Jana Small Finance Bank: PAT growth of 90% & NII growth of 32% in Q1-25 at a PE of 10

Guidance of 30-40%+ PAT growth in FY25. Deposit and AUM growth of 20% in FY25 with ROE of 19-21%

1. A Small Finance Bank

janabank.com | NSE : JSFB

60% of our loan book being classified as secured, primarily in the Home Loan and Loan Against Property (LAP) products.

2. FY21-24: PAT CAGR of 110% & Revenue CAGR of 20%

3. Strong FY24: PAT up 162% & Net Interest Income up 28% YoY

4. Q1-25: PAT up 90% & Net Interest Income up 32% YoY

5. Return ratios: Improving return ratios

6. Outlook: Guiding for 30-40% PAT growth in FY25

7. PAT growth of 90% & NII growth of 32% in Q1-25 at a PE of 10

8. So Wait and Watch

If I hold the stock then one may continue holding on to JSFB

JSFB has delivered a strong FY24 and followed it up with a strong Q1-25 which provides confidence in the managements ability to deliver on the guidance of FY25.

FY25 guidance looks conservative given the performance in FY24. AUM growth of 25% and Deposit growth of 38% in FY24 followed by ~20% growth in AUM & Deposits in FY25 looks conservative. However on a standalone basis the guidance for FY25 is strong.

9. Or, join the ride

If I am looking to enter JSFB then

JSFB has delivered PAT growth of 162% & NII growth of 28% in FY24 at a PE of 10 which makes valuations quite reasonable for the short term.

Outlook for PAT growth of 30-40% in FY25 at a PE of 10 makes the JSFB valuations quite reasonable from a longer term.

With a market cap of Rs 6874 cr against a net worth of Rs 3,577 cr as of Q4-24 end implies that JSFB is available a price to book of 1.8 which makes the valuations fairly valued in the short term but can be sustained over the longer term given the 30-40% growth in PAT expected for FY25

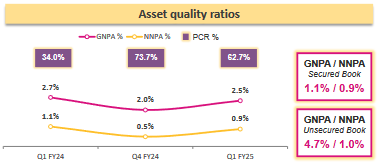

One needs to keep a watch on asset quality of JSFB even though NPA’s are trending down with 70%+ of GNPA covered by provisioning as indicated in the provisioning coverage ratio

GNPA and NNPA increase is event driven and seasonal

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer