Knowledge Marine & Engineering Works Ltd - Blow out performer

Limited yet excellent track record, exciting future outlook and available for a reasonable price

Company Overview

Knowledge Marine & Engineering Works Limited is an India-based company engaged in the business of owning, chartering/hiring along with manning, operation and technical maintenance of marine crafts, dredging and repairs/maintenance of marine crafts and marine infrastructure and allied works in India.

Knowledge Marine & Engineering Works Ltd started its business in the year 2015. Today, it is considered as an established player in the dredging and small-craft business segment in India. In the last 5 years, we have evolved from a small ship-repair unit to a dredging and ship-owning company.

Business segments:

Owning and Operating Marine Crafts

Dredging

Repairs and Maintenance / Refits of Marine Crafts and Marine Infrastructure

Knowledge Marine & Engineering Works Ltd has more than 120 employees.

Share Details

BOM:543273

Closing Price = 1,221 (16-Jun-23)

52 Week High = 1450. Trading at 22% below 52 wk high

52 Week Low = 260. Trading at 335% above 52 wk low.

P/E = 25

Market Cap = 1,221 cr ( ~$ 149 million)

Quality: Returns on capital employed in cash

Consistently high returns on capital are one sign we look for when seeking companies to invest in. On this front Knowledge Marine has delivered magnificently. We had to recheck our calculations multiple times as the numbers were unbelievable.

Growth

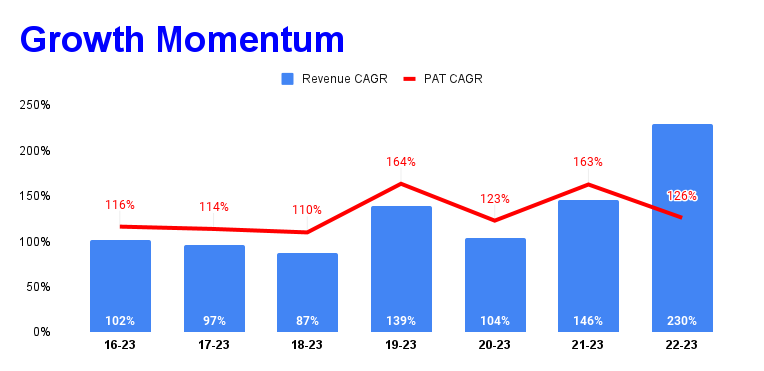

While high returns on capital are one sign we look another sign is a source of growth. High returns are not much use if the business is not able to grow and deploy more capital at these high rates. On the front of growth too then numbers are excellent. Eight financial years of excellent growth.

The growth momentum is not showing any sign of slowing down.

The slides below confirms that the company is very efficient in execution.

While the past looks exciting, we are still circumspect given that its a small company and may not maintain its excellent past performance as it grows bigger. Yet we would like to view the company favorably given the outlook provided by the management

Revenue and cash flow visibility due to long contract tenures > 2 years

Order Book & Visibility: the company has a balance contract of Rs 203 cr which we expect will get over in the next 2 years.

The company has expressed interest in projects worth ~Rs 1,100 cr and is claiming a order wining success ratio of more than 50% in the past

Bidding for only contracts with a target of minimum 30% EBITDA margin

So What????

If I own the stock, I will definitely hold on for the long term till the growth story plays out completely.

If I don’t own the stock, I would like to enter it. A company growing both the top line and bottom line at 100%+ CAGR for 8 financial years quoting at a PE of 25 is worth buying into. I would like to dip build a position in the stock over a period of time while keeping in mind the risk of investing in a small company. Its a penny stock after all.

Another issue that the retail investor may face is that the company listed on the BSE SME platform and currently has a lot size of 125 shares for 1 lot i.e. around Rs 1.5 lakh of investment as per the current market price. Retail investors may not have the risk appetite to enter a stock with a position size of Rs 1.5 lakh.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades