Indo Tech Transformers Q1 FY26 Results: PAT up 224%, CAPEX to Constrain Growth

Muted growth till FY27 on account of capacity constraints. Capacity expansion by 70%+ in FY28 could make the valuations look quate attractive as growth kicks-in

1. Transformer Manufacturer

indo-tech.com | NSE: INDOTECH

ITL, incorporated in 1992, manufactures power and distribution transformers and various special application transformers and mobile sub-station transformers. The company’s manufacturing plants are in Chennai and Kancheepuram in Tamil Nadu. ITL is a subsidiary of Shirdi Sai Electricals Limited, and SSEL currently holds a 70.01% stake in ITL.

Products

2. FY21-25: PAT CAGR of 78% & Revenue CAGR of 32%

3. FY25: PAT up 36% & Revenue up 23% YoY

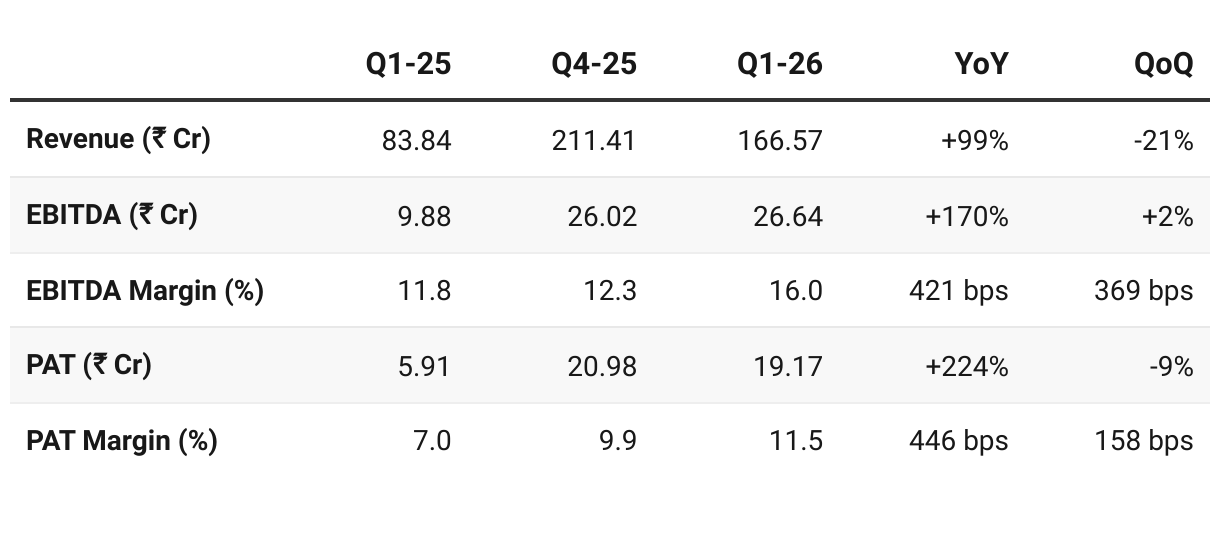

4. Q1-26: PAT up 224% & Revenue up 99% YoY

PAT down 9% & Revenue down 15% QoQ

Strong results given that Q1 is the slowest quarter of the year

QoQ margin expansion in Q1-26 was impressive and the highlight of the quarter

Sustainability of margins need to be monitored

5. Business Metrics: Strong & Improving return ratios

6. Outlook: Growth Muted by Capacity till FY28

6.1 Future Outlook for Indo Tech Transformers (ITL)

Revenue & Growth Visibility

Growth in FY26 to be muted by capacity constraints

Utilisation: Improved from 48% in FY23 → 75% in FY24 → 88% in FY25.

Order Book: ₹882.74 Cr (as of April 30, 2025), equivalent to 1.46x FY25 revenue — providing strong revenue visibility up for FY26.

Growth will be driven by:

Execution of the current order book

Robust demand from domestic infra and energy sectors

Profitability & Margins

Margins are expected to remain healthy (10%–13%) despite raw material price volatility, due to:

Scale-led operating leverage

Price-lock strategies on key raw materials (CRGO steel and copper)

Orders have price escalation clauses one can assume the margins to be sustainable.

~50% of the order mix includes a price variation clause, which mitigates the risk to some extent

Industry tailwinds creating strong demand

Transformer industry is flushed with orders and the demand outlook is positive vis-a-vis end use in various industries such as railways and renewables. The pent-up demand from industrial expansions backed by a rise in capex is leading to higher consumption of power in India, in turn leading to improved order books for transformer manufacturers.

We remain confident of sustaining the market share and maintaining margins at healthy levels.

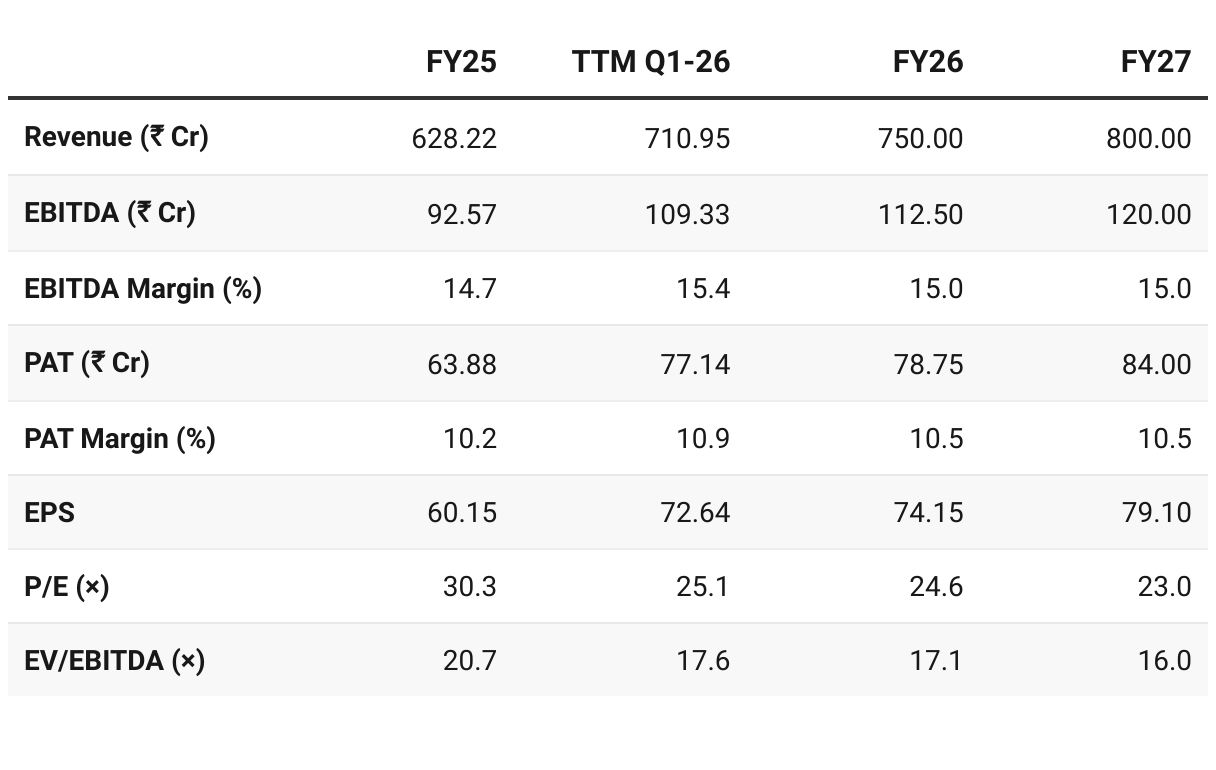

7. Valuation Analysis

7.1 Valuation Snapshot

CMP ₹1,822; Mcap ₹1919.44 Cr

Available at FCF yield of 2.1% based on FY25 cashflows

Capacity expanding by 70%+ in FY28 could trigger strong growth and make valuations look very reasonable.

Indo Tech Transformers is for those who believe

Capex will be executed as per plan

Ready to wait out the period of muted top-line growth till FY28

Industry tailwinds will sustain till FY28

7.2 Opportunity at Current Valuation

Operating leverage: No meaningful expansion until FY27 but opportunity of strong operating leverage remains where bottom-line grows faster than top-line as seen in Q1-26 margin expansion

Capacity Expansion: The proposed capacity addition on 6500 MVA on the current capacity of 9000 MVA coming online from FY28 is not baked into the valuations

Sector Tailwinds: Power infra capex cycle (transmission & distribution upgrades, renewables integration, grid strengthening) creates sustained demand for transformers.

Strong Profitability: EBITDA margin consistently above 15% with PAT margins ~10–11%, placing Indo Tech in the higher-quality mid-cap transformer space.

Opportunity Rating: Moderate–High (backed by sectoral momentum and strong earnings trajectory and capex coming online in FY28, albeit valuations are still on the richer side).

7.3 Risk at Current Valuation

High Promoter Pledge: 77.8% of promoter holding (~58% of total equity) is pledged.

Initial pledge of 30% of promoter holding appears to be linked to securing corporate credit facilities. However, the rapid increase toward the end of 2024 could indicate additional borrowing, perhaps by SSEL for either corporate expansions or external needs.

Management Silence: Management of Indo Tech Transformers in not known to speak and hence analyzing the underlying business is a challenge

Sustainability of Margins:

59% of revenue came from fixed-price contracts in FY25 (vs. 52% in FY24).

Raw Material volatility: Exposure to CRGO steel and copper remains significant (~65–70% of RM costs).

Fixed price contracts with raw material volatitility can impact margins.

Premium Valuation Risk: On forward FY27, P/E and EV/EBITDA are not cheap.

Capex Execution Risk: Execution delays of 6500MVA capex or cost overruns could impact operating leverage timelines.

Sector Cyclicality: Growth depends on sustained infra spending; slowdown in T&D or renewable grid investments would impact topline.

Risk Rating: High (due to the combination of premium valuations + muted growth outlook till FY28).

Previous coverage of INDOTECH

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer