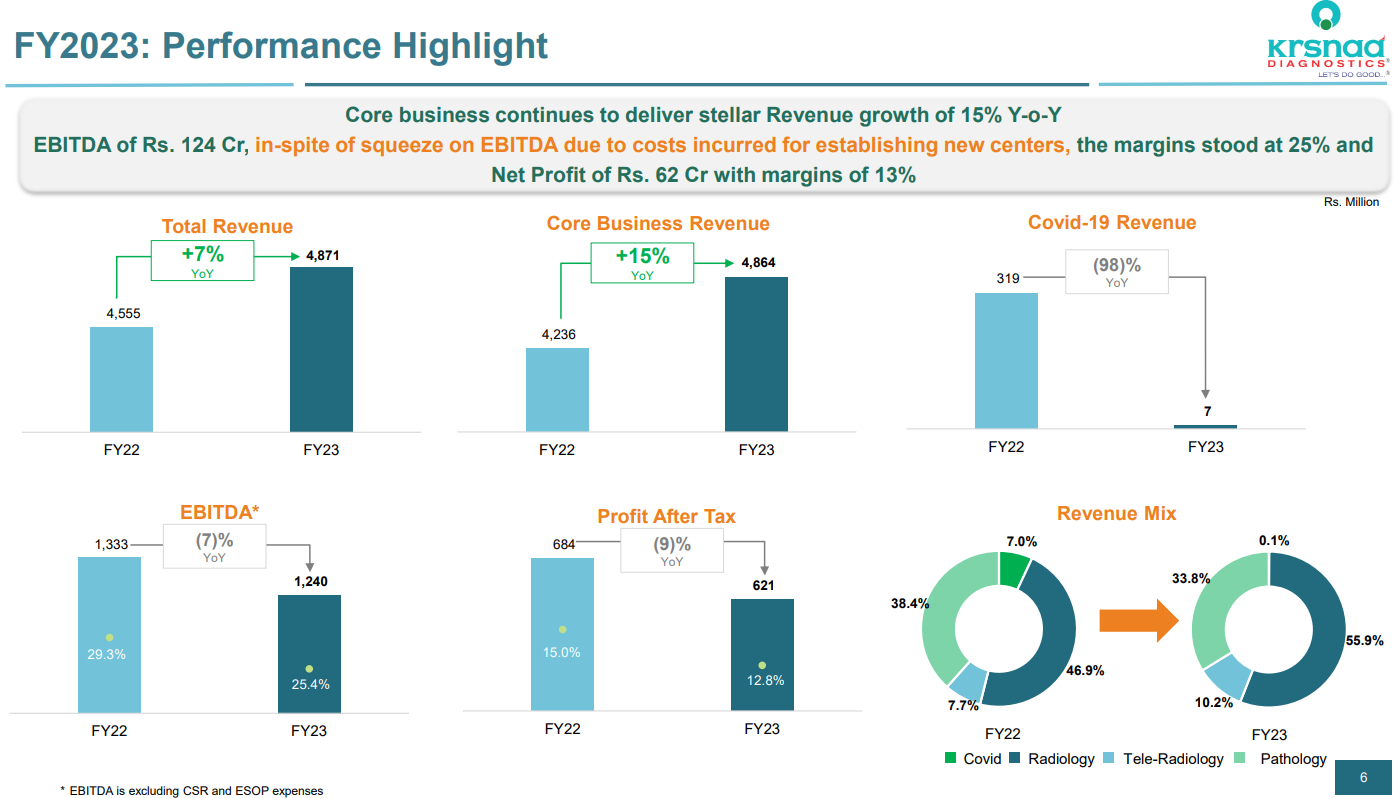

3. Weak FY23: PAT down 9% and revenue up 15% YoY

We achieved core revenues of Rs. 486 crores, representing a remarkable 15% year-on-year growth. Our EBITDA stood at Rs. 124 crores, with a margin of 2

5%. Additionally, we reported a Net Profit of Rs. 62 crores, with a margin of 13%. While recognizing our achievements, it is important to acknowledge that our margins were impacted during FY23 due to the necessary costs associated with establishing new centers.

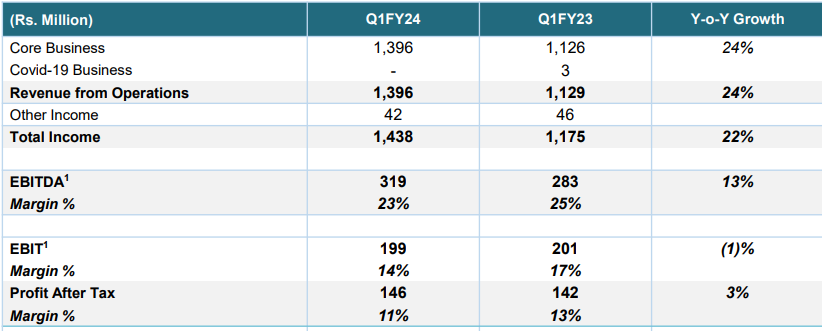

4. Weak Q1-24: PAT up 3% and revenue up 24% YoY

However, it is crucial to acknowledge that our profitability margins have faced some influence, deviating from the previous quarter's performance. This shift can be attributed to our ongoing expansion endeavours. These encompass various projects that, despite incurring higher expenses, are yet to contribute proportionally to the revenues

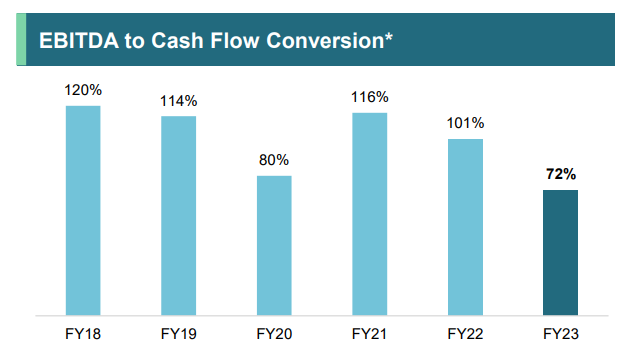

5. Business metrics: Strong cash flow conversion & good return ratios

Krsnaa’s EBITDA to Cash Flow conversion is comparatively lower largely due to increase in inventory, increase in debtors and payments to vendors for operationalizing of new centres considering large state level implementation, and the EBITDA to cashflow conversion is expected to normalizes as the centres mature

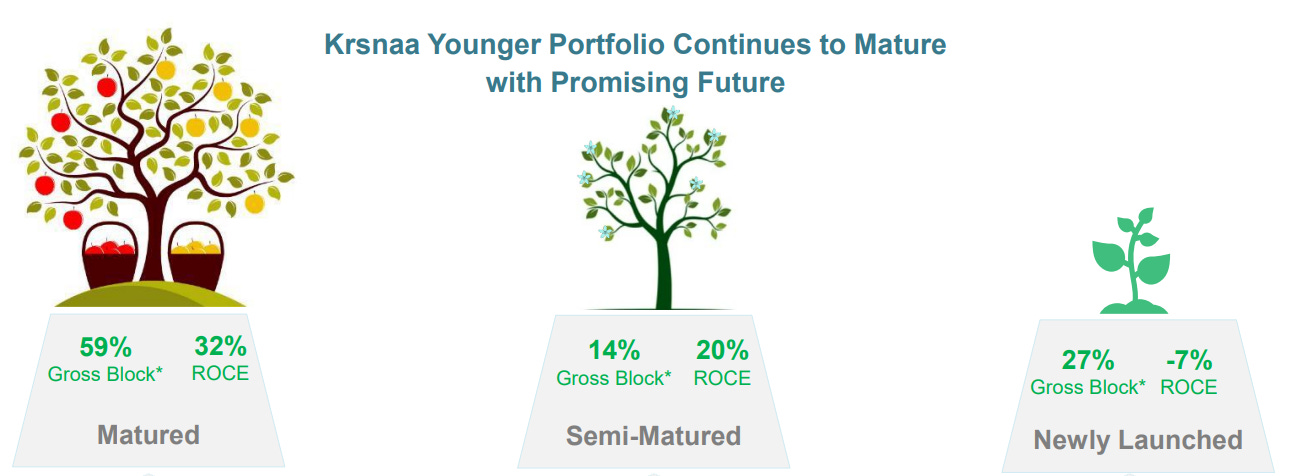

ROCE based on Diagnostic Centres Maturity Profile

6. Outlook: Growth back to 30-35% after a weak FY23 & Q1-24

i. 30-35% revenue CAGR for FY23-25

So, this year, we are expecting 30-35% growth year on year and next year, of course, with Rajasthan being added up, then the growth will also be much higher.

ii. 25% EBITDA for FY24

Margins to be maintained while growing at 30-35% top-line

The margin profile for this year will be a bit impacted

So, we expect a slight impact on the EBITDA margins on a quarter-on-quarter basis as we keep on adding these employees. But we are equally trying to also ensure that the revenue ramp-up is being pushed further to ensure that the dent or the impact on EBITDA will be lower.

However, on an annualized basis, if you see, we expect the EBITDA margins to be about the same 25% or try to improve from here on.

ii. Additional FY25 revenue visibility of Rs 400 cr based on tenders won

Yeah, so if you consider Rajasthan, Assam, Orissa, all these tenders and Mumbai, we expect it to be almost about close to 400 crores as the baseline revenue that we should expect from all these projects put together.

we expect Rajasthan to contribute about close to 300 crores.

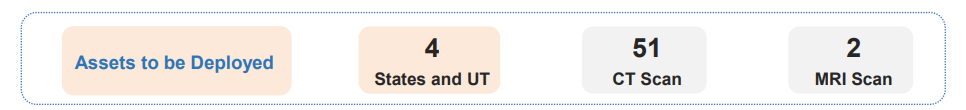

Radiology Tenders Won and Assets to be deployed

Pathology Tenders Won and Assets to be deployed

7. 30-35% EBITDA CAGR for FY23-25 at a PE of 35

Not many would have made money in KRSNAA

8. So Wait and Watch

If I hold KRSNAA then it means I have held it through a week FY23 and a slightly better, yet weak Q1-24. One may continue holding on to KRSNAA given that the management is confident on delivering 30-35% growth in both FY24 and FY25.

Management guidance during Q4-23 earnings call

And in FY24, we expect to achieve double-digit growth for the year and assuming and that all our new centers will get operationalized and implemented by fiscal end of FY24, we expect a higher growth rate in FY25.

The tone of management guidance changed in Q1-24 and they were quite clear in guiding for 30-35% growth in both FY24 and FY25. The growth excludes the impact of the Rajasthan tender.

EBITDA margins were impacted in FY23 and Q1-24 due to investments for growth, however the management has guided for a 25% EBITDA margin. One needs to keep a watch that these margins hold.

The guidance of 25% margin and 30-35% EBITDA is easy to track and one needs to keep watching for it quarter on quarter.

9. Or, join the ride

If I am looking to enter the stock then

30-35% revenue CAGR & 25% EBITDA at a PE of 35 makes KRSNAA fairly valued.

The only way for KRSNAA to deliver on its 30-35% guidance would be a strong qoq growth in the remaining three quarters. In this context, Q2-24 would be important to watch out for.

Given KRSNAA is fairly valued, the price point at which one enters into the stock is important.

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades