Kilburn Engineering: Q2 FY26 Results: PAT up 94%, On-track FY26 Guidance

Guidance of 50% growth in FY26. 20-25% revenue CAGR till FY28 with stable margins. Kilburn after a solid H1 FY26 is available at reasonable forward valuations

1. Manufactures Industrial Drying Systems & Thermal Processing Solutions

kilburnengg.com | BOM : 522101

Group Structure

A. Kilburn Engineering (Standalone) – Drying

Rotary Dryers, Paddle Dryers, Fluid Bed Dryers, Calciners, and Air Preheaters.

Conventional heat transfer (conduction/convection) to dry solids, liquids, & gases

~80% market share in Tea Dryers in India.

B. M.E. Energy (Subsidiary) – Waste Heat Recovery (WHR) Systems

Acquired in February 2024.

Waste Heat Recovery (WHR) systems, Thermal Oil Heaters, and Boilers.

C. Monga Strayfield Subsidiary) – Radio Frequency (RF) Drying Systems

Acquired in January 2025

Radio Frequency (RF) Dryers and Heaters.

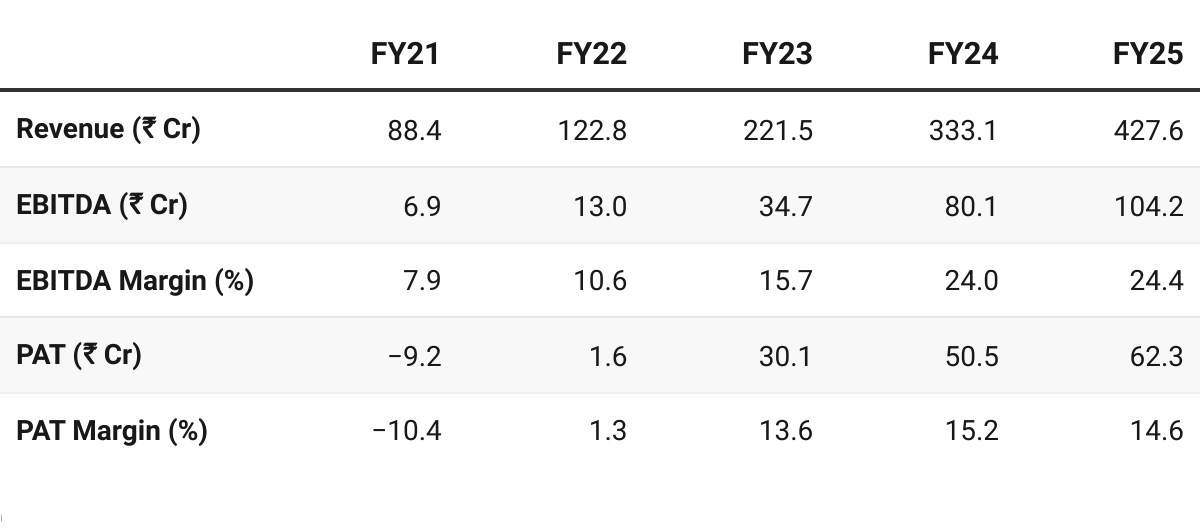

2. FY21–25: EBIDTA CAGR of 97% & Revenue CAGR of 48%

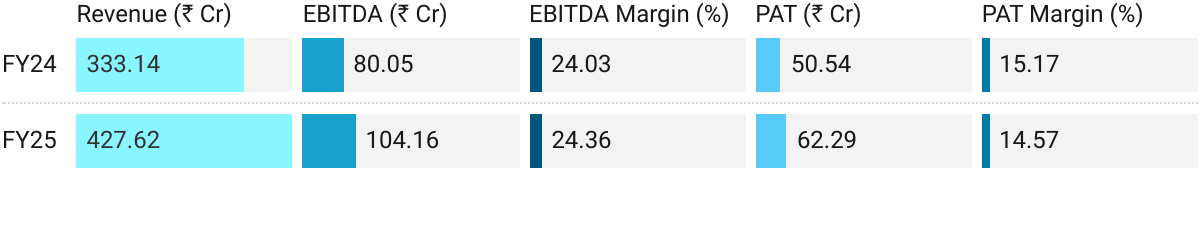

3. FY25: PAT up 23% & Revenue up 28% YoY

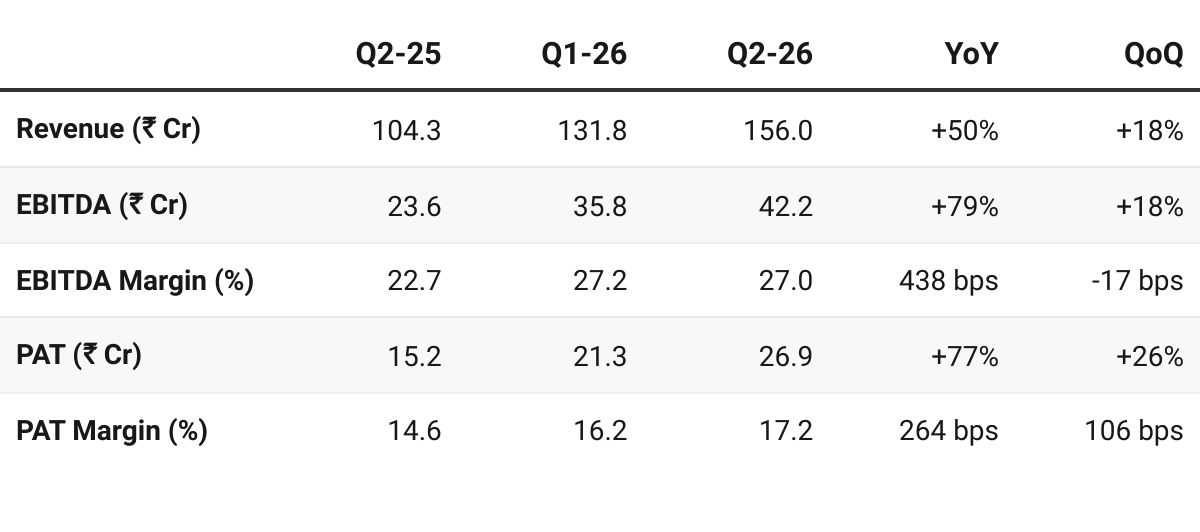

4. Q2 FY26: PAT up 77%, Revenue up 50% YoY

PAT up 26% & Revenue up 18% QoQ

Growth driven by the execution of order book and full integration of subsidiaries

Margin expansion due to operating leverage (scale of execution) and a favorable product mix including high-margin export orders.

Strong traction in both order inflows and execution.

Inquiry Pipeline is strong — ₹4,000 Crores across the group.

Capacity Expansion (CapEx):

Kilburn: Brownfield expansion in to support growth (Completion: Q2 FY27).

M.E. Energy: Phase 2 expansion planned to commence by end of next quarter.

Technology Partnerships — Komline-Sanderson (US) & NARA (Japan)

to enhance product offerings

open opportunities for global markets.

Working Capital:

Increase in receivables and negative cash flow from operations.

Management Explanation: Heavy dispatches occurring in September

Billing done but collections are due in subsequent months.

Management expects cash flow to normalize as these payments come in

5. H1 FY26: PAT up 88% & Revenue up 51% YoY

PAT up 36% & Revenue up 21% HoH

6. Business Metrics: Return Ratios Muted by Equity Expansion

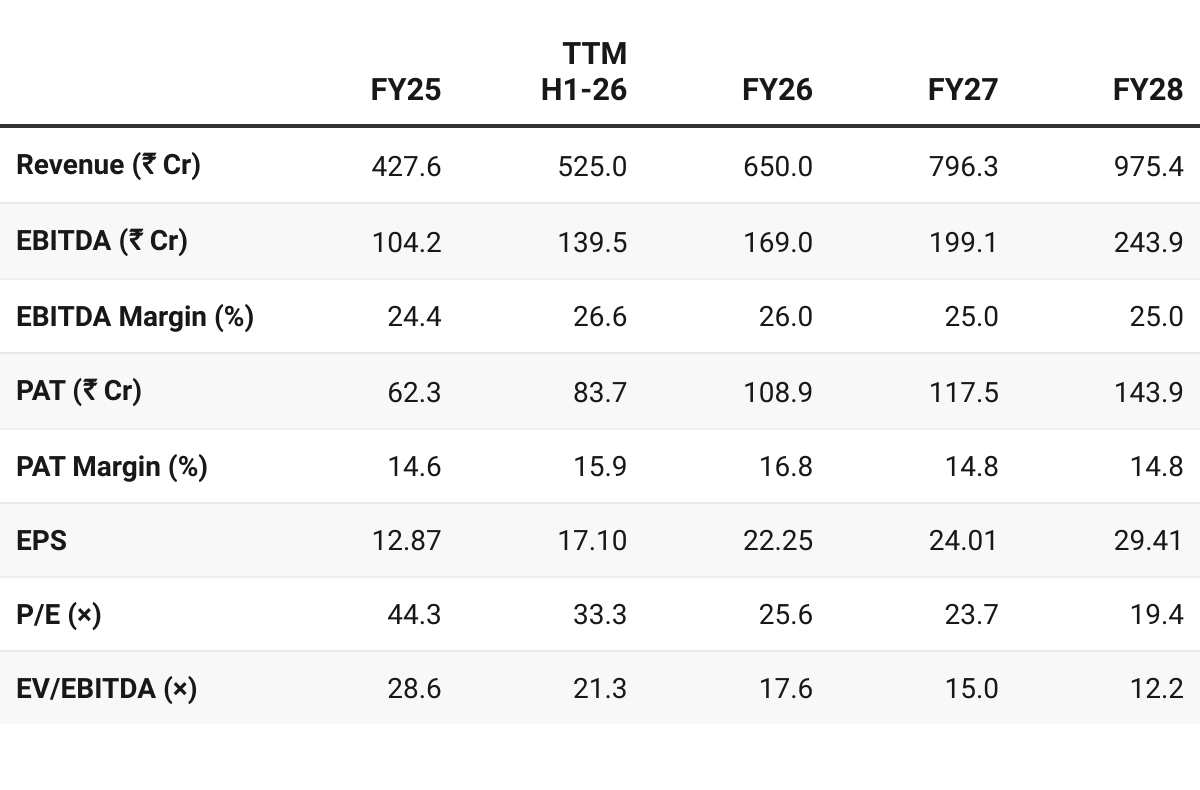

7. Outlook: 50% Revenue Growth in FY26

7.1 Guidance

We continue to maintain target of 50% growth in topline over the last year, which is approximately 650 crores. The current margin profile looks sustainable and we expect to close the year with EBITDA in the range of 26%. This of course is a result of a mix of orders and the scale of execution.

So next two to three years we expect a growth of around 25% CAGR.

EBITDA: I have mentioned around 26% would be for the current year, and next year, I would expect it to be in the range of 25%

Kilburn export share will go up. Earlier, it used to be around 15% of revenue. We believe this can now be 30 to 40% of the revenue.

So, when we are guiding for 20-25% topline growth on an organic manner, we will need the export opportunities to fructify to help us achieve that kind of pace, going forward, on a higher base

7.2 H1 FY26 vs FY26 Guidance — Kilburn Engineering

On-track FY26 guidance on Growth & Margins

Revenue:

H1-FY26 revenue at ₹287.77 Cr, up 51% YoY— 44.3% of the full-year target

Kilburn is project-based with back-ended execution in Q3 and Q4

Reaching 44% of guidance in H1 puts Kilburn on-track to meet ₹650 Cr target

Margins:

H1-FY26 27.1% EBITDA margin exceeds the guidance of 26%.

Improved margins are attributed

to operating leverage,

a better product mix (higher-margin export orders)

full integration of the highly profitable Monga Strayfield subsidiary (consolidated since Jan 2025).

Consolidated Order-book — ₹492.03 Cr (as of H1 FY26 end ):

Incremental Pipeline: Orders & LOIs worth ~₹129 Cr received between October as of 13-Nov-25 in Q3 FY26.

Total Visibility: ₹621 Cr

Order-book in place to support H2 targets.

Challenge is not demand, but execution

8. Valuation Analysis — Kilburn Engineering

8.1 Valuation Snapshot

CMP ₹570; Mcap ₹2,937.7 Cr;

Attractive Forward Valuation:

Valuations price in growth for FY26. Fully valued based on FY26 guidance

Opportunity starts emerging as revenue compounds at 20-25%.

Kilburn at 23.7× FY27 P/E & 15× FY27 EV/EBITDA is reasonable

8.2 Opportunity at Current Valuation

Longer-term opportunities

In-the short term all opportunities based on guidance are in the price.

The opportunities which exist will emerge based on FY27 and FY28 execution

Valuation analysis considers 2 years of 20-25% growth. If the momentum continues into FY29 — Kilburn will start looking quite attractive based on valuations

So next two to three years we expect a growth of around 25% CAGR.

Possibility of Inorganic growth: Current guidance of 20-25% growth is based on organic growth. While no acquisition opportunity currently exists, the possibility of such growth exists

KEL team is very much committed to the vision that we have set for ourselves for the next 3-4 years, including the target of 1,000 crores. And for that, we are working towards both, organic and inorganic growth

Valuation Re-rating — Export

Increasing exports from historical ~15% to 30-40% of revenue.

Catalysts:

OCP Morocco: Entry into the world’s largest phosphate producer opens a massive replacement market.

Tech Tie-ups: Allow Kilburn to manufacture global-standard equipment in India at lower costs.

Valuation Impact: Export-focused engineering companies typically command higher valuation multiples compared to purely domestic players

Expected by FY28 as revenue is closer to ₹1,000 Cr

8.3 Risk at Current Valuation

Priced for Perfection: Market has fully discounted FY26 and partially FY27 guidance. Any deviation from this trajectory poses significant downside risk.

Capacity Bottlenecks:

Demand is not the issue; supply is.

Capacity utilization is currently at 90-95%.

Kilburn is outsourcing 30-40% of turnover. If outsourcing partners fail on quality or delivery timelines, FY26 guidance will be in risk.

Brownfield expansion targeted for completion by March 2026 / Q2 FY27.

Delays in expansion could impact FY27/FY28 growth

Today, out of our total turnover, 30 to 40% is also outsourced or bought outs which come in.

Quality of earnings — weak

Receivables spiked. Negative cash flow from operations for H1 FY26.

While management indicates the situation will be managed — one needs to keep a watch on it

Share Dilution (Warrant Overhang)

Outstanding warrants will convert into equity by June 2026 — dilution to dampen EPS growth — a drag on stock price appreciation.

As Kilburn is open to more acquisitions — future equity dilutions could mute EPS growth

Help your group stay ahead. Share now!

Previous Coverage of Kilburn

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer