Kaveri Seed: PAT growth of 14% & Revenue growth of 6% in H1-24 at a PE of 12

KSCL guiding for 10-12% top-line & 12-15% bottom-line growth for the next 3-5 years, with possibility of inorganic growth. Free cash flow yield of 5% as of H1-24 makes valuations quite attractive

1. Seed production company

kaveriseeds.in | NSE : KSCL

Business Segments

But what we see in the next 3 years, vegetable business is definitely going to grow by more than 25%, 30% year-on-year. And still, we see that it has a potential to grow up to close to INR150 crore to INR200 crore in the next 5 to 8 years. And this is a crop where we have high margins.

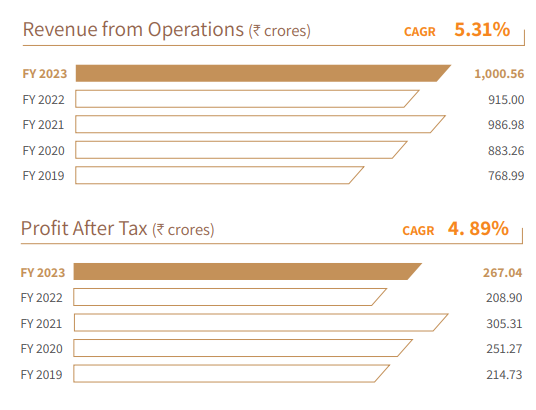

2. FY19-23: Track record of tepid long term growth

3. Strong FY23: PAT up 27% & Revenue up 9% YoY

4. Q1-24: PAT up 13% & Revenue up 8% YoY

5. Q2-24: PAT up 156% & Revenue up 3% YoY

6. H1-24: PAT up 14% & Revenue up 6% YoY

7. Business Metrics: Return ratios are strong irrespective of the tepid growth

8. Outlook: PAT CAGR of 12-15% for next 2-3 years

i. FY24: Top-line growth of 10-12%

we see a projection of 10% to 12% as a top line growth

ii PAT CAGR of 12-15% for next 2-3 years

9. PAT growth of 14% & Revenue growth of 6% in H1-24 at a PE of 12

10. So Wait and Watch

If I hold the stock then one may continue holding on to KSCL

Based on H1-24 performance, KSCL looks on track to deliver the strongest top-line and bottom line performance in FY24. It looks on-track to beat or at least reach closest to its highest PAT of Rs 305 cr, achieved in FY21

KSCL looks on track to meet is 10-12% top-line and 12-15% bottom-line guidance for FY24

Positive outlook of the KSCL management for the next 3-5 years

Even in fact, we said that 10% to 12% in the top line and 15% to 20% in the bottom line growth. That should be what we are anticipating, and that should continue. And we are very bullish on the longterm growth, as well for the next midterm for the next 3 to 5 years, we will see this level of growth.

11. Or, join the ride

If I am looking to enter KSCL then

For a PAT growth of 14% and revenue growth of 6% in H1-24, KSCL at a PE of 12 is reasonably priced.

For an outlook of 12-15% PAT growth for the next 3-5 years a PE of 12 also makes valuations quite reasonable.

KSCL had Rs 732 cr of cash on books as of end of Q2-24 implies that 20% of market cap is in cash which provides a margin of safety in the valuations.-+

Cash and books stood at Rs. 732 core

Possibility of inorganic growth (KSCL has the cash for it) on top of the outlook of 12-15% PAT growth at a PE of 12 can make the valuations attractive

We are open for acquisition. In the previous, as you were not able to find any growth, we have given dividend or buyback. So, again, based on the current scenario, we'll see whether we need to go for the buyback or based on the opportunity we need to acquire a company.

KSCL delivered Rs 189 cr of free cash flow against a market cap of Rs 3640 cr. As of H1-24 end it is available on a free cash flow yield of 5.0% (not annualized) which makes the valuations quite attractive.

KSCL has a track record of rewarding shareholders

So we're a dividend paying company for the last 15 years since the time of listing and we have done buybacks in the last 5 years. If you see the cash in hand numbers in the last five years from 2014 to '15, it’s between INR300 crore to INR400 crore or INR500 crore of cash. And whatever we have generated, we have distributed that to the shareholders, whatever free cash we generated. So that should be our policy going forward.

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

Perspectives may change based on evolving understanding of the company.

Focus is on identifying potential stock ideas for long-term market-beating returns.

Content does not constitute explicit stock recommendations.

Investors should conduct thorough stock research and seek professional advice.

Information is for educational purposes and not financial advice or a call to action