JK Paper: 39% growth in EPS at a PE of 5 and a free cash flow yield of 23%

Possibility of a PE re-rating at JKPAPER, driven by attractive valuations and the full impact of acquisitions made in Dec-22. Presents an opportunity for multi-bagger returns in the stock

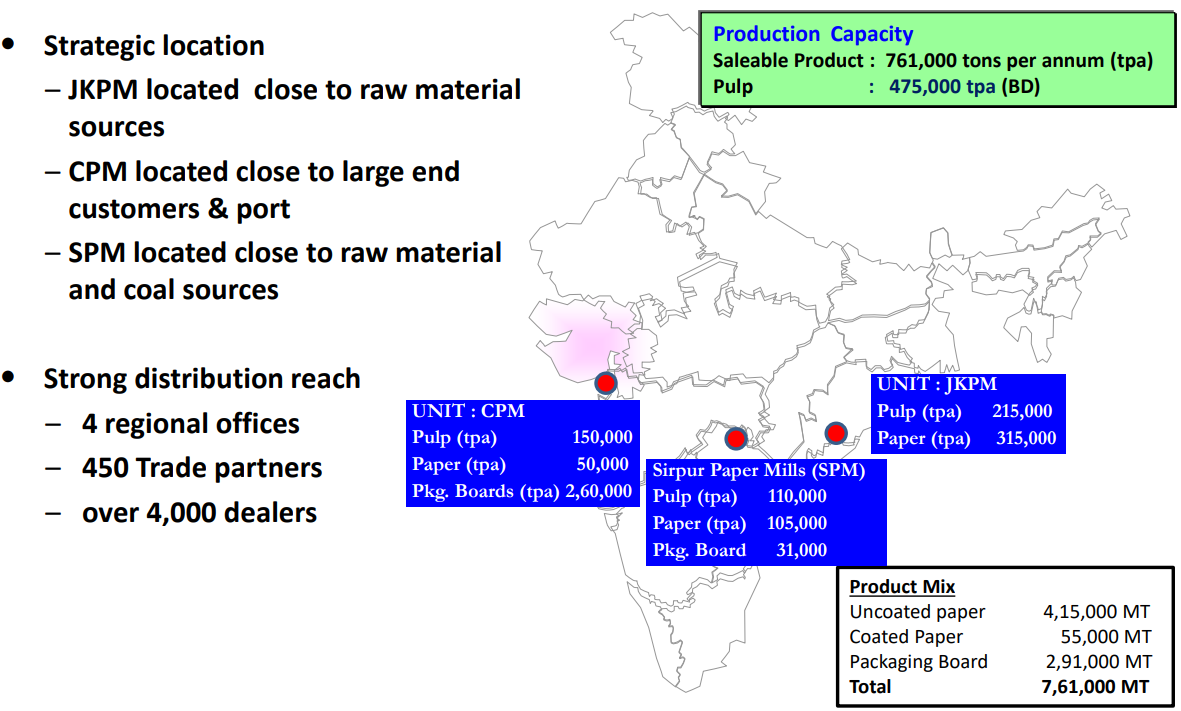

1. One of India’s largest Paper & Packaging Products Companies

jkpaper.com | NSE: JKPAPER

JK Paper Ltd. is the market leader in Branded Copier Paper in India and amongst the top producers of Coated Paper and Packaging Boards in the Country.

Copier Paper (Market Leader): Market Share = 30%

Largest Corrugated Packaging manufacturers

Company acquired 85% Equity Shares of Horizon Packs Pvt. Ltd. (HPPL) and Securipax Packaging Pvt. Ltd. (SPPL) w.e.f. 12th December, 2022, which together are India’s largest Corrugated Packaging manufacturers with seven (7) plants across the country.

Packaging Board: Market Share = 20%

Coated Paper: Market Share = 11%

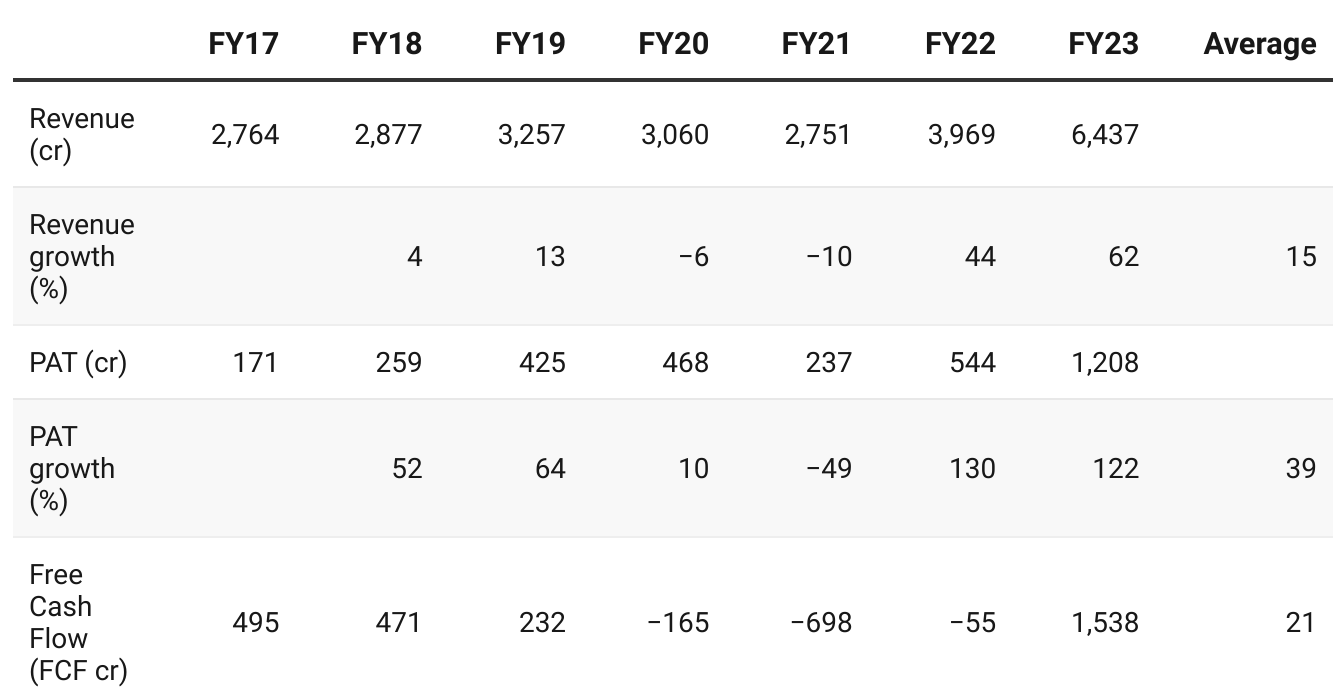

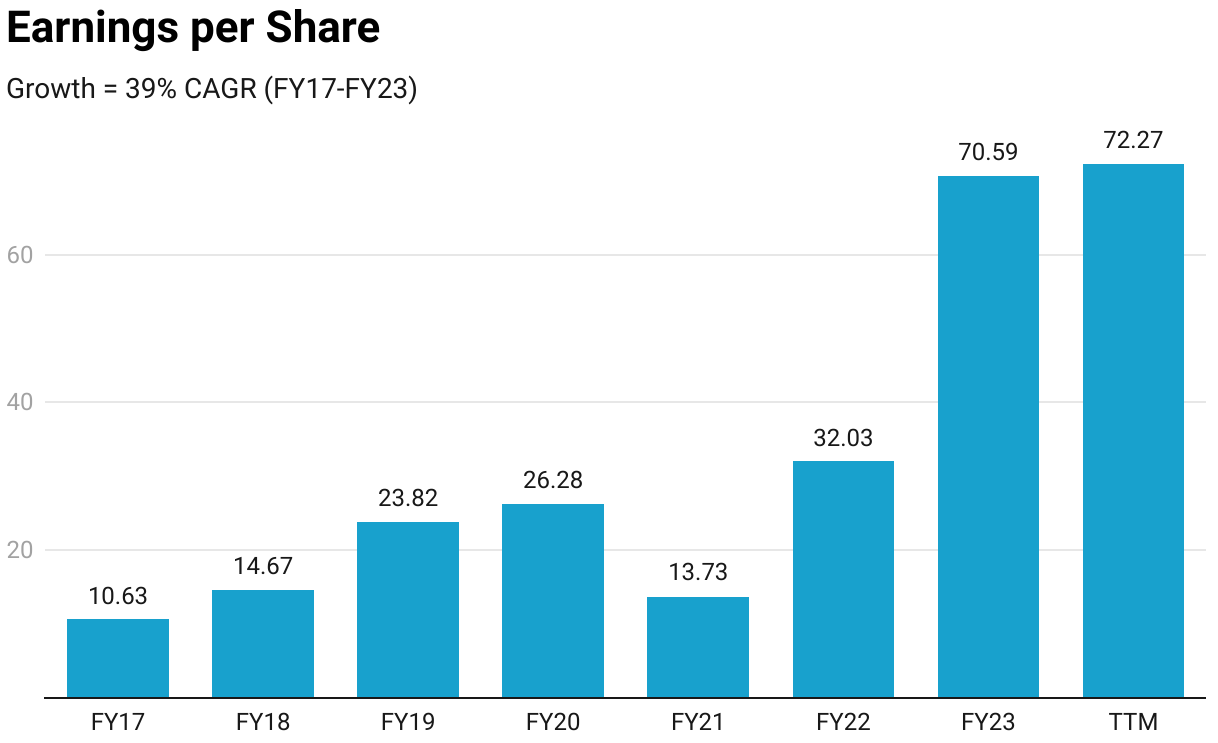

2. FY17-23: Delivering 39% CAGR PAT growth

Barring FY21, PAT has grown sequentially for the last 7 years

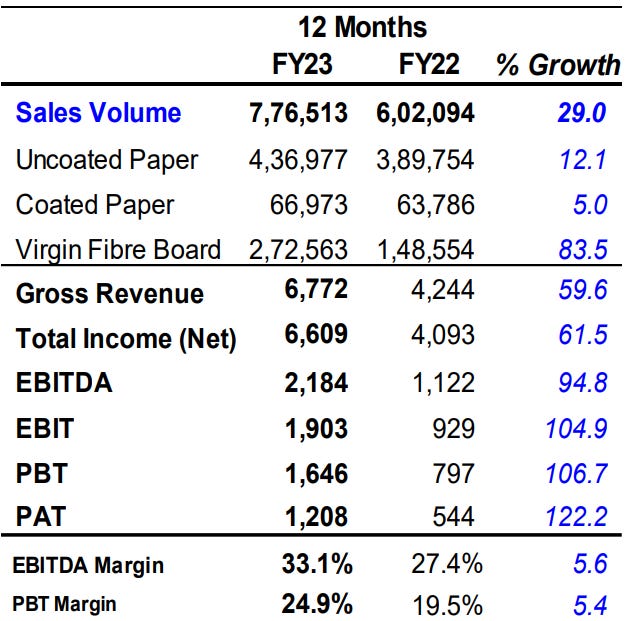

3. FY23: PAT up 122% and Revenue up 61% YoY

Higher volume coupled with increased realisation

Highest ever Consolidated Turnover of Rs. 6,772.17 Crore (up 60%), EBITDA of Rs. 2,184.45 Crore (up 95%) and Profit after Tax (PAT) of Rs. 1,195.79 Crore (up 120 %), for the year ended March’23 (FY 2022-23).

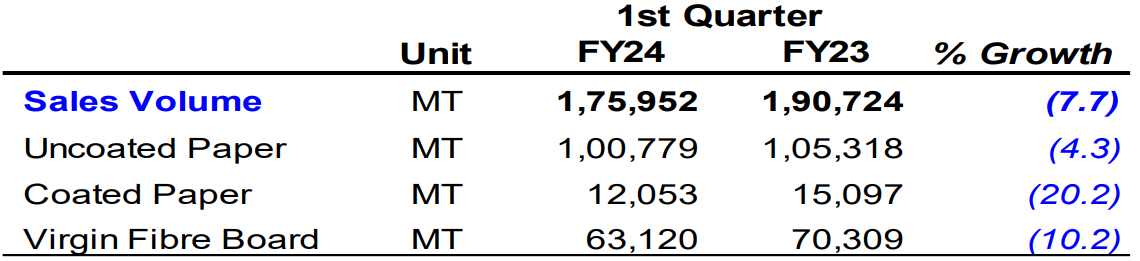

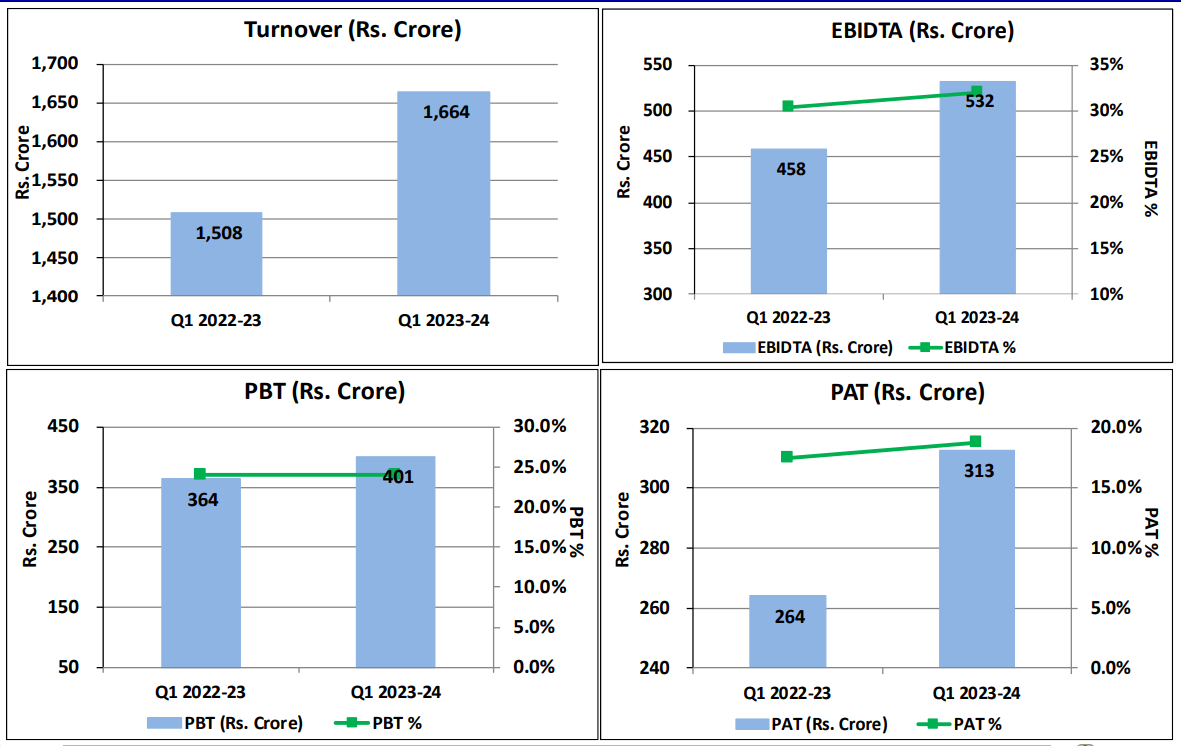

4. Q1-24: PAT up 18% and Revenue up 10% YoY

Strong Q1-24 despite volumes down 8%

Results have improved due to the acquisition of corrugation business during last year and better performance by Sirpur Paper Mills with increased volume and higher sales realisation. However, the Packaging Board business witnessed a drop in volume and sales realization and was impacted by higher Pulp carrying cost.

Turnover of Rs. 1,663.97 Crore (up 10%), EBITDA of Rs. 532.03 Crore (up 16%) and Profit after Tax (PAT) of Rs. 308.67 Crore (up 18 %) on Consolidated basis for the quarter ended June’23 as compared to corresponding quarter of the previous financial year.

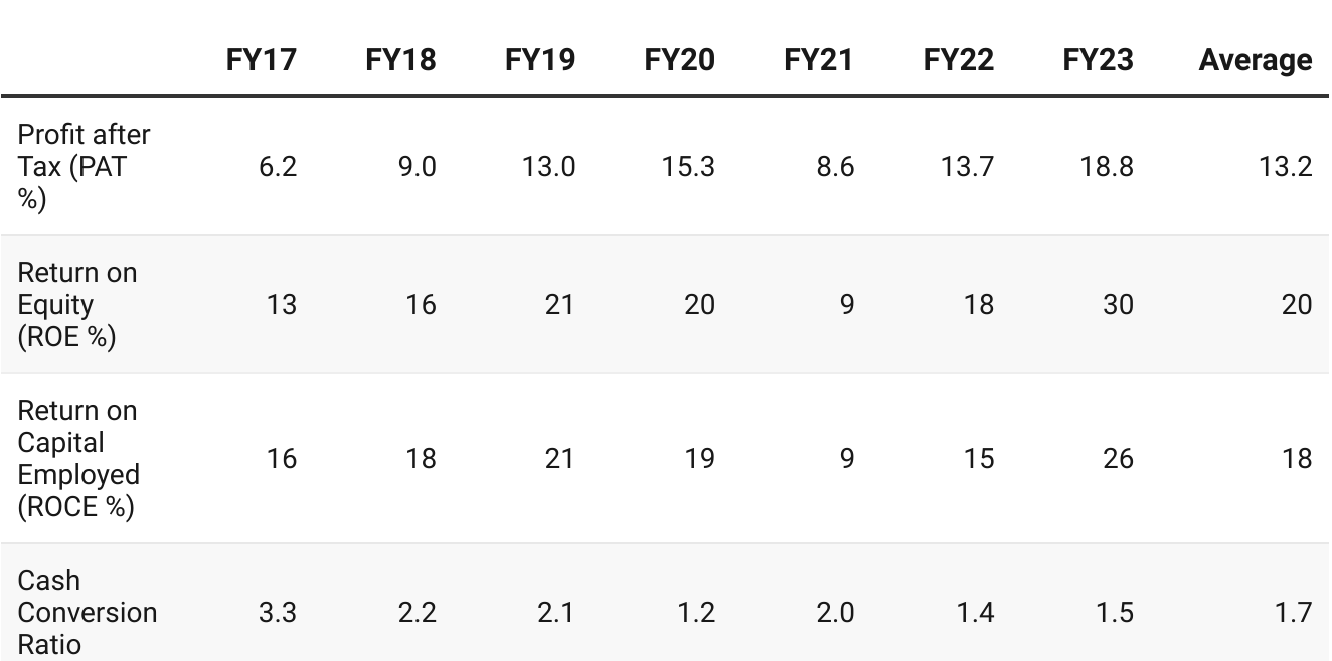

5. Business metrics are strong and consistent

Barring FY21, the business has delivered returns consistently. Cash conversion has been excellent

6. Consistent growth in earnings every year

Regardless of the business conditions, JKPAPER has consistently achieved year-on-year growth in EPS, with the exception of FY21. Over the past seven years, it has accomplished an impressive 39% compound annual growth rate (CAGR) in EPS.

7. 39% EPS CAGR for FY17-23 at a PE of 5

8. So Wait and Watch

If I hold the stock then one may continue holding on to JKPAPER. This efficiently managed business consistently generates EPS growth.

There's a substantial opportunity for PE expansion

An impressive aspect is JKPAPER's ability to generate Rs 1,538 crore in free cash flow (FCF) against a market cap of Rs 6,704 crore. This translates to a highly attractive free cash flow yield of 23%, indicating the stock's excellent valuation.

Looking at the price-to-book ratio for FY23, the stock trades at just 1.7, further increasing its attractiveness.

It's essential to keep an eye on the volume de-growth issue in Q1-24. While PAT showed an 18% YoY increase in Q1-24, volumes declined by 8%. Monitoring volumes closely is crucial, as sustaining earnings growth amidst volume reduction can be challenging for any business.

9. Or, join the ride

If I am looking to enter the stock then

JKPAPER has achieved an impressive EPS CAGR of 39% from FY17 to FY23, making their PE ratio of 5 quite enticing, with the potential for a PE re-rating

Furthermore, when we assess price-to-book and free cash flow yield, JKPAPER remains attractively priced.

It's worth noting that the recent acquisition of corrugated packaging manufacturers only contributed for one quarter in FY23. However, the full impact of this inorganic growth is expected to come through in FY24.

While the valuations are appealing, it's essential to monitor the volume de-growth in Q1-24 closely; it's a potential area of concern.

In summary, the prospect of a PE re-rating, combined with attractive valuations and the impending impact of acquisitions, presents a compelling case for the potential of multi-bagger returns in JKPAPER stock.

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades