Indo Count Industries: PAT growth of 6% & revenue growth of 27% for Q1-25 at a PE of 22

ICIL to double revenue in 3 years at a revenue CAGR of 26%. EBITDA margin guidance of 16-18% intact. Guiding for 14-19% volume growth in FY25.

1. Why is ICIL interesting?

indocount.com | NSE: ICIL

ICIL aims to double its revenue over the next 3 years through a strategy that includes organic & inorganic growth, brand building, and expansion into new markets and product categories. Achieving this revenue doubling at current valuations presents a long-term opportunity for investors in the stock.2. The Largest Global Home Textile Bed Linen Company

Comprehensive product portfolio in the premium segment that comprises of bed sheets, fashion bedding, utility bedding and institutional bedding

Indo Count is recognized among the top three Global bed sheet suppliers in the US

Going forward the company is focused on expanding in value added segments such as Fashion Bedding, Utility Bedding and Institutional Bedding

3. FY20-24: PAT CAGR of 47% & Revenue CAGR of 14%

4. Weak FY23: PAT down 23% & Revenue up 4%

5. Strong FY24: PAT up 22% & Revenue up 18% YoY

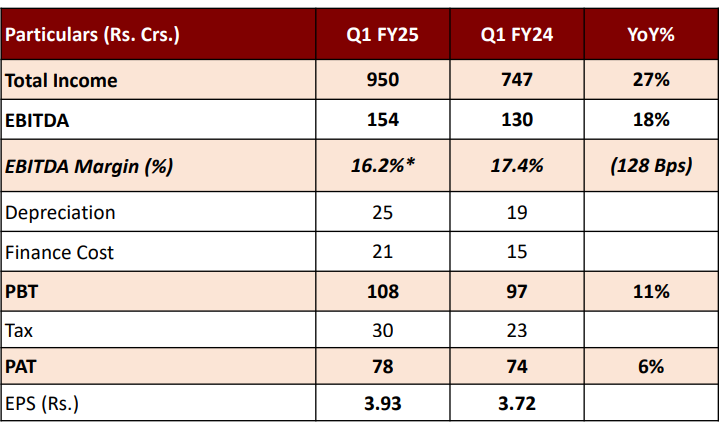

6. Q1-25: PAT up 6% & Revenue up 27% YoY

Robust Volume growth despite logistic issues

Maintained EBIDTA guidance despite higher expenses related to logistics and brand building

7. Business metrics: Strong return ratios

8. Strong outlook: Revenue CAGR of 26%

i. FY25: 14-19% volume growth

ii. FY25: EBITDA Margin Guidance of 16-18%

Margin Guidance of 16% - 18% intact

iii. Revenue CAGR of 26% ICIL to double revenue in 3 years

Doubling revenue over 3 years results in a revenue CAGR of 26%.

We need at least 3 years to double our revenue. So we are confident as an organization that we will be able to double our revenue in the next 3 years

We are focused on utilizing our capacities effectively, enhancing our product range and expanding our geographical reach.

We always look at opportunities, and we are into both inorganic and organic growth because the company is debt-free

9. PAT growth of 6% & Revenue growth of 27% in Q1-25 at a PE of 22

10. So Wait and Watch

If I hold the stock then one may continue holding on to ICIL

Underlying business momentum remains strong, even though profit after tax (PAT) lagged behind revenue growth, as ICIL achieved a 26% increase in volume.

Q1 FY'25 stood at 25.3 million meters versus 20 million meters in Q1 FY '24, a growth of 26%.

ICIL is confident in achieving a strong FY25, even after facing challenges in Q1-25.

Despite increased expenses for logistics and building Wamsutta/Licensed brands, the achieved margin underscores the effectiveness of our strategies.

Market sentiments are improving with new inquiries from key markets.

As the festive season approaches, we are optimistic about a successful FY'25, and are confident in achieving the guidance.

ICIL is indicating improvements in its performance following Q1-25, as it expects stronger momentum in both volume and revenue in the upcoming quarters.

Anticipating Upward Momentum in Volume and Revenue for Upcoming Quarters

The guidance by ICIL to double revenue in 3 years provides a reason to continue with a business which will grow its top-line at a revenue CAGR of 26%

It's important to monitor ICIL's bottom-line performance closely. Continued contraction in PAT margins cannot be sustained, even with strong volume growth and top-line performance.

11. Join the ride

If I am looking to enter ICIL then

ICIL has delivered PAT growth of 6% and revenue growth of 27% in FY24 at a PE of 22 which makes the valuations fully priced in the short term.

With a longer term revenue CAGR of 26% to double revenues in 3 years at a PE of 22 makes the valuations reasonable over the longer term.

Previous coverage of ICIL

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer