ITD Cementation: Order book 3.6X FY23 revenue to grow top-line by 26-34% in FY24

Strong revenue visibility, margin expansion, EPS growth and free cash being generated all at once by ITD Cementation

1. Order book = 3.6X FY23 revenue

Providing multi-year visibility

During the year ended March 2023, we have secured new order for over Rs 8000 Crores and that really bodes well and gives us visibility for revenue in the next year or two to come.

Strong bidding pipeline to fuel future growth

2. Orders driving growth from FY21 into Q1-24

Solid Q1-24 both on QoQ and YoY

3. Order book is being executed efficiently

Solid return ratios, generating cash for ITDCEM

PAT has been weak but there is an outlook for improvement

Last two years we had some legacy jobs like elevated metro at Bengaluru and some other places so those we could not do better, now those jobs are behind us so that will contribute to the bottomline.

Yes some claims and some certificates are always the part of this business that will keep on going but more or less we are under control now

PAT margin in Q1-24 = 2.9% vs 1.4% in FY23

4. Order-book execution converted into EPS growth

EPS growing sequentially

TTM = trailing twelve months

5. Management is guiding for a strong FY24

8000 cr order inflow; 10% EBITDA

Rs 6.4-6.8K cr top-line ==> 26-34% top-line growth over FY23

Order inflow ==> last year we have secured Rs 8,000 Crores job, this year also it should be at least Rs 8,000 Crores that is our target

Top-line ==> Rs 1,600, Rs 1,700 Crores per quarter.

EBITDA ==> we will touch double digit end of the year

Order book pipeline ==> Rs 17K cr with a conversion ratio of 20%

Q4-23 management commentary

Q1-24 earnings call has not take place at the time of publishing of this analysis. Insights from the Q1-24 call will be updated

6. Q1-24 was a beat against the guidance

Top-line: Rs 1.8K+ cr vs guidance of Rs 1.7-1.8K cr

EBITDA: 9.5% vs “will touch double digit end of the year“

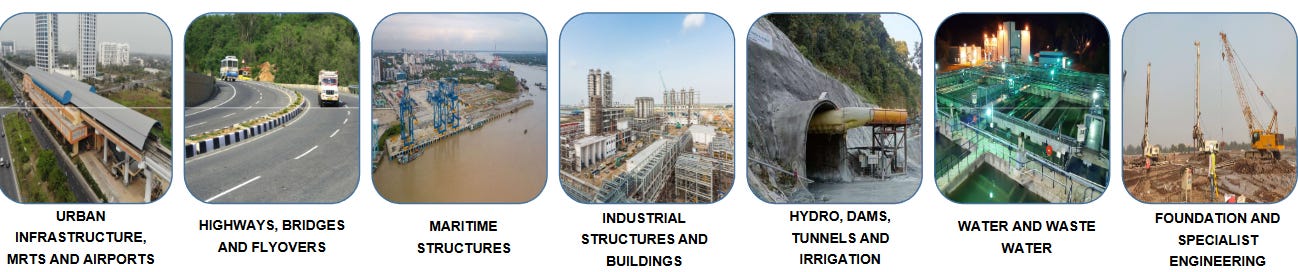

7. BTW, what does this company do?

Leading EPC player undertaking Heavy Civil & Infrastructure projects

NSE: ITDCEM

6. Strong revenue visibility and stock at a 25 PE

25 on FY23 earnings

PE of 21 on trailing 12 months earning

7. So Wait and Watch

If I hold the stock then one must

Wait and watch for quarterly updates on the execution of the order book.

Watch the order book. A 2.5X+ bill to book ratio will give a margin of safety.

ITDCEM has passed the test of Q1-24 strongly

Additionally, adequate confidence is in place that the test for FY24 will also be passed with strength

8. Or else join the ride

If I am looking to enter the stock then

Valuations are reasonable. PE(TTM) of 21 for a top-line growth of 26-33%

Expecting a beat on the top-line guidance given the beat in Q1-24.

If not a beat then a top-line growth of closer to the top-end of the 26-33% range.

Guidance for 10% EBITDA implies bottom-line would grow faster than the top-line

Don’t like what you get every morning?

Let us know at hi@moneymuscle.in

Will send you better stuff.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades