Kilburn Engineering: 50% revenue CAGR till FY25, 35% growth in FY24 at a PE of 19

Anticipate continued substantial revenue growth in the upcoming years, driven by a strong flow of orders and a pending order book. Commitment to acquire ME Energy to add to the organic growth.

1. Manufacturer of drying equipment for various industries

kilburnengg.com | BOM : 522101

The Company is a market leader in solid, liquid and gas drying systems and provides a comprehensive package of solutions for tea, fertiliser, carbon black, soda ash, pharmaceuticals, dyes and pigments and specialty chemicals among other industries.

Commitment to acquire a 100% shareholding in M.E Energy Pvt Ltd

3-Oct-23: Kilburn Engineering Ltd. is delighted to announce its commitment to acquire a 100% shareholding in M.E Energy Pvt Ltd, a distinguished leader in waste heat recovery (WHR) and waste heat reutilization systems for an approximate consideration of INR. 99 crores. subject to due diligence.

2. FY21-23: Recovery in FY23, not a great recent past

Losses in FY21

Break even in FY22

Profitability in FY23

3. Strong FY23: 19x FY22 PAT & Revenue up 80% YoY

Consistent growth in top-line and bottom-line with healthy order inflows

Revenue growth of 80.45% over the previous year

Operating EBITDA margins at 15.65%

Order booking of Rs. 354 cr during the year resulting in a higher Order Backlog of Rs. 246 Crore as on 31.03.2023 , which will be executed during the next fiscal.

Net Debt position of Rs. 49 crs, a reduction of Rs.23 crs

4. Strong Q1-24: PAT up 145% and Revenue up 36% YoY

Consistent growth in topline and EBITDA due to a strong opening order book

Revenue growth of 36.36% over the corresponding previous quarter.

Operating EBITDA margins at 17.59% for the quarter an expansion of 750 bps due to economies of scale and better product mix.

Diversified Order Backlog of Rs. 213 Crore as on 30.06.2023 , which will be executed during the current fiscal.

Rs 32 Crs worth of orders received in the quarter.

Q1-24 Results are strong on a QoQ basis

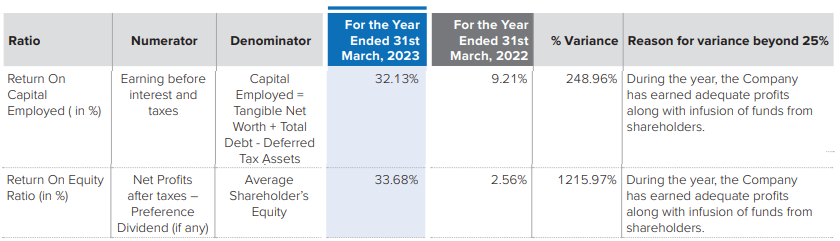

5. Business metrics: Return ratios improved significantly in FY23

The growth in turnover, EBITDA and PBT should continue resulting in higher free cashflows which should enable the company to become net debt free in the next 12 to 18 months

6. Outlook: 50% revenue CAGR till FY25

i. 35%+ revenue growth in FY24

Organic revenue of Rs 300+ cr in FY24 vs Rs 221.5 cr in FY23 implies at least 35% revenue growth in FY24

The full impact of the acquisition of ME Energy Pvt Ltd has not been considered for FY24 as the date on which the acquisition will be closed is not in place.

I would expect that this would give us turnover around ₹300 crores plus in the coming year.

ii. 50% revenue CAGR till FY26

Kilburn plans to achieve Rs 450-500 cr by FY25 or FY26 implies a 27-50% revenue CAGR. One can assume that the business momentum will continue and one can assume at least 35% organic growth of FY24 will continue till FY26.

Assuming the acquisition of ME Energy will be completed within FY24, one can easily assume that the endeavor of Rs 500 cr of revenue will be achieved by FY25 instead of FY26, translating into a revenue CAGR of 50%

What we endeavor is to reach a turnover of around, let's say, ₹450 crores to ₹500 crores in two to three years' time.

iii. Margin expansion

EBIDTA margin of 15-17% was 15.65% in FY22. EBITDA margin of 17.59% delivered in q1-23.

While Kilburn is claiming that the ME Energy transaction will amplify margins we are assuming that the previously indicated margins of 15-17% will be sustained.

We have got orders in the pipeline which have a good margin. So going ahead, we endeavor to keep this margin of around 15% to 17% of EBITDA margin, continue with this type of margins.

Additionally, the transaction is poised to yield cost efficiencies, trimming overheads and amplifying margins at a consolidated level

iv. Order-book 1.5X FY23 revenue

Rs 102 cr orders received in H1-24 vs Rs 246 cr opening order book for FY24

ME Energy order book to add to the order book of Kilburn

Ideally what happens is along with the orders in hand as on 1st April and what we receive in the first four to five months that is what we go ahead and execute during the year.

With regard to the order book, M.E Energy initiated the year with an order backlog of Rs. 50 crores and has since secured orders amounting to Rs. 68 crores year-to-date.

7. 50% revenue CAGR till FY25 at a PE of 19

8. So Wait and Watch

If I hold the stock then one may continue holding on to Kilburn

Clear outlook for 35% revenue CAGR in FY24.

Order book up from Rs 212 cr as of Q1-24 end to Rs 325 cr as of Q2-24 end

Kilburn business is turning around from FY21 and there is a roadmap for growth to Rs 500 cr which will play out by FY25 or FY26 without capex

With the current setup and the current capacity, we can easily touch around ₹400 plus crores, ₹450 crores to ₹500 crores.

Assuming the due diligence goes through smoothly, one can assuming that the ME Energy acquisition will be earnings accretive from FY25 onwards

Kilburn will capitalize on ME Energy's infrastructure, bolstering capacity and revenue streams for both firms. Additionally, the transaction is poised to yield cost efficiencies, trimming overheads and amplifying margins at a consolidated level

Kilburn does not have a consistent track record of solid execution. One needs to monitor execution on its guidance quite closely.

9. Or, join the ride

If I am looking to enter the stock then

Kilburn is guiding for 35% organic revenue CAGR till FY25 at PE of 19 which makes the valuations quite reasonable.

Adding inorganic growth to Kilburn which takes the total revenue CAGR to 50% till FY25 at a PE of 19 which makes the valuations look attractive.

Kilburn has grown its order book by 47% from Q1-24 end to Q2-24 end which gives confidence in its ability to deliver on its revenue guidance.

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades