Kilburn Engineering: PAT growth of 68% & revenue growth of 49% in FY24 at a PE of 29

Guidance of 50% revenue growth in FY25. Order book of Rs 350 cr in place to support revenue of Rs 500 cr in FY25.

1. Drying solutions & customised process equipment

kilburnengg.com | BOM : 522101

Kilburn Engineering Limited (KEL) is engaged in the designing, manufacturing, and commissioning of customised equipment/systems for diverse applications in industries such as chemical, petrochemical, oil & gas, refineries, power, steel, cement, fertilizer, mining, sewage treatment, food, among others. It also manufactures specially designed packages required for various onshore and offshore applications.

Kilburn has completed the acquisition of 100% stake in M.E. Energy Private Limited on 20th February, 2024. The transaction is at a total consideration of ₹987 Million.

The company is engaged in designing, manufacturing, and installing waste heat reutilization systems solutions

Accordingly, M.E. Energy became a wholly owned subsidiary of the Company with effect from the above date.

2. FY20-24: PAT CAGR of 77% & Revenue CAGR of 26%

3. Strong FY23: PAT up 1843% & Revenue up 80% YoY

4. Strong 9M-24: PAT up 54% & Revenue up 34% YoY

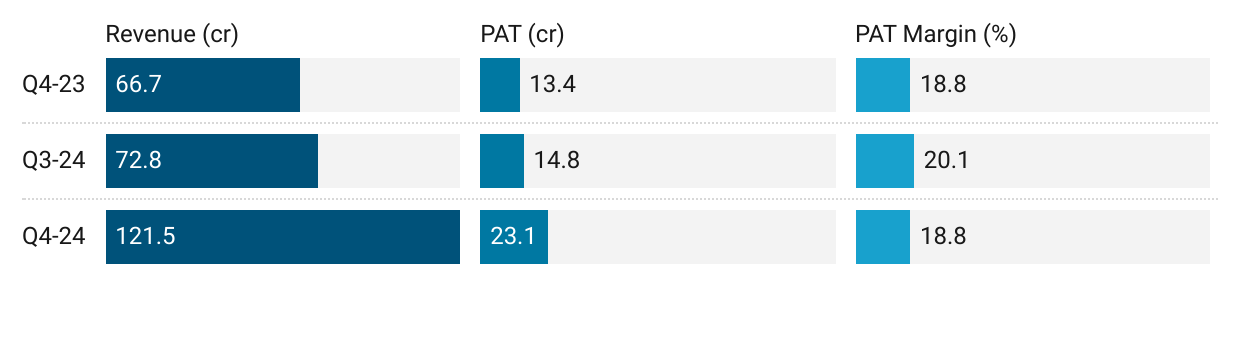

5. Strong Q4-24: PAT up 73% & Revenue up 82% YoY

PAT up 56% and Revenue up 67% QoQ

Impact of acquisition on Q4-24 results

M.E. Energy, the acquisition of this company by Kilburn was completed on 20th of Feb, 2024.

6. Strong FY24: PAT up 68% & Revenue up 49% YoY

7. Business metrics: Strong return ratios

The growth in turnover, EBITDA and PBT should continue resulting in higher free cashflows which should enable the company to become net debt free in the next 12 to 18 months

8. Outlook: 30% revenue CAGR in FY24

i. FY25: Revenue growth of 50%

From a consolidated revenue of Rs 333 cr in FY24 to Rs 500 cr in FY25 implies a revenue growth of 50%

For the financial year '24- '25, we are targeting a consolidated revenue of ₹500 crores

ii. EBITDA Margin of 20% in FY25

Guidance is lower than FY24 EBITDA & one needs to watch out for weakness in margins in FY25 impacting bottom-line growth.

Guidance: EBITDA of 20%

FY24: Achieved a robust operating EBITDA margins of 25.21% and 23.19% for the quarter & year ended respectively.

iii. Order-book providing revenue visibility for H1-25

Reduction in closing order book for FY24 as a trend needs to be watched closely. However, in the short term a consolidated closing order book of Rs 285 cr provides cushion for H1-25 execution. Rs 350 cr (285 + 65) orders in place to support revenue target of Rs 500 cr.

Our order book backlog as of 31st March at group level, that is both the companies together stand at ₹284 crores.

In the current financial year, we have received orders of ₹65 crores till date.

Current enquiry pipeline is in the range of ₹2,000 plus crores for both the companies together.

At the group level, we are targeting order intake of ₹500 crores plus

9. PAT growth of 68% & revenue growth of 49% in FY24 at a PE of 29

10. So Wait and Watch

If I hold the stock then one may continue holding on to Kilburn

Coverage of Kilburn was initiated after Q1-24 results. The investment thesis has not changed after a strong FY24. Increased confidence in the management to deliver as per FY25 guidance, given FY24 revenue was delivered as per guidance.

FY24: The revenue expected for Kilburn in the current financial year is expected to be in the range of ₹290 crores to ₹300 crores by the end of Q4 on a standalone basis. The revenue for M.E., which would be added to the KEL share post acquisition would be in the range of ₹30 crores.

The outlook is strong for FY25 and one can wait and see the execution play out.

Kilburn has grown both revenue and PAT sequentially on a QoQ basis for all the 4 quarters of FY24 and one needs to ride the business momentum.

Before FY23, Kilburn does not have a consistent track record of solid execution. One needs to monitor execution on its guidance quite closely as the management is guiding for strong upcoming years

Anticipate continued substantial revenue growth in the upcoming years, driven by a strong flow of orders and a pending order book.

11. Or, join the ride

If I am looking to enter the stock then

Kilburn has delivered PAT growth of 68% & Revenue growth of 49% in FY24 at a PE of 29 which makes valuations fairly priced in the short term.

Kilburn is guiding for revenue growth of 50% in FY24 to reach a revenue of Rs 500 cr at a PE of 29 which makes the valuations reasonable from medium term.

The order-book containing orders worth Rs 350 cr to be executed within the year covers 70% of the revenue guidance of Rs 500 cr in FY25, providing confidence on the ability of the management to deliver on the revenue guidance.

And when it comes to order to execution, I mentioned earlier also, it could be between four to six months, right up to 11 to 12 months.

Previous coverage of Kilburn

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer