ITD Cementation: PAT growth of 112% & Revenue growth of 58% in 9M-24 at a PE of 26

37%+ revenue growth in FY24 followed by 25% growth in FY25 on the back of a strong order book. Strong bidding pipeline in place to fuel future growth for ITDCEM.

1. EPC player undertaking Heavy Civil & Infrastructure projects

itdcem.co.in | NSE : ITDCEM

ITD Cementation India Limited is one of the leading Engineering and Construction Companies undertaking Heavy Civil, Infrastructure and EPC business and operating in India for nine decades with an established presence and expertise in Maritime Structures, Mass Rapid Transit Systems, Airports, Hydro-Electric Power, Tunnels, Dams & Irrigation, Highways, Bridges & Flyovers, Industrial Structures and Buildings, Foundation & Specialist Engineering.

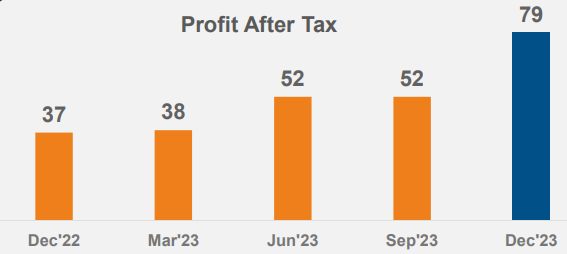

2. FY20-23: PAT CAGR = 42% & Revenue CAGR = 21%

3. Strong FY23: PAT up 80% & Revenue up 34%

4. Strong H1-24: PAT up 111% & Revenue up 61%

5. Strong Q3-24: PAT up 113% & Revenue up 52%

6. Strong 9M-24: PAT up 112% & Revenue up 58%

7. Business metrics: Improving return ratios

8. Outlook: 37% revenue growth in FY24 followed by 25% growth in FY25

i. 37%+ top-line growth in FY24

Revenue expected to grow to Rs 7,000 cr+ in FY24 implies a 37%+ growth in FY24.

I think, we'll maintain the same, which is around INR 7,000-core-plus in the top line. We hope that EBITDA will be just 10% above this end of the year.

ii. 25% top-line growth in FY25

So, revenue-wise, we should be able to achieve around 25% more than this year.

iii. Strong order-book: Multi year revenue visibility

9. PAT growth of 112% & Revenue growth of 58% in 9M-24 at a PE of 26

10. So Wait and Watch

If I hold the stock then one may continue holding on to ITDCEM

Coverage of ITDCEM was initiated after Q1-24 results. The investment thesis has not changed after a strong 9M-24. The only changes are the delivery of a strong Q3-24 and the increased confidence in the management to deliver a stronger FY24

Q4-24 is expected to be as good Q3-24

Actually, we have already done quite good in Q3. So, what we used to do in Q4, we have achieved in Q3. So, Q4 will be almost same like Q3.

PAT is increasing QoQ for the last 4 quarters. One can hold on as ITDCEM is in the middle of a good run.

11. Or else join the ride

If I am looking to enter ITDCEM then

ITDCEM has delivered PAT growth of 112% & Revenue growth of 58% in 9M-24 at a PE of 26 which makes the valuations look reasonable from a longer term .

Top-line growth of 37%+ in FY24 followed by 25% revenue growth in FY25 with expanding margins at a PE of 26 which makes the valuations look reasonable.

The FY24 guidance is in the price and short-term opportunities would be limited.

Execution against the FY25 guidance would drive ITDCEM in the medium term. Over the long term order intake and build up of the order book would create opportunity in ITDCEM.

Previous coverage on ITDCEM

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer