KPI Green Energy: PAT growth of 99% & revenue growth of 83% in Q1-25 at a PE of 66

Guidance of earnings CAGR of 45-50% for the next 2-3 years. Strong revenue visibility based on orders in hand at 4X of execution in FY24

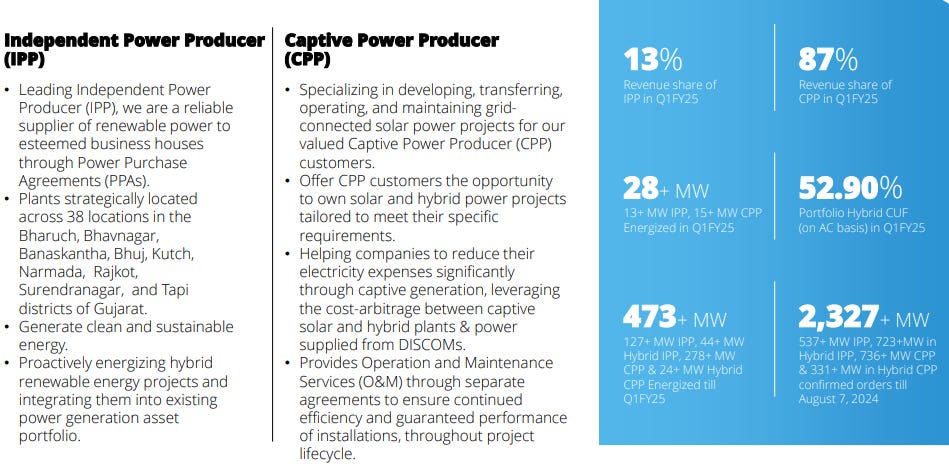

1. Renewable power generating company in Gujarat

kpigreenenergy.com | NSE: KPIGREEN

Business Segments

2. FY20-24: Revenue CAGR of 124% & PAT CAGR of 104%

3. Strong FY23: PAT up 154% & Revenue up 180% YoY

4. Strong FY24: PAT up 48% & Revenue up 59% YoY

5. Strong Q1-25: PAT up 99% & Revenue up 83% YoY

PAT up 53% & Revenue up 19% QoQ

Financial Highlights – All time high

6. Business metrics: Strong return ratios

Debt Management thru raising equity via QIP to manage debt to equity while interest coverage ratio has reduced.

7. Outlook: Earnings CAGR of 45-50%

i. FY24-26: Earnings CAGR of 45-50%

The management is confident of growing the earnings by 45-50% CAGR over next 2-3 years.

ii. FY25: Strong revenue visibility - Order book at 552 MW

A very strong o132 MW capacity energized in FY24. The visibility of the order book is 4 times the FY24 run-rate.

FY24 closing order book: The current order book in rupee terms is estimated to be at Rs 3,500-3,700 cr which is ~3.5x of its FY24 sales thus offering healthy revenue visibility in medium terms.

Capacity Energised in FY24: 132+ MW (Including 21+ MW IPP & CPP 111+ MW)

Installed Capacity in Q1FY25: 28+ MW (IPP 13+ MW CPP 15+ MW)

8. PAT growth of 99% & revenue growth of 83% in Q1-25 at a PE of 66

9. So Wait and Watch

If I hold the stock then one may continue holding on to KPIGREEN

Coverage of KPIGREEN was initiated after Q1-24 results. The investment thesis of strong earnings growth supported by an equally strong order book has not changed after a strong FY24 and equally strong Q1-25

Strong order book is providing confidence of a strong FY25 and providing revenue visibility and one can keep riding the business momentum as long as it lasts

10. Or, join the ride

If I am looking to enter KPIGREEN then

KPIGREEN has delivered PAT growth of 99% & Revenue growth of 83% in Q1-25 at a PE of 66 which makes valuations fully priced in the short term.

The outlook for earnings CAGR of 45-50% for the next 2-3 years provides the opportunity in KPIGREEN at PE of 66.

Strong revenue visibility based on orders at hand. Order book at 4X the FY24 execution. The order book creates confidence in the management outlook to deliver the growth in KPIGREEN.

At a PE of 66 margin of safety is not high. One weak quarter and the impact would be clearly seen on the stock price. Strong execution is needed to sustain valuations

Previous coverage of KPIGREEN

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer