Jewellery Q3-25: Gold, Growth & Going Formal, Shift to Scale and Structure

Not just a bet on gold, it’s a bet on formalization, branding, & India’s rising aspiration. Structural demand & margin levers in place. Jewellery sector offers asymmetric upside with controllable risk

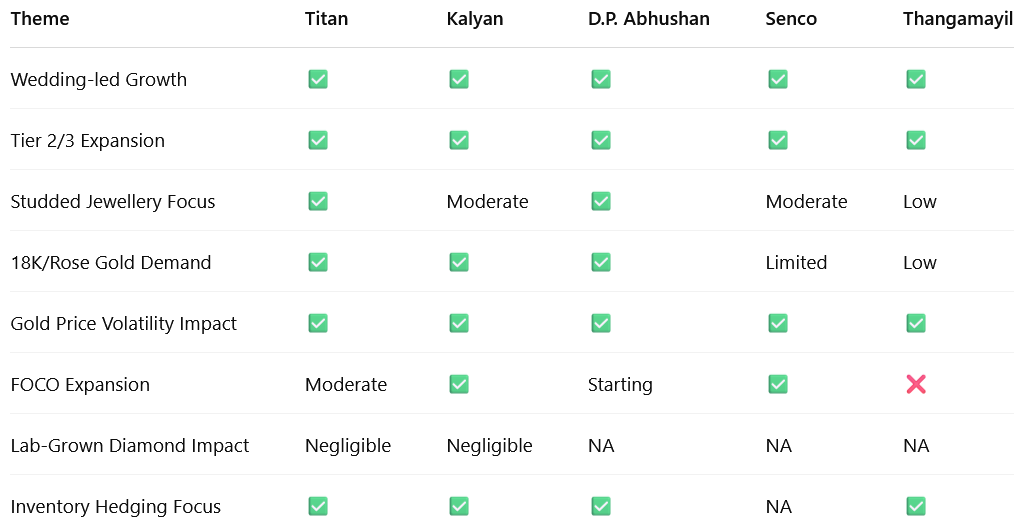

1. Emerging Trends & Challenges

1.1 Robust Demand Driven by Weddings & Festivals

All companies reported strong double-digit growth, largely powered by wedding and festive buying.

The Indian wedding market, projected at ₹10 lakh crore by 2025, remains a huge demand driver.

1.2 Rising Gold Prices Not Deterring Customers

Despite a sharp 25%-30% YoY increase in gold prices, demand remains strong.

Consumers now pause briefly during price spikes but return quickly, especially for wedding-related purchases.

1.3 Shift Toward 18K, Rose Gold & Diamond Jewellery

Younger buyers are driving demand for trendy jewellery, including 18K, rose gold, and studded jewellery.

Companies are tailoring collections toward this evolving preference.

1.4 Tier 2/3 Cities Fuel Expansion

Retail expansion is focused on Tier 2 and Tier 3 cities, where consumer aspirations and gold affinity remain high.

Players like D.P. Abhushan, Kalyan, and Thangamayil are growing aggressively in these regions using both COCO and FOCO models.

1.5 Omnichannel Growth & Digital Integration

Online channels (like Candere, CaratLane) are gaining traction, especially among younger audiences.

CRM tools and loyalty programs are helping brands drive personalized engagement and repeat purchases.

1.6 Organized Sector Gaining Share

Due to hallmarking mandates and rising compliance costs, consumers are migrating from unorganized to organized players.

Organized players are expected to reach 50% market share by FY29.

1.7 Margin Pressures from Gold Price Surge

The rising gold-to-diamond cost ratio is diluting gross margins, especially in studded jewellery.

Studded margins are under stress due to the increased weight of gold relative to diamonds.

1.8 Competitive Intensity in Regional Markets

Intense price wars, especially in southern India and Tier 2/3 towns.

Regional players are becoming more aggressive with local digital marketing and promotional pricing, forcing national brands to increase spending.

1.9 EBITDA Margin Compression in FOCO Expansion

FOCO (franchise-owned, company-operated) models are lowering EBITDA margins, though PBT margins improve due to lower capital expenditure.

1.10 Global Volatility and Regulatory Risk

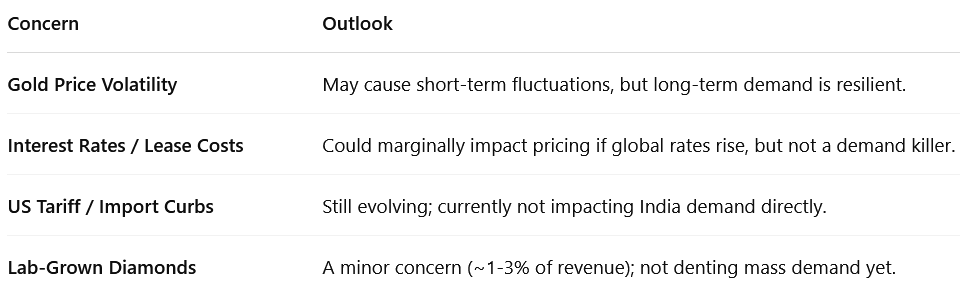

Uncertainty around US tariffs, volatility in gold lease rates, and customs duty changes are creating cost unpredictability.

Companies are reviewing their hedging strategies to remain insulated from these shocks.

1.11 Lab-Grown Diamonds (LGDs) Still a Niche Threat

LGDs are impacting the solitaire segment, but this currently forms a small portion of revenue (~1%-3%) for most players.

Players like Titan and Kalyan are watching this space, but not materially affected yet.

1.12 Inventory Valuation & Hedging Complexities

Players like D.P. Abhushan highlighted risks related to inventory accounting methods and market vs. book price mismatches during volatility.

Proper hedging (via GML or futures) is becoming more critical.

2. Demand Outlook

2.1 Short to Medium-Term

Strong Wedding Pipeline to Sustain Momentum

Wedding jewellery continues to be the biggest growth engine, with brands optimistic about ongoing wedding demand in Q4 and beyond.

Titan, Kalyan, and D.P. Abhushan are all expecting to end FY25 strongly, driven by wedding-related purchases.

Consumers Adapting to High Gold Prices

Gold prices have jumped ~25% YoY, but customers are more accustomed to volatility now.

Brief pauses in buying are followed by quick recovery—especially for weddings, where purchases cannot be delayed for long.

Non-wedding demand is more sensitive, but brands note resilience, especially in metros and younger cohorts.

Consistent Festive & Occasion-led Demand

Tier 2/3 markets remain robust, with jewellery tied to regional festivals and life events.

Jewellery is still seen as a preferred store of value, especially amid global uncertainty.

2.2 Medium to Long-Term (FY26–FY29)

Organized Retail to Capture Market Share

The organized segment is projected to reach 50%+ market share by FY29, up from ~35%-40% today.

This shift will be driven by hallmarking mandates, better designs, and rising trust in national brands.

Younger Consumers Driving Growth

Brands are bullish on demand from millennials and Gen Z buyers, who are driving growth in:

18K, rose gold, and white gold

Stones/studded jewellery

Everyday lightweight jewellery

Titan and CaratLane are betting on this through personalized offerings and omnichannel access.

Structural Drivers Remain Intact

India’s rising disposable income, urbanization, and financial inclusion continue to expand the buyer base.

Jewellery remains a multi-generational, culturally rooted category, and gold retains emotional + financial appeal.

2.3 Overall Sentiment

Titan: Sees steady long-term demand, driven by premiumization and deeper customer engagement.

Kalyan: Confident about strong wedding pipeline, continued showroom expansion.

D.P. Abhushan: Expects 20-25% growth next year, led by expansion into new states and formats.

Senco: Optimistic outlook based on urban/rural traction and wedding/festival visibility.

Thangamayil: Predicts solid performance from Tier 2/3 growth and gold-as-investment sentiment.

“Despite volatility in prices, consumer appetite for jewellery—especially wedding and investment gold—remains rock solid. The demand curve might wobble, but it's still climbing.”

3. Jewellery Pricing Outlook – 2025 and Beyond

“Brands will protect premium pricing, but tactically bend where they must. With volatility in gold and studded margins, smart pricing – not just competitive pricing – will define the winners.”

3.1 Gold Price Volatility – A Double-Edged Sword

Gold prices surged ~25–30% YoY, leading to higher ticket sizes but also margin pressure, especially in studded jewellery.

Management across all companies noted volatility will likely continue due to:

Global economic uncertainties

Anticipated US tariffs

Currency fluctuations (USD strength)

Central bank buying

Most expect prices to remain elevated or range-bound in FY26.

Outlook: High gold prices are the new normal, with occasional sharp spikes. Brands are adjusting product strategy to manage.

3.2 Gross Margin Headwinds – Especially in Studded Jewellery

Titan and Kalyan noted that rising gold prices dilute margins on studded jewellery since gold makes up a larger share of product cost but earns lower margin than diamonds.

Margins in studded products (especially above ₹1 lakh) may remain under pressure unless gold stabilizes.

Outlook: Gross contribution (GC) in studded jewellery may stay flat or dip slightly until gold stabilizes.

3.3 Making Charges – Tactical Flexibility Across Markets

Brands use differentiated making charges to compete in local markets:

Stable for staple designs

Higher for designer/exclusive pieces

Kalyan and D.P. Abhushan emphasized that making charges are tactically adjusted based on local competition and product positioning.

Outlook: Making charges will remain dynamic – a key lever for margin optimization and competitive pricing.

3.4 Pricing Discipline in Organized Sector

Despite regional price wars, large players maintain a premium over local jewelers due to:

Branding and trust

Design quality

Customer service and loyalty programs

Titan, in particular, is clear about not compromising pricing integrity, even in competitive markets.

Outlook: Expect continued premium pricing for national brands, but more aggressive pricing at lower price points or new markets.

3.5 Franchise (FOCO) Model Affecting Pricing Strategy

As FOCO share rises (especially for Kalyan and D.P. Abhushan), EBITDA margins will compress slightly, though PBT stays healthy.

Brands may use pricing incentives (discounts, offers, product bundling) to support franchisee sales without affecting net realization.

Outlook: Expect local promotional pricing and flash discounts in FOCO-heavy geographies, but not sustained price cuts.

3.6 Lab-Grown Diamonds – Limited Pricing Impact (For Now)

LGDs are impacting solitaire pricing (1-carat+), but this segment contributes <3% of revenue for most.

Studded jewellery using smaller diamonds is not affected yet.

Outlook: No major disruption in pricing from LGDs in the near term, but brands are watching the space.

4. Under-the-radar insights

4.1 Inventory Accounting Methods Skew Margin Comparisons

Normalize inventory accounting when comparing margins across jewellery stocks.

D.P. Abhushan uses weighted average cost for inventory valuation. This can artificially inflate gross margins during rising gold price environments (since inventory is carried at older, lower prices).

Many peers use FIFO or mark-to-market. So, comparing gross margin across companies without normalizing for accounting can be misleading.

4.2 Structural Shift in Revenue Mix: Coins and Investment Gold Are Up

Companies like Titan and D.P. Abhushan reported higher sales of gold coins, signaling:

Gold is being increasingly used as a liquid asset or short-term hedge.

Younger and newer buyers may be entering via small-ticket investment purchases before graduating to jewellery.

Jewellery businesses are acting as gold investment platforms—crossover potential with fintech/wealth tech.

4.3 Repeat Buyers & CRM Are Becoming Core Growth Engines

Titan has over 4 crore customers in its CRM. A large portion of revenue growth is coming from repeat buyers, particularly in high-value studded segments.

Brands are using CRM data to trigger event-based marketing (e.g. anniversaries, weddings, birthdays) — boosting conversions.

Jewellery is moving from a “one-time purchase” category to a lifecycle relationship business.

4.4 Product Innovation in Lightweight, Everyday Jewellery

CaratLane, Mia, and others are seeing growing traction in daily-wear lightweight jewellery, especially among working women and Gen Z.

These products have higher margins, faster inventory turns, and open up higher repeat purchases than wedding sets.

Brands with strong lightweight/studded portfolios may deliver better asset turns and customer LTVs.

4.5 Store Productivity Varies Widely — Even in Top Cities

Example: Titan mentioned that new competitors near their stores (even in metros) are affecting performance. Some stores face underperformance despite being in mature markets, while others in Tier 2 towns are exceeding expectations.

Expansion success is not linear. Store location, format, and local brand pull are critical.

4.6 Premiumization and Designer Collaborations as Differentiators

Titan’s Tarun Tahiliani x Rivaah and D.P. Abhushan’s exhibitions like “Jewels of Mewar” show a clear trend:

High-income consumers are willing to pay a premium for designer-backed, culturally rich collections.

This helps protect margins and fight price wars in crowded markets.

Designer tie-ups are becoming a key lever for margin defense and aspirational positioning.

5. Investment Opportunity: Indian Jewellery Sector

5.1 Sector Opportunity

$100B+ TAM: India is the world’s second-largest jewellery market (~$90B+ in size), expected to grow at 8–10% CAGR over the next decade.

Low Organized Penetration (~35%): Massive formalization tailwind via hallmarking, GST, and digital transformation. Expected to reach 50%+ by FY29.

Cultural Stickiness: Gold and jewellery are entrenched in weddings, festivals, and investment habits.

Aspirational Demand: Younger India is embracing branded, modern, designer jewellery (18K, rose gold, diamond).

Expanding Margins & Scale: Larger players benefit from scale-driven operating leverage, better sourcing, and CRM-driven repeat sales.

5.2 Risk Factors to Monitor

5.3 Investment Checklist

Consider high-quality players with:

Strong brand equity

Visible expansion plans

Margin improvement levers (product mix, CRM, repeat customers)

Asset-light scalability (franchise/FOCO)

Diversify across formats (wedding-focused, daily wear, diamond-led players).

Monitor gold prices, wedding trends, and store economics (SSG, breakeven periods, inventory cycles).

Disclaimer

Content Accuracy and Reliability: This summary of the earnings call is generated using an artificial intelligence large language model (LLM). While every effort has been made to ensure the accuracy and completeness of the information, the summary may not fully capture all nuances or details of the original earnings call. The content provided is for informational purposes only and should not be construed as financial advice or a recommendation to buy or sell any securities. Verification: Readers are encouraged to refer to the official earnings call transcript, company filings, and other authoritative sources for comprehensive and accurate information. The creators of this summary do not guarantee the accuracy, completeness, or timeliness of the information and accept no responsibility for any errors or omissions. No Liability: The use of this summary is at your own risk. The creators and distributors of this content disclaim any liability for any loss or damage arising from the use of or reliance on this summary. Consult Professional Advice: For investment decisions or financial advice, please consult a qualified financial advisor or other professional