KPI Green Energy: PAT growth of 52% & revenue growth of 59% in 9M-24 at a PE of 63

KPIGREEN has delivered QoQ growth in all the 3 quarters of FY24. Lot of headroom to grow in FY25. Orders in hand are 5X of execution in FY24

1. Renewable power generating company in Gujarat

Generates and supply power as an IPP and CPP

kpigreenenergy.com | NSE: KPIGREEN

2. FY17-23: Revenue CAGR of 71% & PAT CAGR of 65%

FY20-23: 10.9X Revenue & 17X PAT

3. Strong H1-24 : PAT up 57% & Revenue up 44% YoY

In comparison the H1 of FY22-23

the consolidated CPP Sales of H1 of FY23-24, grew 35% from INR 245.54 Crs to INR 330.87 Crs (H1 FY23-24)

while that under the Independent Power Producer (IPP) grew by 99% from INR 36.47 Crs to INR 72.38 Crs.

4. Strong Q3-24: PAT up 47% & Revenue up 84% YoY

5. Strong 9M-24: PAT up 52% & Revenue up 59% YoY

6. FY24 return ratios expected to be better than FY23

7. Outlook: Order book 5X+ FY24 expected execution

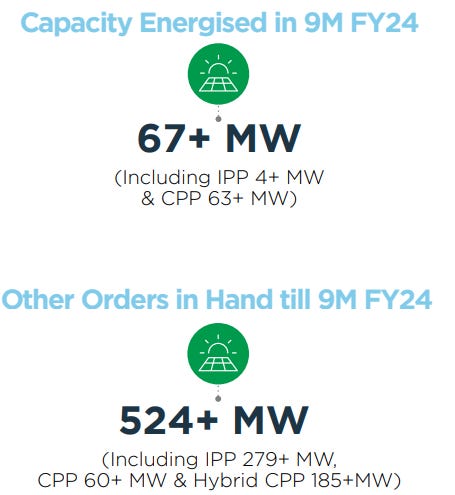

i. Order book at 524 MW

Order book at 524 MW as of Q3-24 end vs the 67 MW capacity energised in 9M-24. Assuming 90-100 MW capacity energised in FY24 based on 9M-24 run-rate, the visibility of the order book is 5 times the current run-rate.

8. PAT growth of 52% & revenue growth of 59% in 9M-24 at a PE of 63

9. So Wait and Watch

If I hold the stock then one may continue holding on to KPIGREEN

Coverage of KPIGREEN was initiated after Q1-24 results. The investment thesis has not changed after a strong 9M-24. After a solid Q3-24 confidence in the management is in place to deliver a strong FY24

KPIGREEN has grown both revenue and PAT sequentially on a QoQ basis for all the 3 quarters of 9M-24 and one needs to ride the business momentum.

One needs to watch out for the margin contraction seen Q3-24. Strong growth can cover up for the margins but this needs to be observed.

Strong order book is providing confidence of a strong FY25, though one needs to wait for management commentary for FY25.

10. Or, join the ride

If I am looking to enter KPIGREEN then

KPIGREEN has delivered PAT growth of 52% & Revenue growth of 59% in 9M-24 at a PE of 63 which makes valuations reasonable.

Strong revenue visibility based on orders at hand. Order book at 5X the FY24 execution. Order book creates opportunity for future upside in stock.

At a PE of 63 margin of safety is not high. One weak quarter and the impact would be clearly seen on the stock price.

Previous coverage of KPIGREEN

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Hi, I loved your analysis. One thing, PE is not 33 ... How did you derive the PE? Let me know if I'm missing something