KPI Green Energy Q3-26 Result: PAT up 67%, On-track FY26 Guidance

Guidance of 60% revenue CAGR for FY25-30 with stable 30-35% margins. Available at attractive valuations based on FY26 and FY27 projected earnings

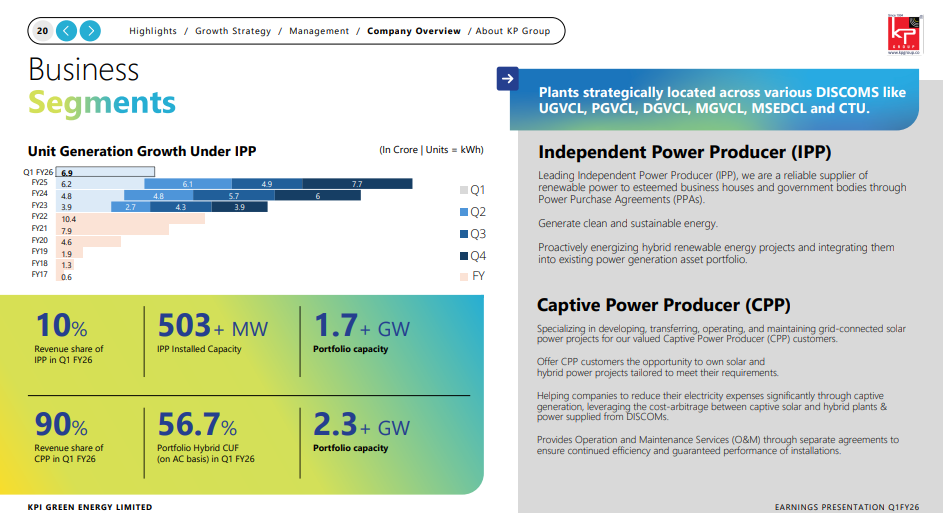

1. Renewable power generating company in Gujarat

kpigreenenergy.com | NSE: KPIGREEN

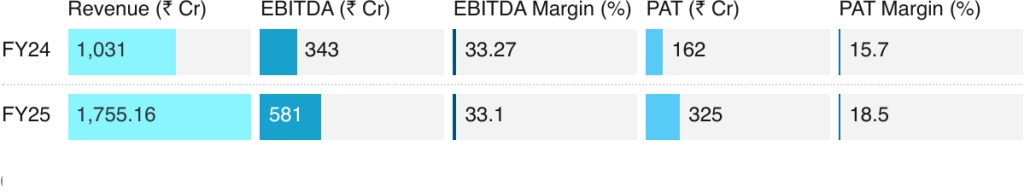

2. FY21–25: PAT CAGR of 111% & Total Income CAGR of 67%

3. FY25: PAT up 101% & Total Income up 70% YoY

Guidance Out-performance: Revenue growth at 70% vs guidance of ~60%

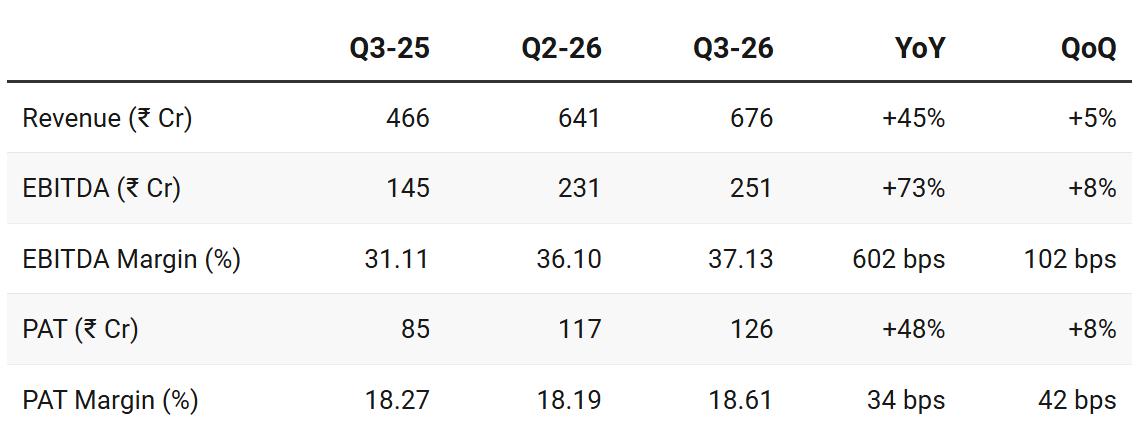

4. Q3-26: PAT up 48% & Revenue up 45% YoY

PAT up 8% & Revenue up 5% QoQ

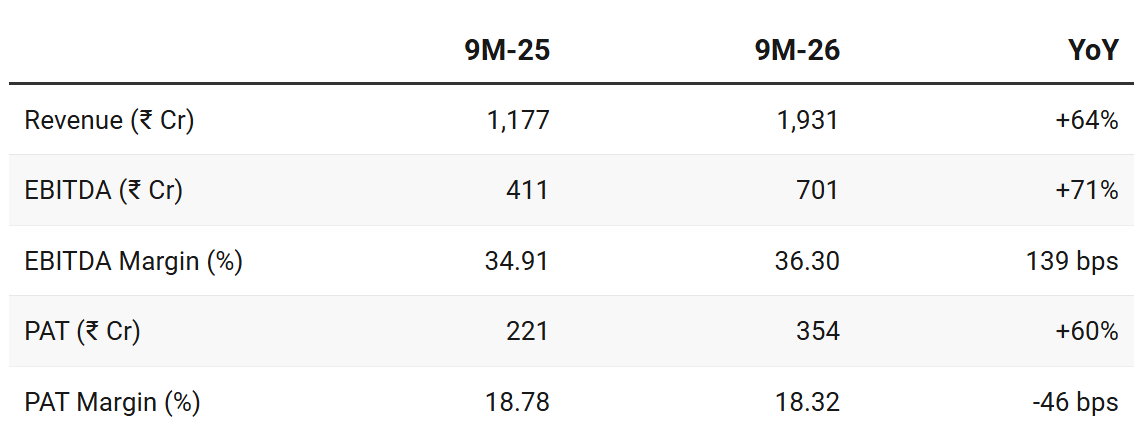

5. 9M-26: PAT up 60% & Revenue up 64% YoY

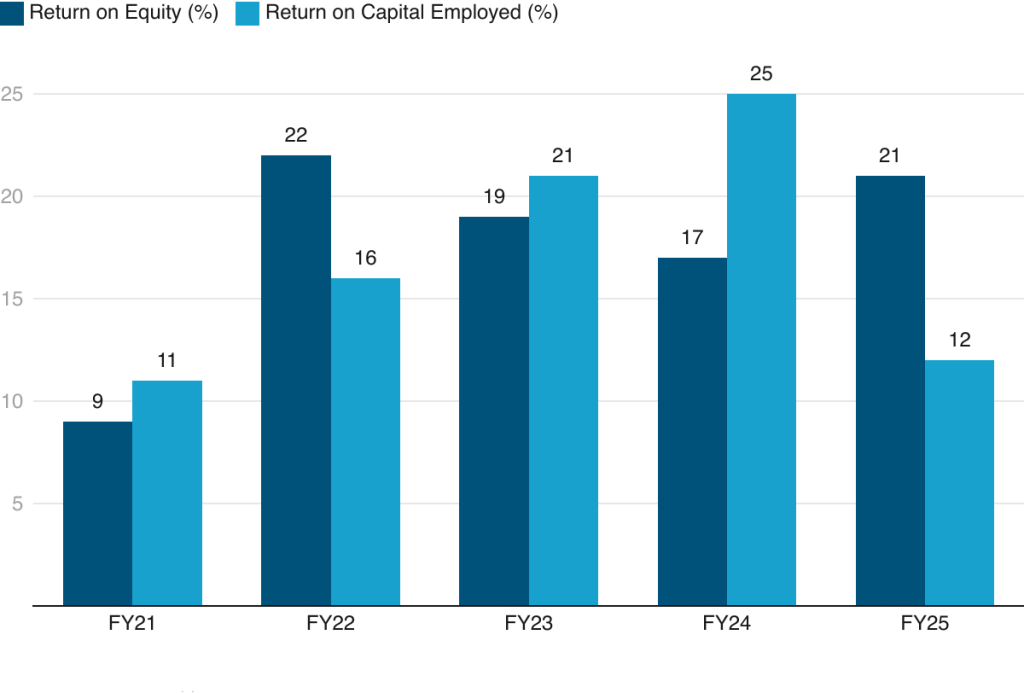

6. Business metrics: Steady Return Ratios

What we have usually been around 20% to 24% kind of return on equity that we are seeing here. We will be in the range of 20 to 24.

FY25 Return Compression: Returns moderated in FY25 due to higher capital employed, with equity tripling YoY as the company scaled.

Healthy Profitability Maintained: Even with equity dilution, KPI delivered high-teen ROE and double-digit ROCE, reflecting efficient asset monetization.

7. Outlook: Revenue CAGR of 60%

7.1 Management Guidance

FY27 Revenue Guidance: But as we have told in our various public forums, we expect 50% to 60% growth year-on-year.

Continuation of Guidance set for FY26

Capacity Goals: Vision of achieving 10 gigawatts (GW) of capacity by 2030 — confident of achieving the milestone earlier than the targeted date.

Independent Power Producer (IPP)

Target: 1 GW of capacity by September 2026

IPP segment (offers long-term annuity income) to contribute 25-30% of total revenue by 2030,.

Margins: 85-90% EBITDA margins.

Once 1 GW capacity is stabilized (by FY27/FY28) — expected to generate ~₹300 Cr in recurring revenue annually

Captive Power Producer (CPP/EPC)

Order-book grew to 1.96 GW in Q3 vs 1.60 GW in Q2 — at over ₹5,500 Cr.

Margins: 18-20% EBITDA margins.

Blended EBITDA margin to remain stable around 30-35%.

Sun Drop Energy (Subsidiary) & IPO Plans — in H1 of FY27

Sun Drop will function as a separate vertical focused on

Battery Energy Storage Systems (BESS)

smaller projects (under 35 MW) catering to MSME and retail clients,.

Sun Drop to achieve ₹500-600 Cr revenue in FY27 — EBITDA margins of 25-30%,.

International Expansion (Botswana)

Signed an MOU for 5 GW IPP project in Botswana — to commission 500 MW in the next 1 to 2 years

7.2 9M FY26 Performance vs FY26 Guidance

Revenue: On-track to deliver 60% growth

Margins: 9M-26 EBITDA at 36.3% — ahead of the 30-35% guidance given

60% growth of FY26 to carry over to FY27

8. Valuation Analysis

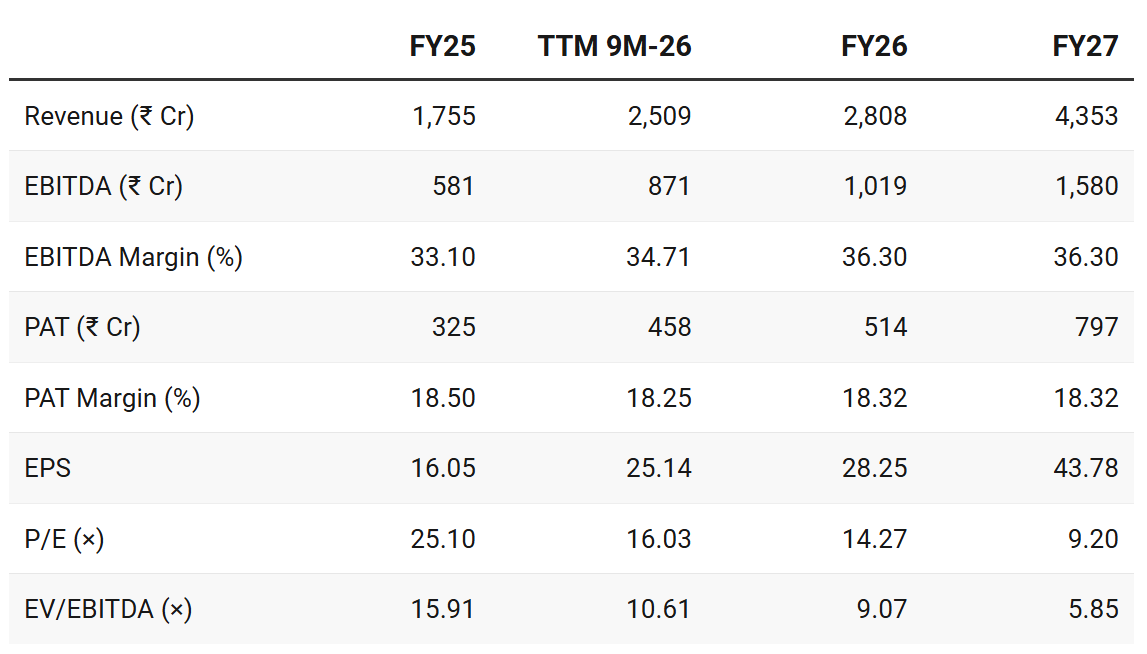

8.1 Valuation Snapshot – KPI Green Energy Ltd

Current Market Price = ₹403 | Market Cap = ₹7,932.4 Cr

Assuming 50-60% growth till FY27 with stable margins

Forward analysis restricted to FY27 as one needs to watch execution play out.

If growth plays out as per management guidance till FY30 — current valuations implies that KPIGREEN is available at throw away valuations

Valuations are attractive based on FY26 expected earnings

Market has not discounted FY26 and FY27 earnings

Past track record of diluting equity

Concerns on debt-equity as debt has risen the fund the growth

8.2 Opportunity at Current Valuation

Valuations: Markets are not discounting FY26 and FY27 execution

Creates opportunity of re-rating of valuations

Margin of safety: The forward valuations have a margin of safety to support one or two weak quarters

Sun Drop Energy (Subsidiary) & IPO Plans — Monetization potential not yet discounted

New Business Optionality: New business not considered in valuations till FY27. Beyond FY27 they could another axis of growth

Operations and Maintenance (O&M) Services

In-house O&M team manages its own IPP and CPP portfolios

KPIGREEN intends to leverage these capabilities to bid for and manage third-party O&M contracts in the future, turning this cost center into a revenue-generating service vertical

8.3 Risk at Current Valuation

Based on forward valuations — Markets does not believe the numbers and will not believe in it for a long period of time.

Disbelief in numbers is reflected in the stock price — its not going anywhere

Delivering 60% growth CAGR FY25-27 for any company is a challenge though the management is confident on delivering on it.

Conversion of profits to cash is a concern

Increase in receivables – customers haven’t paid

Profit is being used to build inventories

Quality of growth needs to be watched

Historically growth driven by equity dilutions

Growth fueled by increasing debts

High Execution Risk on Capital Expenditure

A power producer ties up a large amount of capital in projects not yet complete. These projects are not yet generating revenue. This situation poses a significant execution risk.

Execution-heavy: Lumpy EPC revenue; project delays (permits, monsoon, logistics) can disrupt growth.

IPP still scaling: Cash flows growing but still small vs EPC; full annuity benefits yet to kick in.

Sector risks: Policy changes (ALMM, grid, BCD) and state-level delays could impact timelines.

Previous coverage of KPIGREEN

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer