Jyoti Resins and Adhesives - Growth or illusion?

Good volume growth but lower than top-line growth.on account of loyalty program

Company Overview

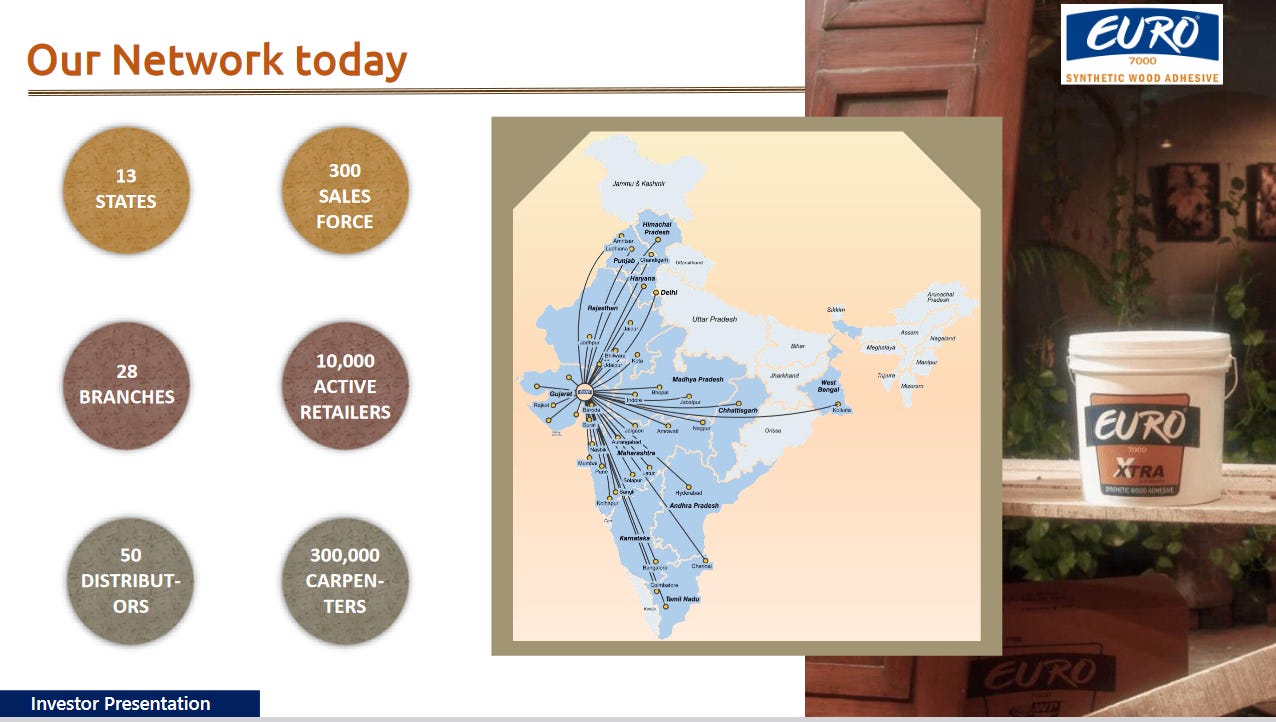

Jyoti Resins and Adhesives Ltd is a manufacturer of synthetic resin adhesives. The Company manufactures various types of wood adhesives (white glue) under the brand name of EURO 7000. Euro 7000 is the second largest selling wood adhesive (white glue) brand in India in the retail segment.

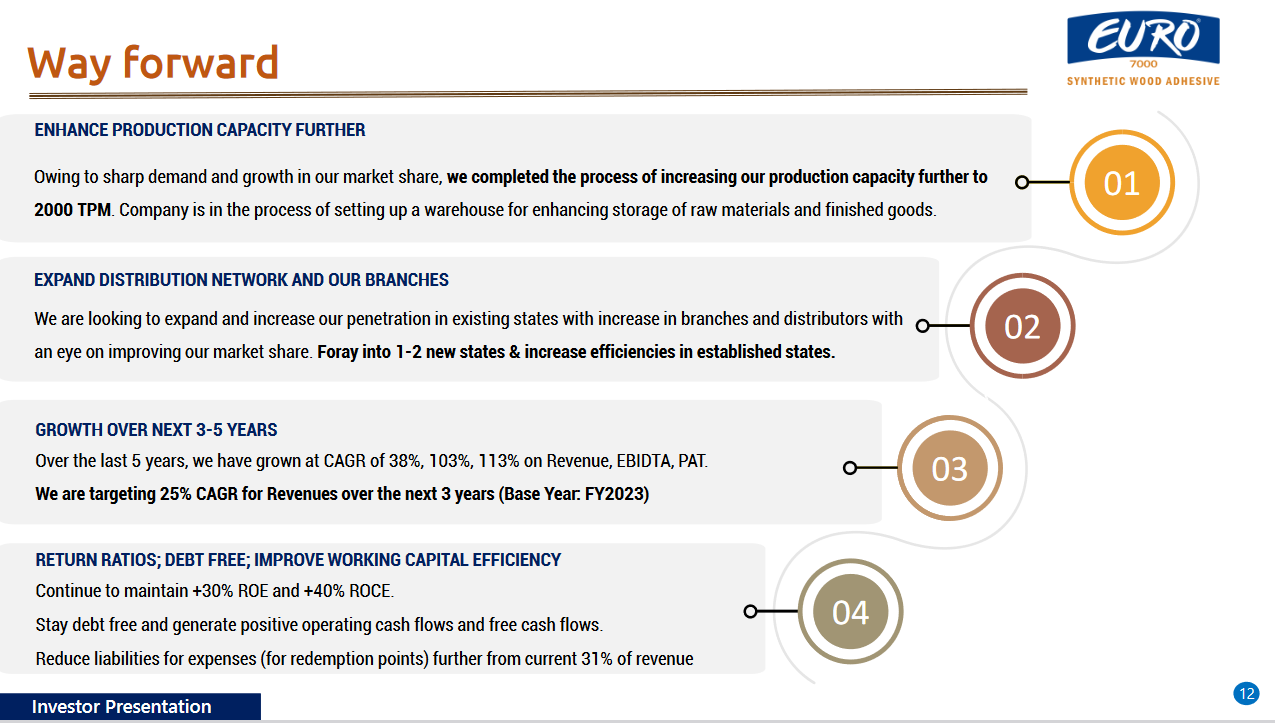

It has a manufacturing plant at Santej, Ahmedabad with a capacity of 2000 TPM (24,000 TPA).

Share Details

BOM:514448 ( euro7000.com)

Quality: Returns on capital employed in cash

Return ratios are quite good but cash conversion is quite poor for a retail business. A retail business should generate cash and can be seen as a point to keep in mind.

Growth

Growth numbers are excellent but they need to be analyzed in conjunction with the loyalty program being run with carpenters

We also have an efficient carpenter reward model system, which is nothing else but a loyalty program for our carpenters who get points when they purchase any drum, any bucket or any of the packets.

Financial liabilities, which are the liabilities for expenses with respect to the buyer schemes, which is nothing else, but an accumulation of the dealer/carpenter reward program. This used to be 91% of revenues in FY '21, came down gradually to 46% of revenues in FY '22 and is now down to 32% of revenue in FY '23, and we aim to take it to 25% in the coming years.

Whenever any carpenters are -- let's say buying Rs. 100 worth of goods, right, and Rs. 10 is the points accumulated on that purchase, what goes to your revenue is Rs. 90. What goes to your liability for expenses is Rs. 10. And as and when this points are redeemed, this Rs. 10 gets added back to revenue as well as it gets added to your expenses.

Discussion on carpenter rewards in Q4-23 earnings call

As points are getting redeemed, in the above example Rs 10 gets added to the revenue so is it inflating the accounting revenue with the real revenue?

In terms of volume, we have grown at 27.5% for the year.

Volume growth is lower than the revenue growth which implies that redemption is inflating top-line growth. Hence we need to track volume growth. Impact of redemption is not being clarified by the management

Growth Momentum

The revenue growth momentum is high but we can ignore it as it seems inflated with redemption. The PAT growth momentum is high but its not converting to cash.

Outlook

We are planning to grow with 25% of growth volume base and margin we are comfortable with 22% to 23% of EBITDA margin.

Given the redemption being added to the top-line it is good that the company is giving guidance in terms of volume growth. A 25% volume growth for the next 3 years is a solid guidance.

While looking at the outlook is nice, it is also good not to forget the past.

So What????

If I currently hold the stock, I may continue holding it based on my past returns, expectations for future returns, and the availability of alternative stock ideas. We should watch out for the company delivering on 25% volume growth guidance and not look too much into revenue growth.

If I don't currently own the stock, I may not want to enter it.

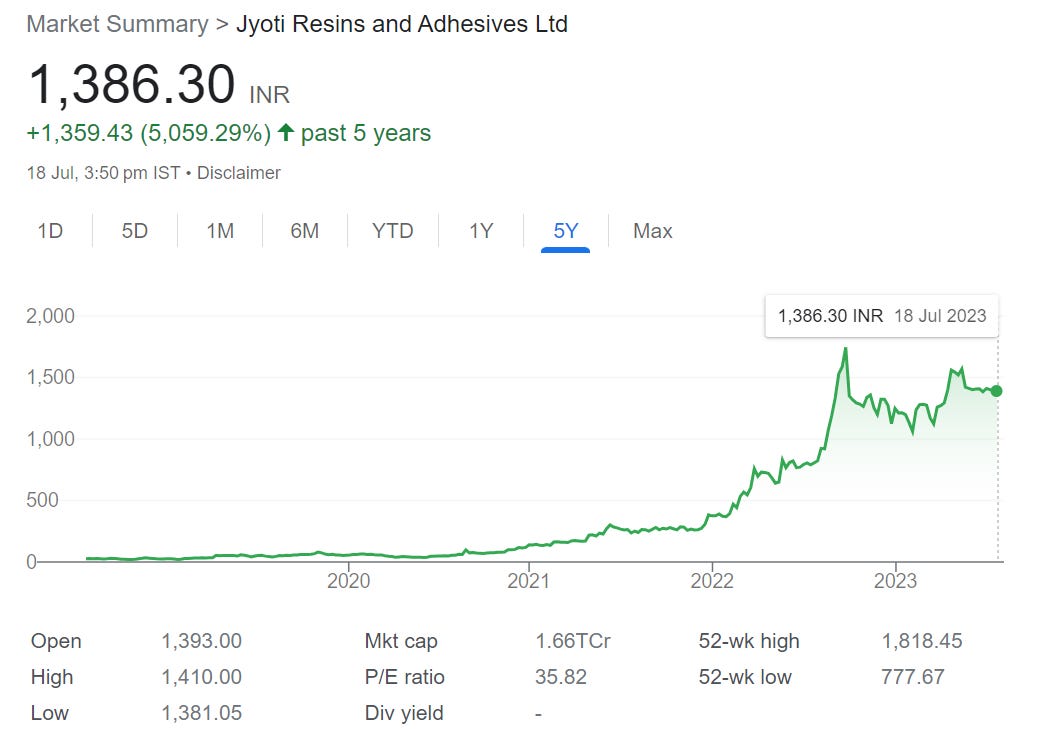

Its expensive at a PE of 36, promising volume growth of 25%.

Return ratios being promised are great but, for a retail business it is not generating cash. The cash conversion is poor.

I am not clear about the impact of the illusion of growth due addition of redemption values to the revenue in the absence of clarity from the management.

Promoter history

Even if we ignore everything, PE of 36 for 25% volume growth and absence of cash generation is enough to take a view on the stock.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades