Insolation Energy FY25 Results: PAT up 127%, Strong Growth till FY28

Guiding 6.5x revenue by FY28 with strong margin expansion. Undemanding valuations 3.3x FY28E PE, for a ₹8,000+ Cr business growing at 80%+, delivering 16% margin

1. Solar PV Modules

insolationenergy.in | BOM: 543620

Solar Module Manufacturing (Mainstay Business):

Solar PV modules including MonoPERC and TOPCon N-type technologies.

Capacity: ~950 MW, scaling to 4 GW in FY26 and 8 GW by FY28.

Dealer-distributor channel contributes 15–20% of module revenues with higher margins compared to bulk/utility orders.

Solar Cell Manufacturing (Upcoming):

3 GW solar cell line under construction in MP, to be operational by Jan 2027.

Aluminum Frames — support internal module production

EPC & Projects Division (Forward Integration)

Major supplier under PM KUSUM (A, B, C), PM Surya Ghar Yojana, Jal Jeevan Mission, etc.

IPP Projects – Solar park development and independent power producer partnerships.

Rooftop Solar – Corporate and state government rooftop tenders

O&M — Provides long-term Operation & Maintenance services

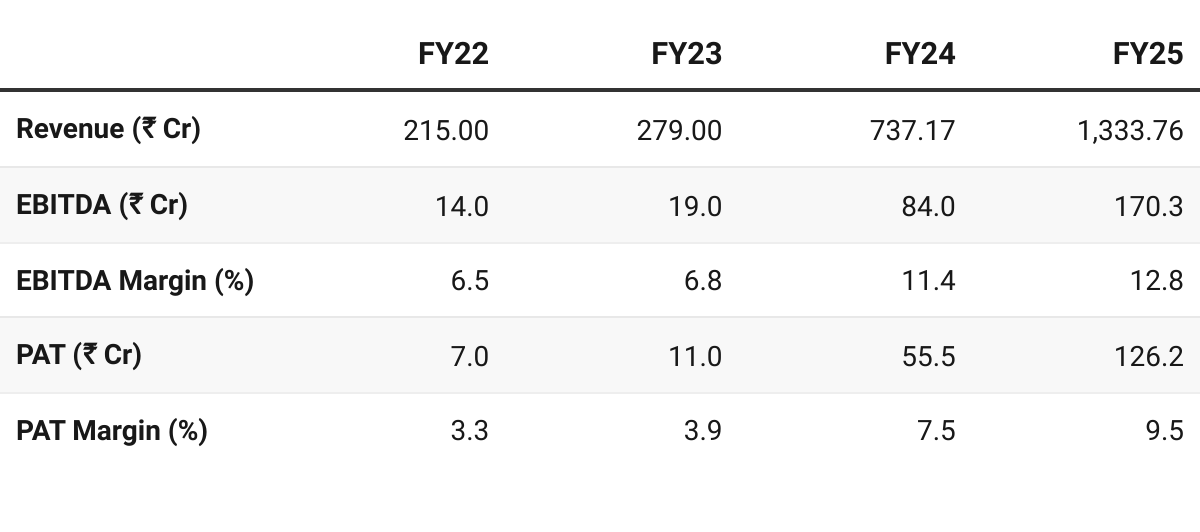

2. FY22–25: PAT CAGR of 162% & Revenue CAGR of 84%

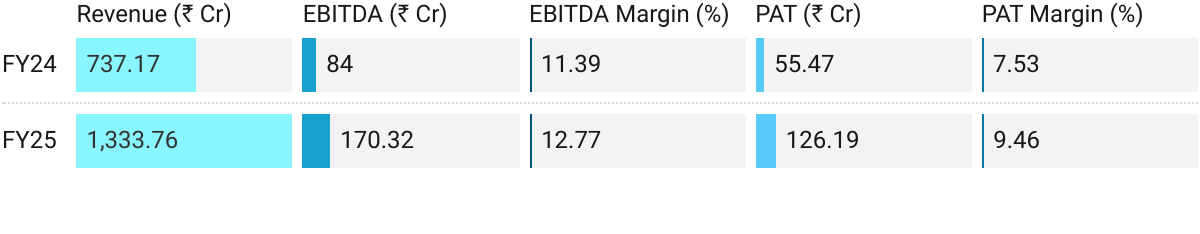

3. FY25: PAT up 127% & Revenue up 81% YoY

Growth led by higher solar module sales, strong EPC execution, and geographic expansion into Central & South India.

Margins improved due to scale, better mix, and cost optimization.

₹395 Cr raised via preferential issue (to fund capacity expansion).

Working Capital: Improved to 31 days (vs 44 days in FY24), driven by better dealer network terms.

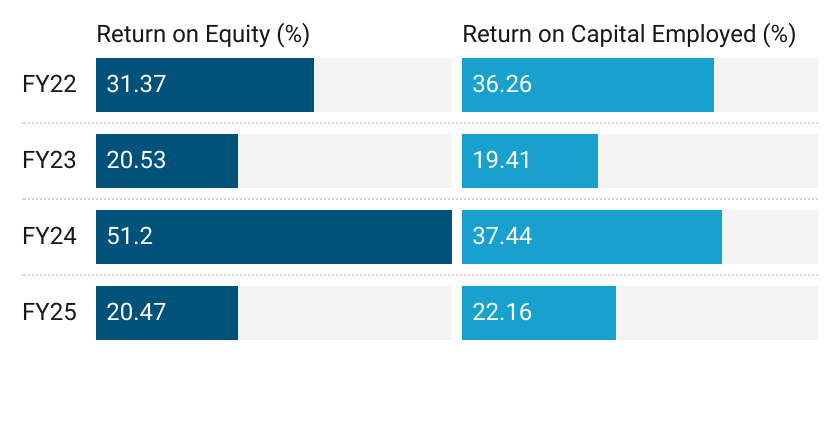

4. Business Metrics: Strong Return Ratios

FY25 — Muted on account of INR395 crores raised via preferential issue during year for expansion plans

5. Outlook: FY28 Revenue 6.5x Over FY25

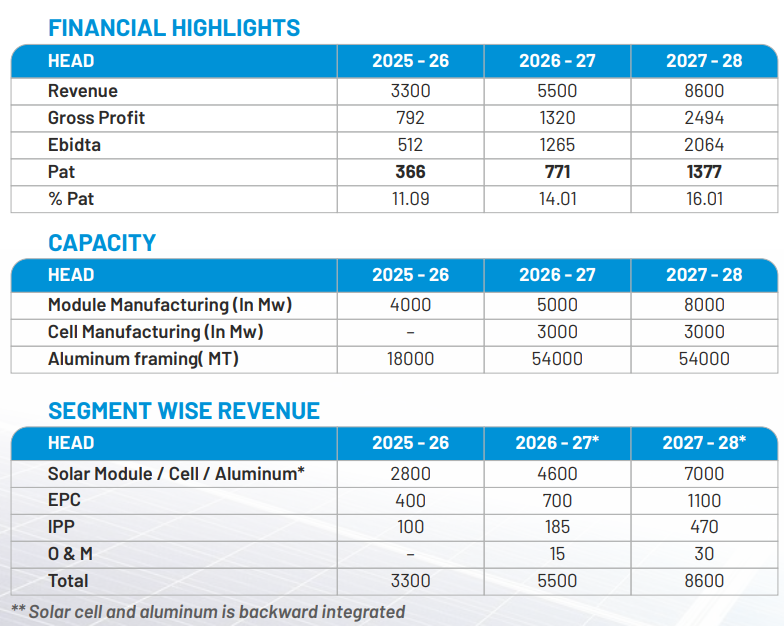

5.1 Guidance

Capacity Expansion

FY26 — 4 GW module capacity operational (3 GW Unit 3 + 950 MW existing converted to TOPCon).

FY27

3 GW solar cell line (TOPCon N-type) to start operations, ramp-up by Jan 2027.

54,000 MT aluminum framing capacity.

FY28:

8 GW module capacity + 3 GW solar cell capacity fully integrated.

Technology shift: Complete transition to TOPCon N-type modules across units.

Order Book & Pipeline

Current ₹2,500+ Cr order book across EPC, rooftop, government schemes, and developer projects.

KUSUM A & C: 700+ MW tender participation; management confident of winning significant capacity.

Rooftop Solar: 100+ MW secured pipeline for FY26; corporate/state tenders gaining traction.

MoU with Rajasthan Govt.: ₹10,000 Cr commitment for rooftop, solar parks, and manufacturing by 2030.

Strategic Growth Areas

Backward Integration: Solar cells & aluminum frames (FY27) to improve margins by 400–500 bps.

Battery Energy Storage (BESS): Entry once a clear government policy emerges; land secured in MP for future setup.

Solar Wafer Manufacturing: Plans to enter when policies are supportive, completing the entire solar value chain.

Exports: Potential long-term play as India becomes the world’s 2nd largest solar PV manufacturer by 2026 (policy tailwinds + PLI).

Capital & Incentives

Capex: ~₹1,300 Cr for MP project (funded via ₹300 Cr internal accruals + ₹1,000 Cr debt at <9–9.25%).

Incentives: MP govt. support includes free/low-cost land, subsidized power & water, and 17–35% capex subsidy.

Other Initiatives

Shift from SME platform to BSE Main Board post Oct 2025.

7. Valuation Analysis

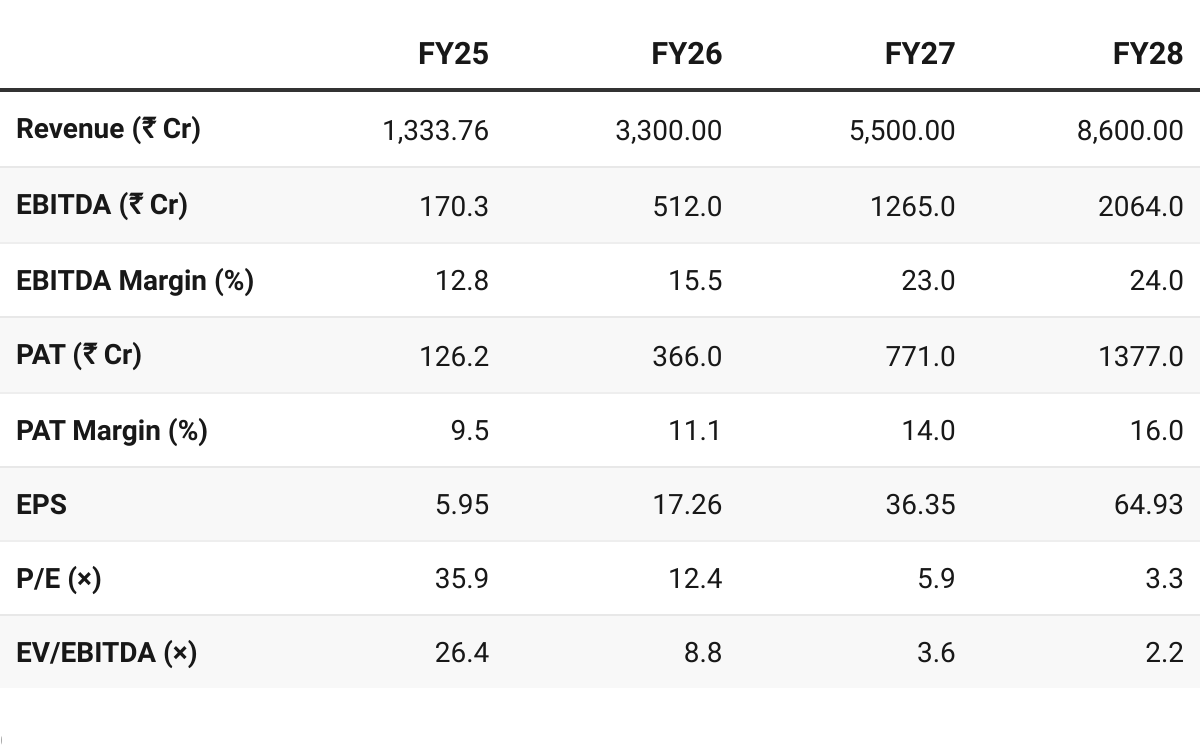

7.1 Valuation Snapshot — Insolation Energy

CMP ₹213.5; Mcap ₹4,704.3 Cr;

Attractive Forward Valuation:

Insolated generated free cash flow of ₹28.05 Cr in FY25 which indicates that the quality of good is good

Free cash flow yield of 0.6% — Insolation looks expensive on an historic basis

FY25 multiples (P/E 36×, EV/EBITDA 26×) look expensive due to small base.

Forward multiples collapse rapidly (FY27 P/E ~6×, EV/EBITDA ~3.6×) — suggesting steep undervaluation if execution on capacity and margins is delivered.

On a FY27E basis, Insolation offers a rare combo: 40–50%+ growth, PAT margins rising to 14%, and valuations at mid-single digit multiples.

Re-rating potential is significant as company migrates to main board and scales to ₹8,600 Cr revenue by FY28.

7.2 Opportunity at Current Valuation

Opportunities subject to FY26 guidance:

If FY26 guidance is not met all future projections will fall like a pack of cards

Growth Visibility: Management guiding for 6x revenue growth (₹1,334 Cr in FY25 → ₹8,600 Cr in FY28) with PAT margin expansion from 9.5% to 16%

Order Book Strength: ₹2,500+ Cr order book across EPC, rooftop, and govt. schemes provides execution visibility in FY26–27

Government Tailwinds: Strong policy support (PLI, ALMM/ALCM, PM-KUSUM, Surya Ghar Yojana) ensures steady demand for domestic solar modules.

Valuation Comfort: At FY27E P/E ~6× and EV/EBITDA ~3.6×, stock looks undervalued — provides leeway if guidance is partially met

Re-rating Trigger: Migration from BSE SME to Main Board in FY26 could unlock higher participation.

7.3 Risk at Current Valuation

No Track Record of Massive Expansion: While FY25 growth was strong, Insolation has not yet demonstrated execution at multi-GW scale; scaling from sub-1 GW to 8 GW capacity within three years carries high operational risk.

Execution Risk: ₹1,300 Cr capex in MP (cells + modules + aluminum) is large relative to current scale; delays or cost overruns could derail growth plans.

Margin Pressure: Rapid industry-wide capacity addition (100 GW+ modules, 26 GW+ cells by FY27) may compress margins faster than expected.

Working Capital Intensity: Despite FY25 improvement (31 days cycle), scaling EPC and govt. projects could elongate receivables.

Policy Dependence: Heavy reliance on govt. schemes/incentives (PLI, ALMM, subsidies). Any adverse regulatory change may impact demand/pricing.

Competitive Intensity: Solar sector is highly competitive, with established players (Waaree, Vikram, Premier) having greater scale and deeper integration.

Technology Risk: Fast-paced evolution in solar tech (TOPCon, HJT, perovskite) could render existing lines less competitive if adoption lags.

The risks are huge if execution is not per plan. Hence entry into the stock has to be measured. Any early warning signals of guidance not being executed cannot be ignored.

Help your group stay ahead. Share now!

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer