KPI Green Energy: Minimum 50-60% volume growth in FY24. At reasonable valuations

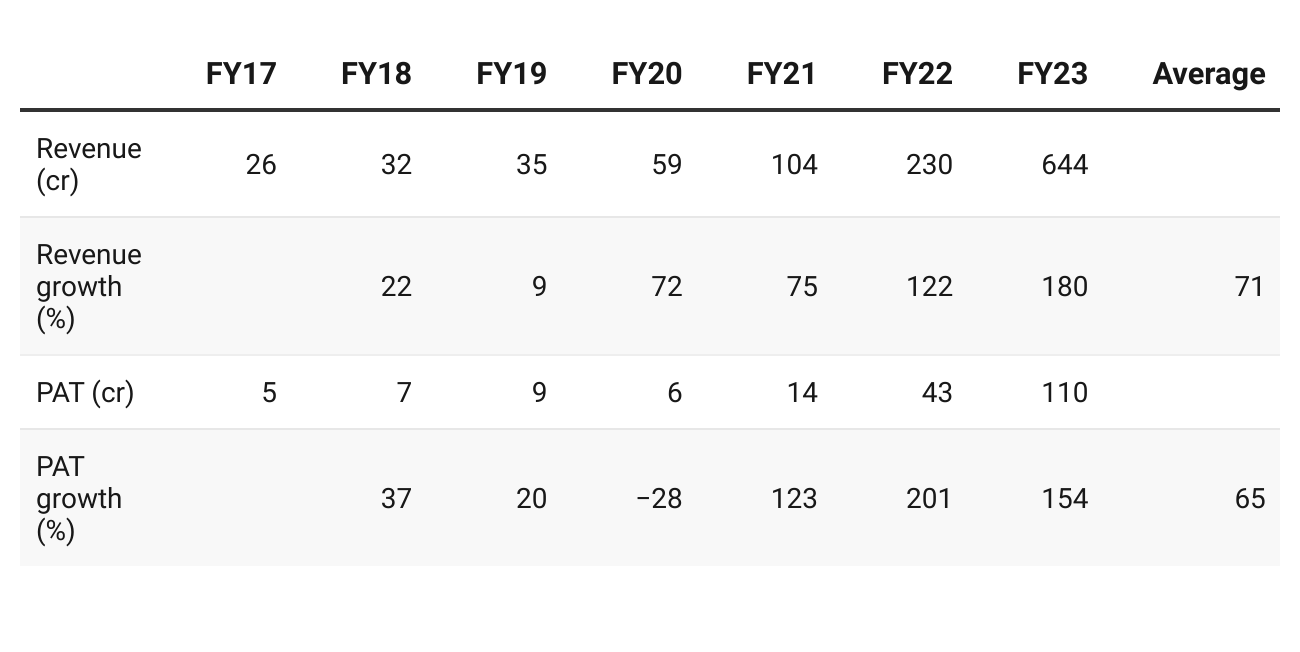

KPIGREEN has grown revenue at 71% CAGR and PAT at a CAGR of 65% in the last seven financial years FY17-23. Still its available at very reasonable valuations

1. Renewable power generating company in Gujarat

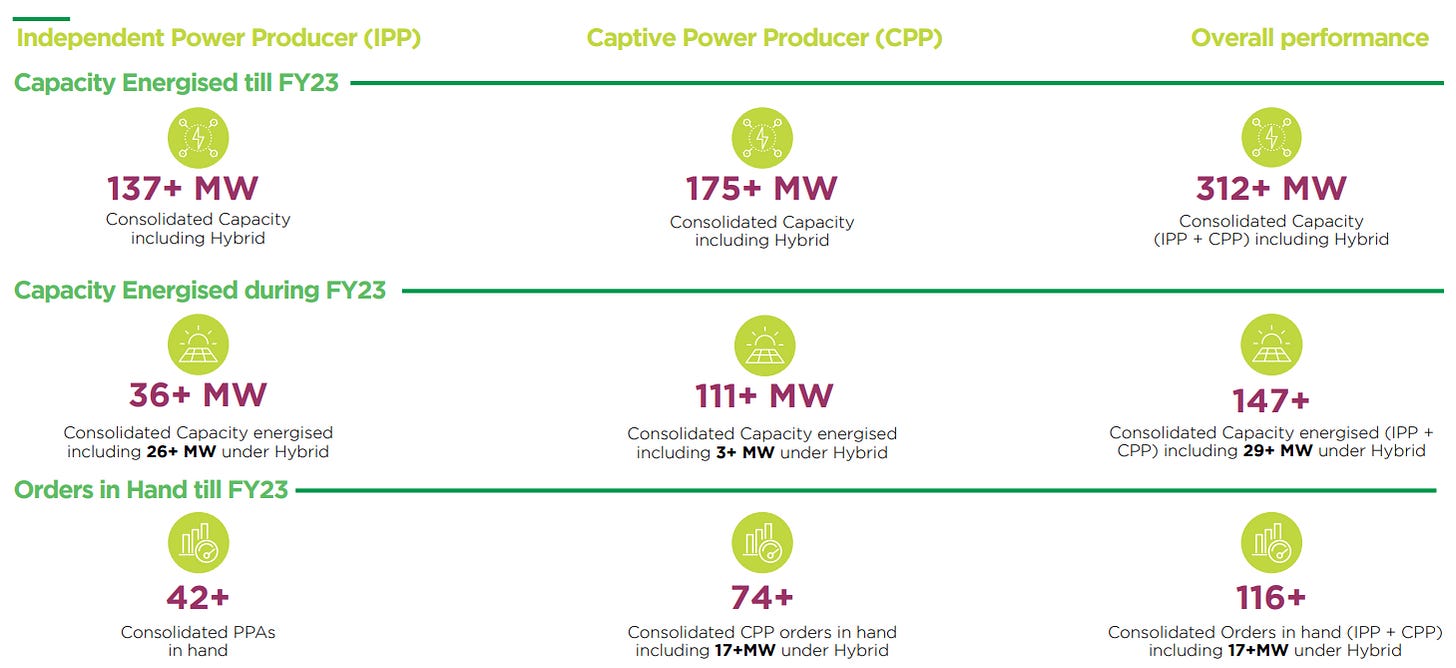

Generates and supply power as an IPP and CPP

kpigreenenergy.com | NSE: KPIGREEN

As an independent power producer (IPP), KPIGREEN generate revenue by supplying the power, generated from our solar power plants to reputed business houses through Power Purchase Agreements (PPA)

As captive power producer (CPP), generate revenue by selling Solar power project to customers to help companies save on electricity expenses as the cost per unit for captive plants is lower than that from DISCOM.

KPIGREEN also offers Operation and Maintenance Services (O&M) to its customers. This provides us with a long-term annuity stream of revenue.

2. Revenue CAGR= 71%, PAT CAGR= 65% for FY17-23

10.9X Revenue and 17X PAT in four years

KPIGREENS has grown year on year, every year for the last seven years

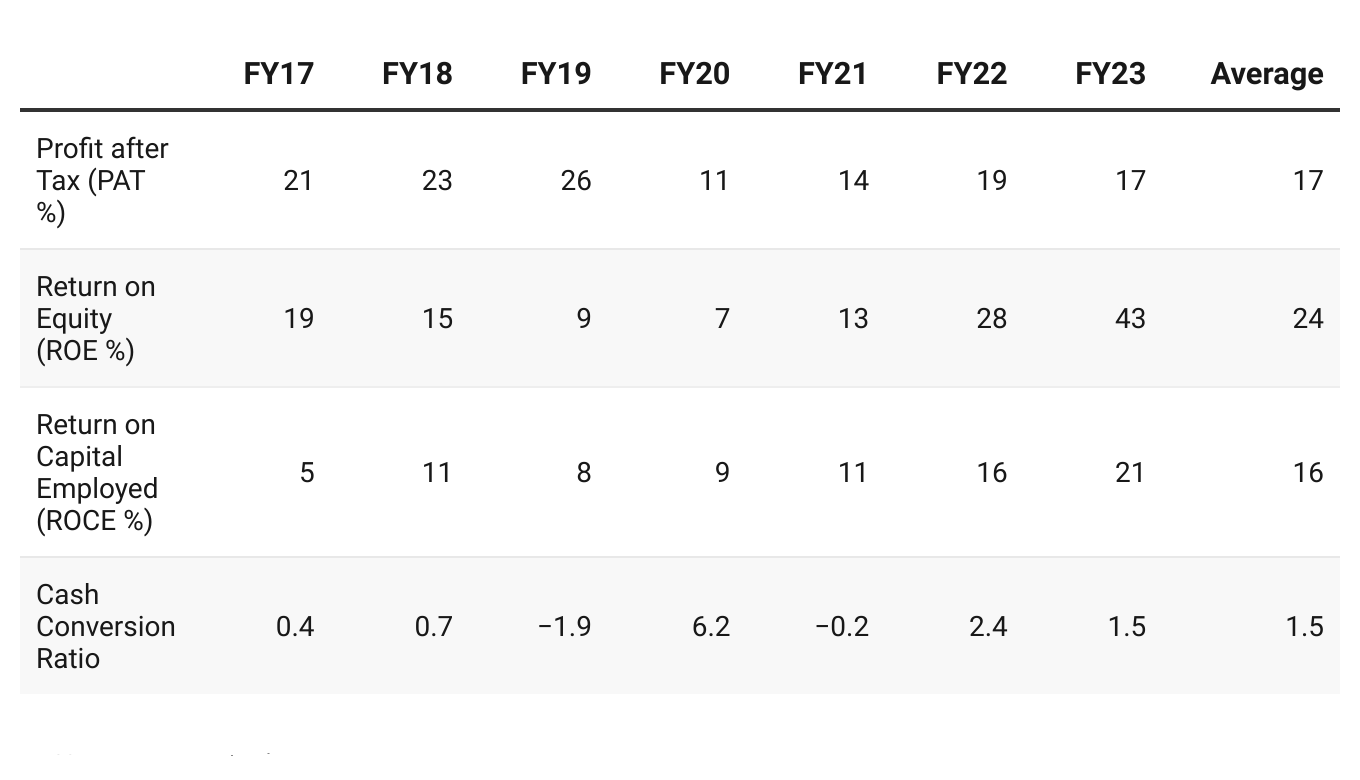

3. High quality growth, return ratios have improved

Return ratios are solid, consistent and improving over the last seven years. Most importantly returns are getting converted to cash.

4. Q1-24, the momentum continues

Revenue increased by 55% YoY

PAT increased 49% YoY

5. FY24: Strong guidance

i. Minimum 50%-60% growth in megawatt.

50% to 60% top line growth I'm talking about top line growth for the megawatt. I may add somewhere between 25 to 50 MW this year minimum. Going forward also we will add to that. As you are aware that now our target is that by 2025 we have to touch 1,000 MW that's 1 GW. So, accordingly we will match that. But on the conservative side, we will grow 50% to 60% overall. I am highlighting the minimum which we will be doing.

ii. IPP: 50% growth on the 14.7 cr units sold in FY23

So, our target is at least 22 crores unit.

ii. CPP, order book at .7X FY23 total KPIGREEN revenue

At present, I'm sitting on 425, 450 kind of order book in CPP itself.

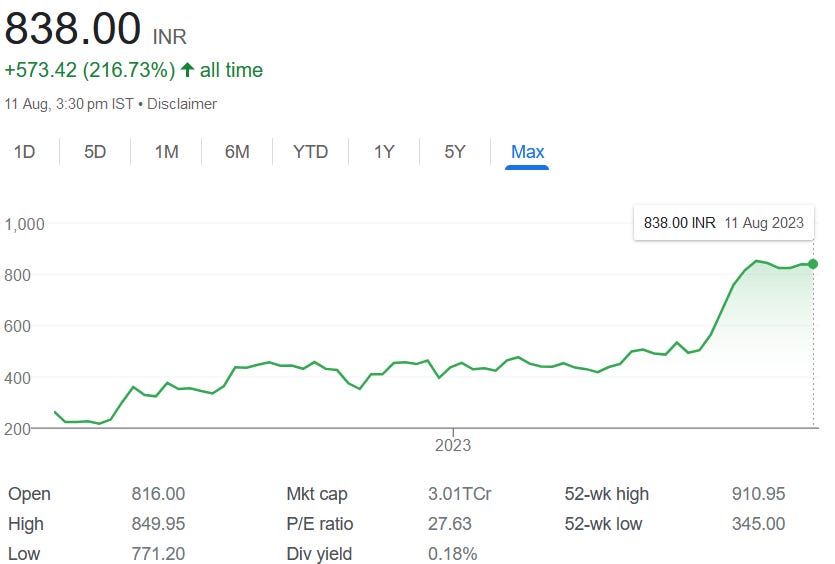

6. Min 50%-60% growth in megawatt, at a PE of 23

Valuations at a 23 PE (trailing twelve month), is very attractive considering a guidance of minimum 50-60% growth in megawatt delivered in FY25

The 23 PE(TTM) corresponds to and PE of around 28 on FY23 EPS.

7. So Wait and Watch

If I hold the stock then one must

Wait and watch for quarterly results to see if the company is on track to meet the 2025 target of 1000 MW

8. Join the ride

If I am looking to enter the stock then

Valuations are reasonable. PE of 23 for 50-60% growth guidance

This is story which plays out by FY25 i.e. 7 quarters away. So the upside should come quickly.

On the flip side the margin for error is small. One bad quarter in the seven remaining quarters to reach the FY25 target and the asking rate will become quite high.

Don’t like what you get every morning?

Let us know at hi@moneymuscle.in

Will send you better stuff.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades