Kirloskar Oil Engines: Executing 2X-3Y strategy. Double revenue in 3 years. Double by FY25.

Based on FY23 and Q1-24, KOEL is on track to deliver on its strategy to double revenue to Rs 6,250 cr by FY25 with a double digit EBITDA

1. India's largest diesel genset manufacturers

kirloskaroilengines.com |NSE: KIRLOSENG

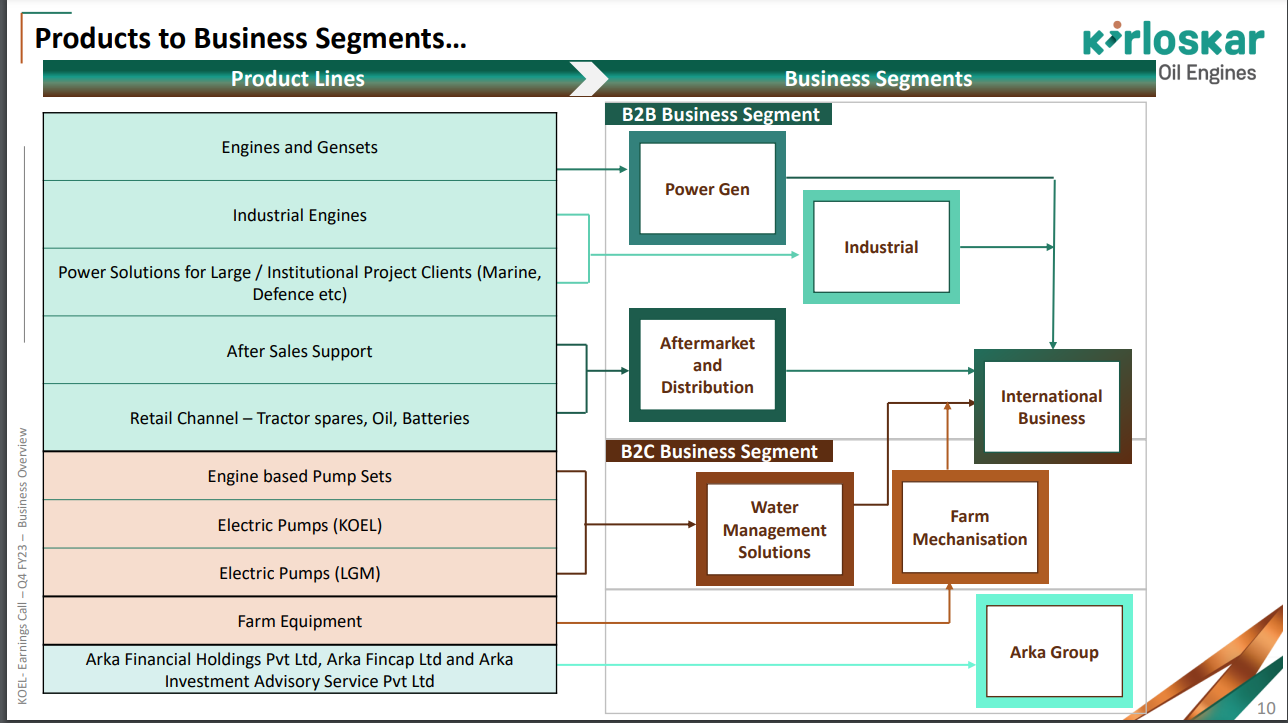

Kirloskar Oil Engines Limited (KOEL) is one of India’s largest engineering conglomerates. It is a leader in the manufacturing of diesel engines, farm equipment and generator sets with a sizable presence in international markets. It also manufactures world class diesel engines for construction equipment. It specialises in manufacturing air-cooled and liquid-cooled engines for diesel generator sets across a wide range of power outputs (2.1 kW to 5200 kVA).

KOEL is one of the leading genset players in India with lead market share in medium and large gensets

KOEL has diversified into the NBFC business through its subsidiary, Arka Financial Holdings (P.) Ltd.

2. KOEL is working on a 2X-3Y strategy

2X-3Y: Double FY22 revenue within 3 years

Revenue of Rs 6,500 cr with double digit EBITDA by FY25

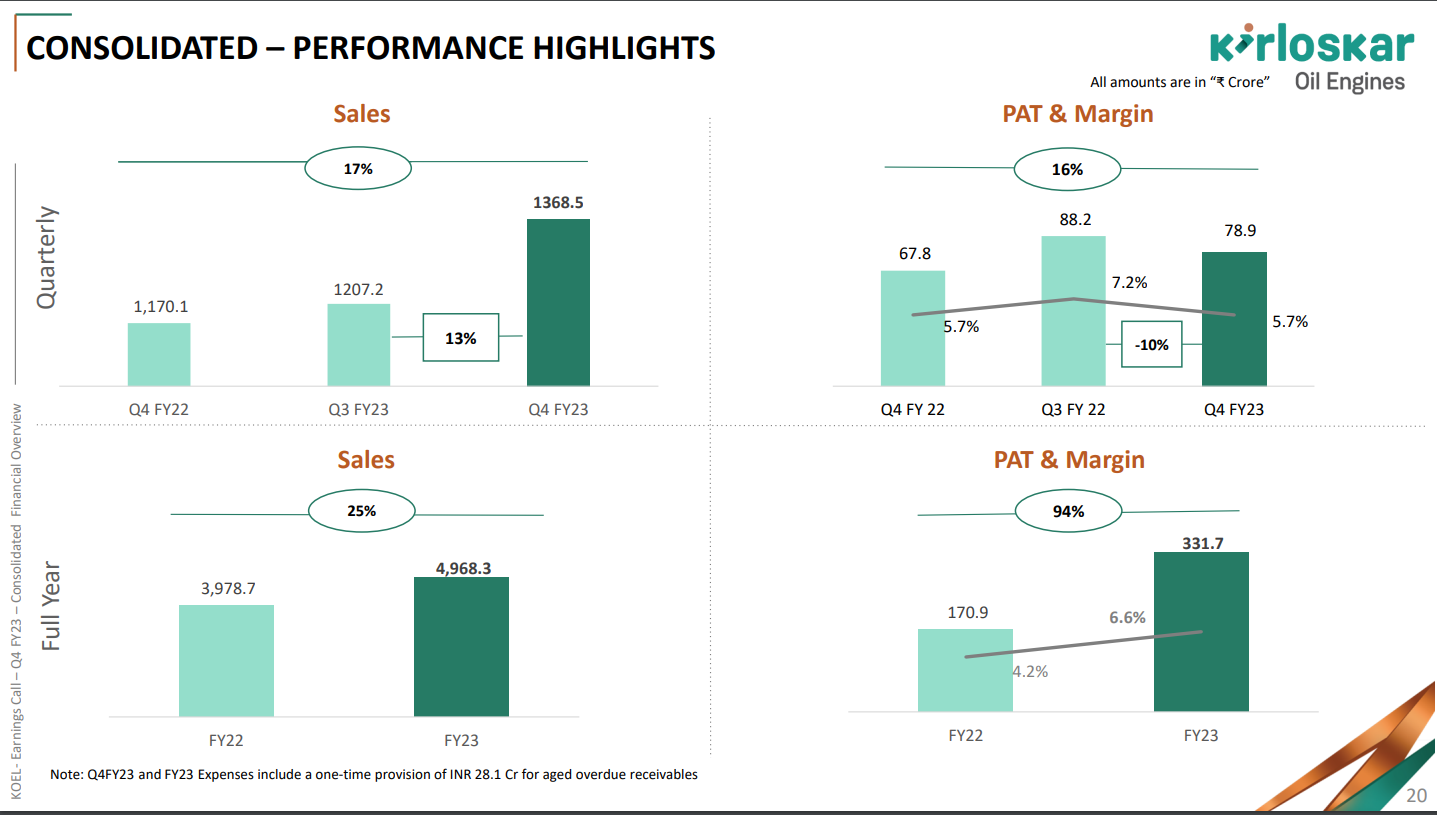

3. FY23: 25% revenue growth as per the 2X-3Y strategy

Confidence on the 2X-3Y strategy and progress.

The full year revenue from operations is INR5,024 crores, a 25% growth year-on-year. Net profit for the full year stood at INR332 crores, registering 94% growth on year-on-year. This reflects our efforts to improve profitability across all of our business segments.

4. Q1-24: 30% revenue ahead of the 2X-3Y run-rate

FY23 and Q1-24 PAT YoY growth ahead of revenue growth

Revenue from operations was Rs. 1,543.4 crores for the current quarter versus Rs. 1,191.4 crores for the same quarter last year, registering a 30% increase year-on-year. Net profit at Rs. 125.5 crores versus Rs. 82.1 crores for the same quarter last year generating a 53% increase year-on-year.

5. Q1-24: Strong performance beats FY24 guidance

On track to deliver on the 2X-3Y strategy

What I would definitely say is we are phasing out our execution in line with the 2X-3Y

Caution and optimism about Q2-24

I would say this quarter we continue to deliver a very strong performance. Our outlook for the quarter is cautious as well as optimistic as the strong prebuy demand is not expected to continue. However, we remain positive about the growth outlook due to our ability to expand our product portfolio and offerings to serve the customer needs across new geographies. These elements are pivotal to our 2X-3Y strategy and as a team, we are continuously working towards realizing these market opportunities.

7. 25% revenue CAGR growth till FY25 at a PE of 18

7. So Wait and Watch

If I hold the stock then one must hold on as KOEL is providing is providing visibility thru its 2X-3Y strategy till FY25. One needs to wait and watch for quarterly results to see if the company is on track to execute on their guidance till FY28. As of now the performance of FY23 and Q1-24 provide confidence that KOEL is on track to deliver on its KOEL strategy.

8. Look before you get in

If I am looking to enter the stock then

PE at 18 looks very reasonable for 25% revenue CAGR till FY25 with double digit EBITDA

Double digit expansion of EBITDA leading to PAT growing faster than revenue in FY23 and Q1-24. A PAT growing faster than the 25% revenue growth makes the PE of 18 look even more attractive

Q1-24 has grown at 30% YoY, faster than the asking rate providing a cushion for the remaining quarters of FY24.

There is a risk related to a history of disputes among the larger Kirloskar family which may have a negative impact on KOEL

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades