Jupiter Wagons: Order book 3X FY23 revenue, to be executed in 18 months, outlook for 85% revenue growth in FY24

A very strong outlook in FY24 as well as in the coming years. Jupiter Wagons is bullish on it current trajectory as it continues to scale various business lines as planned.

1. One of the largest player in India’s Railway sector

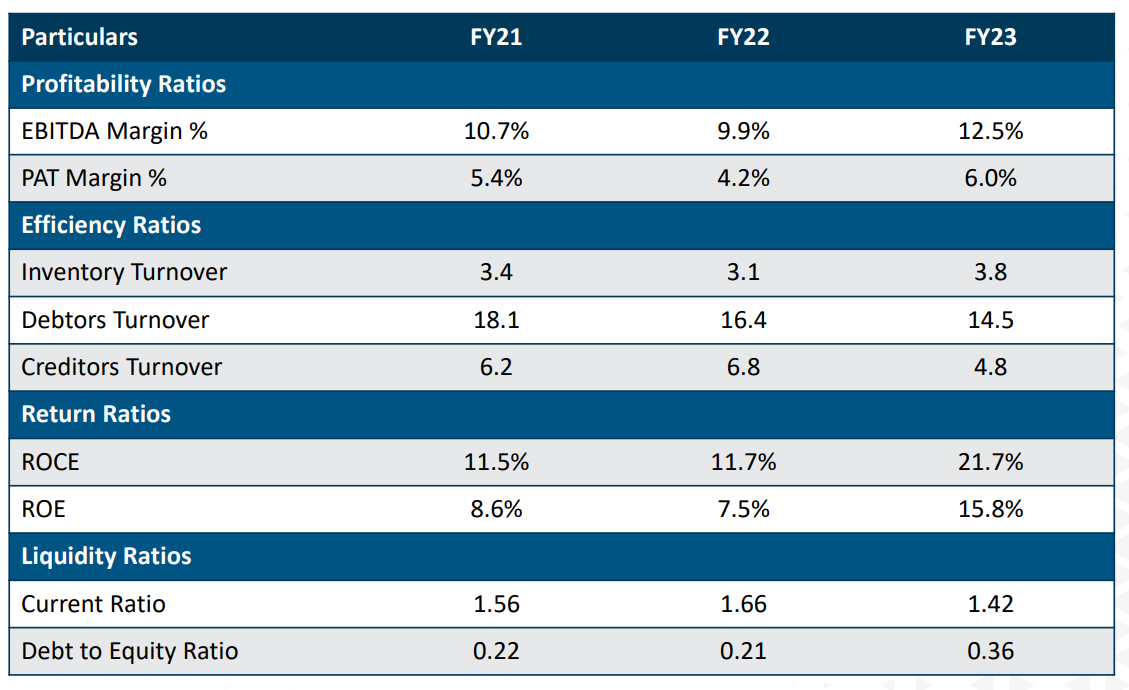

2. Solid growth since FY21: 50%+ CAGR growth in PAT

3. JWL an efficiently run company

Net of cash is that we are a net zero debt company.

4. Q1-24: The good performance continues

Due to an improved product mix and the introduction of value-added products, we reported an EBITDA margin of 13.2%, representing an expansion of 260 bps YoY.

5. Outlook: Revenue growth of 85%+ in FY24 on the back of strong wagons demand & new products

i. Order book 3X of FY23 revenue and growing

Order Book of Rs. 6,12,230 lakh as on June 30, 2023

Order Book of Rs. 5,81,836 lakh as on March 31, 2023

Order Book of Rs. 5,70,283 Lakh as on Dec 31, 2022

ii. Expecting top-line growth of 85%+ in FY24

Order book of Rs 5,818 cr on 31-Mar-23 to be executed in 18 months, implies a revenue of Rs 3,800 cr+ top-line in FY24 i.e. a 85%+ growth.

Q1-24 growth of 100%+ ensures that the asking rate for the remaining quarters of FY24 is under control.

We are looking to execute it over the next 18 months.

iii. Demand momentum for wagons to continue till FY25

The Freight Wagons Business continues to enjoy high visibility. This is expected to sustain there remains significant momentum from private customers, which is expected to continue for the next couple of years.

iv. Demand driving capex = 1.5X capacity for wagons by FY25

Growth driven by wagons, Q1-24 capacity of around 570 wagons per month (1713/3) to be increased to 1000 by FY24 end

We expect to reach a capacity of close to 800 wagons per month. And by next year, we are looking to manufacture about 1,000 wagons per month.

v. Brake Disc: New addition to bottom-line in FY24:

Joint Venture with Kovis of Slovenia – JWL Kovis India Pvt. Ltd. will add to the bottom-line as it generates initial revenues in FY23-24

The Brake Disc business is expected to generate initial revenues in FY23-24 as orders have already been received and execution has commenced. The Company expects to further scale up order bookings and aims to generate annual revenues of Rs. 250-300 crore, within two years of commencement of this business, with equal contribution from domestic and export markets.

vi. Weldable CMS Crossings: New addition to bottom-line in FY24:

Joint Venture with Talegria of Spain – JWL Talegria India Pvt Ltd manufacturing of Weldable CMS Crossings

Will start commercial production from Q3 of FY23-24

Set to rollout a pilot batch in Q2

Strong levels of order booking are anticipated over next 18 months

6. Outlook for 85%+ growth in FY24 at a PE of 61(ttm)

7. So Wait and Watch

If I hold the stock then one must wait and watch for quarterly results to see if the company is on track to execute its order book in the next 18 months from Q4=24 end. Its not a long wait as is only five more quarters away and. First quarter of the 6 quarters (18 months) has been excellent and JWL looks to be on track to meet the asking rate

8. Join the ride

If I am looking to enter the stock then

Valuations are priced to perfection. PE of 61 for 85%+ revenue growth expectation

This is story which plays out by 18 months starting FY24 i.e. 5 quarters away. So the upside should come quickly.

On the flip side the margin for error is small. One bad quarter in the five remaining quarters and the asking rate will become quite high. At a PE of 61, the stock can become quite expensive quite quickly

Positions need to be built over time over bad days when the stock is not doing well.

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will send you better stuff.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades